Banking Built For

PHYSICIANS

Whether you’re moving for residency, looking for ways to fund your practice, or simply want personalized service from your banking partner — Panacea Financial was built specifically for you.

Whether you’re moving for residency, funding your practice, or building your savings — Panacea Financial is designed for physicians at all stages.

As seen on

About Us

Today’s financial companies are in the way. We’re going to change that.

Born out of the shared pain and experiences of our founders. Panacea Financial was created by doctors, for doctors. We’re dedicated to making financing simpler to understand and easier to access.

PRN Personal Loans For Physicians & Medical Students

Fair, affordable PRN Personal Loans designed for physicians and physicians-in-training to use as needed.

- Low, fixed rates1

- No cosigner required9

- Up to $50,0001

Medical School Loan Refinance

Refinance designed for the loans incurred in medical and podiatry school. Four rates to choose from that do not change with your income or debt level – no wasted time on a pre-application to find your rate.

- Transparent Rates

- No Maximums

- No Cosigners

- In-House Servicing

Transparent

Rates

Cosigners

No

Maximums

In-House

Servicing

Transparent

Rates

No

Maximums

Cosigners

In-House

Servicing

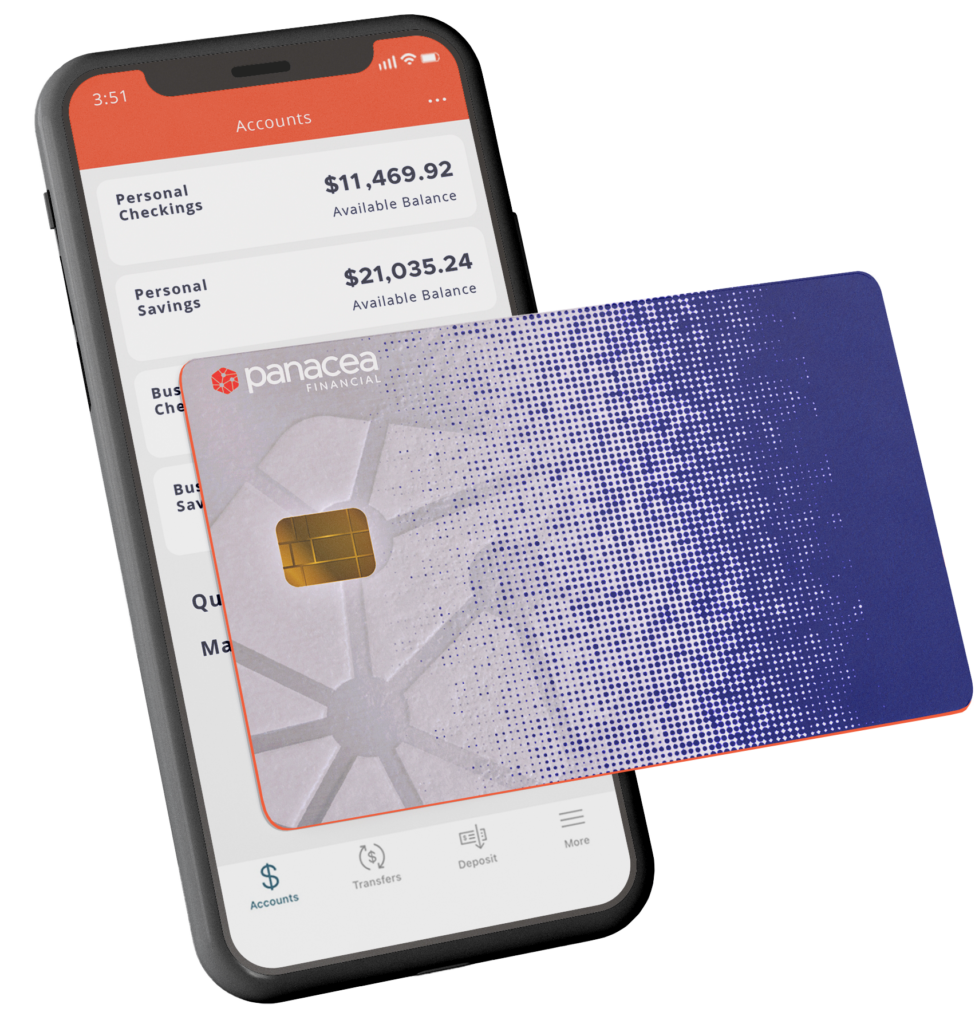

Personal Checking & High Yield Savings Accounts

Loans for doctors, checking and savings accounts for everyone. Take advantage of free checking and high-yield savings accounts without the hassle.

- High-yield savings account at 3.15% APY2 – over 8x the national average!3

- 100% free checking with unlimited ATM use nationwide.

- No monthly fees. No overdraft fees. FDIC insured7.

Personal Checking & High Yield Savings Accounts

Loans for doctors, checking and savings accounts for everyone. Take advantage of free checking and high-yield savings accounts without the hassle.

- High-yield savings account at 3.15% APY2 – over 8x the national average!3

- 100% free checking with unlimited ATM use nationwide.

- No monthly fees. No overdraft fees. FDIC insured7.

Practice Loans & Deposits

Lending and banking7 services for your practice needs.

The Panacea Practice Solutions team is here to help you accelerate your practice through specialized credit structures, competitive pricing, and experienced advice as you start, build, and grow your practice.

- Partner Buy-In

- Refinance/Consolidation

- Acquisition

- Expansion/Relocation

- Equipment

- Commercial Real Estate Financing

Partner Buy-In

Refinance/Consolidation

Acquisition

Expansion/Relocation

Equipment

Commercial Real

Estate Financing

Community Engagement

We are committed to diversifying our physician workforce through scholarships and grants to underrepresented minority medical trainees as well as funding like-minded organizations.

This is part of our mission, this is who we are. We will make medicine better.

Articles & Resources

Career Advice After Residency

Congratulations! You made it through medical school and have completed your residency. Now what? As you take the first step toward planning your career as...

What is the Average Ob/Gyn Physician Salary?

About 4.5% of all active physicians in the U.S. are obstetricians/gynecologists, according to the Association of American Medical Colleges. Whether considering the specialty during medical...

Should Doctors Own or Lease Their Medical Office Space?

When it comes to setting up a medical practice, one of the key decisions doctors face is whether to lease or buy their office space...

Build Your Team

It takes a team of experts to navigate life as a doctor — build yours here.