A Dentist’s

Guide to

Acquiring a Practice

minute read

Skip Ahead

Ready to buy a dental practice?

Whether you’re a recent dental school graduate eager to step into ownership or a seasoned practitioner looking to open your first practice, taking the leap into practice ownership can be daunting. As you start this new chapter, equip yourself with the knowledge and tools needed to move through this process with ease.

Use our Acquiring a Dental Practice guide to lead you through the four phases of becoming a practice owner: preparing for ownership, find your practice, from due diligence to closing, and post-closing. Drawing from real-world experiences and the expertise of our team, we’ll provide you with practical tips, valuable resources, and actionable strategies to empower you on your journey.

Timeline for Acquisition

PREPARE FOR OWNERSHIP

- Review your personal and professional goals

- Interview and build your core team – CPA, Attorney, Lender

- Review your financial preparation needs

FIND YOUR PRACTICE

- Network to find your practice

- Perform initial clinical and financial due diligence

- Tour potential locations

- Make an offer and begin negotiations

FROM DUE DILIGENCE TO CLOSING

- Perform final financial, clinical, equipment/facility and insurance due diligence

- Set a closing date

- Start to draft a purchase agreement

- Build out the rest of your business support team

- Form a legal entity

- Review lease or purchase options on facility

- Negotiate seller employment agreement, if needed

- Draft employee retention agreements

- Set up necessary business and personal insurances

- Secure employee benefits

- Credential with insurances

- Set up business banking services and operations

- Meet with staff before closing

- Update team handbook/policies

- Final plan for transitioning the practice

POST-CLOSING

- Grow patient base

- Foster new patient growth and communication

- Perform marketing review and community outreach

- Update website

- Build patient reviews and promote word-of-mouth referrals

- Review and address staffing needs

- Update or purchase equipment, as needed

- Make cosmetic updates, as needed

Panacea Financial Announces Fifth Annual Match Day 2026 Giveaway to Support Medical Students Transitioning to Residency

LITTLE ROCK, Ark. — Panacea Financial, the financial technology platform built exclusively for doctors and their practices, today announced its fifth annual Match Day Giveaway...

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Preparing for ownership

Review your personal & professional goals

WHAT ARE YOUR GOALS?

Consider your short- and long-term personal, financial, and professional goals. What do you hope to achieve in your career and by the time you retire? Do you want additional education to enhance your clinical ability or expand your procedure mix?

Clearly defining your goals before taking a major career step can help guide your decisions.

WHERE DO YOU WANT TO LIVE? WHAT TYPE OF COMMUNITY DO YOU WANT TO BE IN?

Choosing a location for your practice is a complex decision. You must consider your professional needs, your personal needs, and if you have a family, your family’s needs.

Great practices can often be found in less populous areas. Being flexible with your desired location can allow you to find the perfect practice.

- What city, state or region do you want to practice in?

- What is important to you when choosing your practice location?

Note: Considering the current market and saturation in your ideal location is essential when finding a dental practice. Don’t choose a location that is already oversaturated with dental practices. This can restrict growth and prevent success in your new practice.

ADA members can find location-based demographic information including distribution of active dentists, population median income, and more here.

PROCEDURES

- What is your current procedure mix?

- What other procedures would you like to do in the future?

- What Continuing Education courses do you need to take to be able to do these procedures? How will you complete those?

PRACTICE STRUCTURE

- How large of a team do you want to manage?

- Do you want to be a solo practitioner or work with a team of dentists?

- In the future, will you want to stay with a single location or expand to a multi-location practice?

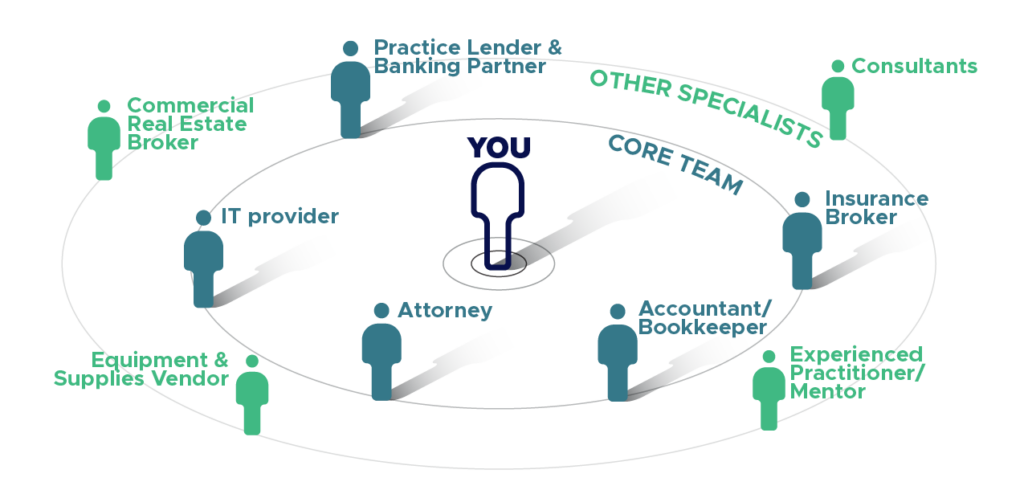

Build your team

Assembling your team is an essential step as you begin the pursuit of practice ownership. This team will help you review the cash flow, clinical make-up, operations and anything else that you may want to perform further due diligence on with the subject practice.

DO YOU HAVE THESE PROFESSIONALS ON YOUR TEAM?

- Practice lender and banking partner

- Attorney

- Accountant / Bookkeeper

- Insurance broker

- IT provider

ADDITIONAL TEAM MEMBERS TO CONSIDER

- Commercial real estate broker (if facility lease/purchase negotiation needed)

- Consultants (practice management, credentialing, etc.)

- Experienced practitioner/mentor

- Equipment and supplies vendor

TO ENSURE A SMOOTH TRANSITION, WE RECOMMEND THE FOLLOWING PROFESSIONALS:

- Your practice lender and banking partner will provide financing and guidance throughout the acquisition.

- An attorney will negotiate terms of your acquisition and review your lease and any other contracts.

- An accountant will prepare you from a tax perspective and help assess the financial health of the practice. They may also support you with bookkeeping post-transition.

- An insurance broker can help you set up all business insurances needed for your practice to ensure it is protected. They also may support any personal insurances needed, such as life and disability.

- An IT provider can assess the practice’s current technology and determine what needs to be updated (if necessary). They can also help you ensure HIPAA compliance and cybersecurity and get your practice set up for operation.

OTHER PROFESSIONALS THAT COULD ADD VALUE:

- If you are wanting to buy the location with the practice, a commercial real estate broker can facilitate the acquisition of the real estate. In a leased scenario, a commercial real estate agent may be helpful to review or re-negotiate lease terms.

- Consultants can help you with marketing, practice management, credentialing and more.

- An experienced practitioner/mentor can share their expertise as you navigate the difficulties of practice acquisition and ownership.

- An equipment and supplies vendor can evaluate the equipment of the practice and help you purchase new equipment if needed. You will also review your supply management needs with your vendor.

WHAT MAKES A GOOD BANKING PARTNER & LENDER?

Choosing a lender based solely on rate can lead to problems throughout the life of the loan. Consider the relationship you are creating with your lending bank, the support and services they provide, and how their structure allows you to focus on patient care. Dental practices and their needs are different than those of other small businesses, so working with a bank who understands and specializes in working with dentists can make the process much smoother.

Read our guide to selecting a practice lender.

HOW TO: BUILD YOUR TEAM

Navigating practice ownership can be difficult, especially if you are a first-time owner. Surrounding yourself with a team of tenured experts can help you make educated decisions throughout the process, and ultimately help you sleep better at night knowing you are making a good decision. If you need help creating your team, our Build Your Team program is here to help you!

We have an extensive network of industry-specific professionals that can help you achieve your goals. Get connected for free here.

Financial preparation

Acquiring a dental practice typically involves hundreds of thousands of dollars being exchanged. Before purchasing a practice, it is important to assess your personal finances to ensure your personal financial foundation is set.

This will also help guide you to the size of practice you should look for, as the more personal expenses you may have, the more profitable of a practice you may need to find to support your established lifestyle. The financial decisions you’ve made as an individual prior to deciding to purchase a practice can ultimately negatively or positively affect your financing options and prospects.

PERSONAL FINANCIAL STATEMENT REVIEW

A personal financial statement gives you a snapshot of your wealth at a specific moment in time. It takes into account your assets (what you own) and your liabilities (what you owe) to find your net worth (assets minus liabilities).

Assets:

- Liquid assets – assets that can easily be converted into cash in a short amount of time (cash, money market instruments, and marketable securities)

- Note: Rounding is okay

- Large assets (houses, cars, boats)

- Investments (bonds, stocks, CDs, mutual funds, and real estate)

- Retirement

Liabilities:

- Debts owed (cars, homes, credit card balance – if not paid off in full, student loans)

- Other debts

STUDENT LOANS

Most dentists take on student debt to pay for dental school. Despite the negative connotations around debt, it is important to know that student debt isn’t “bad debt.” The loans you took on to pay for your education allow you to earn the higher-than-average income of a dentist.

Many dentists see student loans as a barrier to entry into practice ownership, but they don’t prevent you from owning a practice. Your student debt can affect your debt-to-income ratio and credit score, two factors that are used to determine your lending eligibility. This means if these metrics are unfavorable, you could be denied a loan, but there are ways to improve them.

Dentists don’t need to wait until their student loans are repaid to start a practice. Actually, practice ownership could help you pay your loans off faster.

ANALYZE PERSONAL DEBT-TO-INCOME RATIO

A debt-to-income ratio compares how much you owe each month with how much you earn. Lenders use your debt-to-income ratio to evaluate your ability to take on another payment.

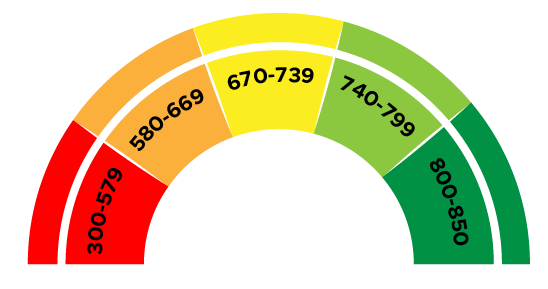

PERSONAL CREDIT REVIEW

Credit score is one of the main considerations by lenders for dental practice financing. Individuals with “excellent,” “very good,” even “good” scores will likely qualify for lower interest rates and more favorable loan terms, depending on the lender.

If you don’t have a favorable score, there are lenders who will work with you to secure financing. Taking the time to improve your score could pay off.

HOW DO I IMPROVE MY CREDIT SCORE?

Improving your credit score will take time, but the effort is worth it for lower rates and more favorable loan terms. Ways to improve credit score include:

- Check your score and understand why it may be low. There can be a variety of reasons you can have negative marks on your credit score. It is important to know if you have any, if they are legitimate, and if they need to be challenged or fixed.

- Paying your bills and debts on-time. It will likely take at least six months of on-time payments to see a change in your credit score.

- Use less of your available credit. If possible, reducing how much credit you are using will help you maintain a lower credit utilization rate.

- Keep old credit accounts open. When you decide to stop using a credit card, it is often best to not close the account because doing so will likely raise your credit utilization rate.

NEEDED NET INCOME

When considering your current finances, you should assess the expenses you will need to cover:

- Family/living expenses

- Personal residence(s)

- Car payments

- Student loans

This will help determine the needed cash flow of the practice. The greater the personal monthly debt obligations, the greater the cash flow requirement.

LIQUIDITY

Liquidity refers to “the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price,” according to Investopedia.

What is liquidity? When assessing a doctor’s liquidity for a practice loan, banks consider savings, stocks, bonds, mutual funds, and any money you can take out of an account without penalty.

What is not considered liquidity? Since liquidity is money that can be taken out of an account without penalty, liquidity does not include retirement accounts, like 401(k)s, IRAs, Roth IRAs. It also doesn’t include any equity you have in your home.

Why is liquidity important in practice ownership? Liquidity protects from the risk that the practice doesn’t perform well right away. Especially when building a patient base and streamlining productivity and profitability, you have the means to use personal funds to maintain practice cash flow. While most practice lenders finance the working capital or liquidity needs of a practice, having cash to put to work if needed is recommended.

Additionally, it’s always wise to have 3-6 months of personal living expenses saved for you and your family as a cushion should any unexpected expenses arise. If you only have enough savings to cover a month or two of expenses, you may put yourself and your practice in a tough position.

Learn more about building an emergency fund.

How does liquidity affect the ability to purchase a practice? When buying a practice, a lender will consider how much cash or savings the loan applicant has. The more liquidity a prospective practice owner has, the more eligible they are for a larger loan—depending on other factors as well.

How much liquidity does a doctor need before buying a practice? Each situation is case by case. Banks typically require 5-10% of the practice price in liquidity, but it can depend on if you are purchasing accounts receivable and your transition plan. Some banks look at each applicant’s personal financial statement in more detail to come up with a liquidity number or requirement, based on that individual.

Tips for maximizing liquidity: Especially for young dentists just a few years out of school, it can be tough to have the significant liquidity needed to buy a practice. Here are some tips that may help you find the liquidity you need to purchase your practice:

- Save your money. When preparing to buy a practice, instead of paying down student or other loans, you may want to save your money. Though your loan balance may be high, banks often prefer to see high debt and high liquidity than low debt and low liquidity. Your lending eligibility often weighs more heavily on cash flow and savings than debt load.

- Balance your retirement savings. Many people put a lot of their excess funds into their retirement accounts, but if you plan to buy a practice, this could hurt your lending eligibility. Because retirement savings don’t factor into your liquidity, keeping more funds in savings and investment accounts may be a better option.

- Build an emergency fund. Create an emergency fund that can be used as a financial safety net for unexpected expenses or periods of unemployment. Without these savings, a period of financial strain can have a lasting impact.

Finding a lender

Financing your purchase is an incredibly important part of a dental practice acquisition, and choosing how you will finance is a complex decision that can affect you and your business for many years.

If you plan to use a lender, we recommend engaging them early in the process. You don’t want to find a practice you love then struggle to secure financing quickly. Having an existing relationship with a lender makes the process more streamlined once you are ready to purchase your practice.

It’s never too early to educate yourself on how practice lending works. Find more practice ownership resources here.

The two main options for financing you will encounter are seller financing and bank lending.

SELLER FINANCING

Seller financing is one option for buying your practice. In this method, the buyer will pay off the price of the business over time directly to the seller.

Seller financing can be easier to get and more flexible than traditional lending options. Additionally, because the seller will continue to be attached to the business, this can prevent the seller from exaggerating the business’s performance.

This could be an option for transactions that cannot be financed by a lender.

PRACTICE LENDER

A second common financing option is to use a lender and bank. There are lenders who specialize in dental-specific practicing lending, like Panacea Financial.

Buyers could benefit from conventional financing through a practice lender and bank because of the potential for a lower interest rate. Banks are required to follow many regulations that protect the lender when taking out a loan; seller-financed acquisitions do not have those same protections.

Focus on more than just rate

Many individuals in search of a loan will focus solely on rate, but knowing other aspects of the loan and lender is incredibly important. Consider the lender’s terms and rates, structure and servicing, merchant services and future support.

Another critical factor is the impact of the prepayment penalty, which essentially marries you to your lender or bank with a penalty should you want to move banks. Many practice lenders lock you into their program for up to five years with a prepayment penalty to recoup the interest they need to earn on their initial low-rate loan.

The last thing you want to do is choose a loan today based on rate, when that lender may not be equipped to fulfill your next need, causing you to get hit with a prepayment penalty because you are forced to change lenders to handle your new need.

This series of events could negate your rate-based decision and may cost you even more money than what you saved in the first place with the lower rate.

Finding a lender that has the best program and will provide you the best support is likely the best course of action as you make this important business decision.

How To Improve Your Credit Score For Doctors

Despite high earning potential, many doctors find themselves with less-than-ideal credit scores due to substantial student loan debt and the financial strain of school and...

How To Get An 800 Credit Score As A Doctor

Credit scores are an incredibly important financial tool. Many doctors, especially trainee and early-career doctors, are burdened by a low credit score because of the...

How Does Debt-To-Income Ratio Affect Doctors?

Medical, dental and veterinary professionals endure years of education and training to be well equipped to serve their patients. Despite the years of learning, doctors...

Find a practice

Once you have found team members and advisors and prepared yourself for the acquisition, it is time to find and evaluate the practice you will purchase. Use your answers to the “Review your professional goals” questions.

Network to find a practice

Get connected with your community and the dental community to find a practice you want to purchase. We recommend:

- Connecting with business brokers and other transition specialists who work directly with potential sellers

- Joining state or local dental societies, study clubs and other organizations where dental colleagues network

- Directly reaching out to dentists in your target market

Tour

Once you have identified a practice you are interested in, it is time to tour the practice and determine if it will be a good fit. Here are things you should consider:

- Number of operatories

- Size of practice (square footage of practice)

- Ability to expand

- Quality of the equipment

- Location of the practice

- Aesthetic/look

Initial due diligence

As you narrow down the practice you want to purchase, you will want to review the clinical and financial details. Here are some of the things you should consider:

CLINICAL

- Review practice management reports:

- Production by procedure report

- Production by provider report

- Patient analysis reports

- Inspect equipment, tools, instruments and fixtures.

- Chart audits – Review a number of patient charts to understand the treatment planning and other clinical aspects of the practice you are acquiring.

FINANCIAL

- Will the cash flow sustain the needs of your practice, employees and owner’s pay?

- Send financial details to your CPA and lender for feedback on cash flow and profitability.

- Review contracts with suppliers, insurers, staff and more.

- Review insurance payor mix.

Make an offer

SUBMIT A LETTER OF INTENT

A letter of intent signifies an agreement to exclusively proceed with the seller. This document should outline desired basic deal points then be submitted to the practice seller for term negotiations.

An attorney can help you draft a document that will provide the smoothest transition over time. Here are the minimum elements that should be included in your LOI:

- Included and excluded assets – It is important to clarify which assets are included in the sale and which are not. Included assets typically will be furniture, computers, equipment, supplies, fixtures, digital assets (website and phone number), etc. Excluded assets often include cash, personal effects, seller’s liabilities and employee benefits.

- Accounts receivable and A/R purchase schedule – You should know if and under what terms you are purchasing accounts receivable.

- Purchase price and asset allocation – It is essential to include purchase price with a detailed breakdown of the allocation of the total price. This breakdown will affect how quickly you can depreciate and write off the value of the practice, potentially lowering your taxes.

- Due diligence timeline – Clarify the length of time you and your team will need to conduct adequate due diligence.

- Real estate – Are you buying the building? Renting from the seller? If renting, would you like the right of first refusal on the sale of the building?

- Seller’s transition – To ensure a smooth transition between owners, you will want to define what the seller will be doing in the transition period. This could include a letter to existing customers and consultations or questions related to practice operations.

- Employees – Clarify that all accrued benefits like bonuses and PTO are the responsibility of the seller.

SIGNING THE LOI

Once the LOI is submitted, it must be negotiated and signed by both buyer and seller before proceeding with due diligence. The seller of the practice will negotiate the terms to make the transaction more beneficial to them.

Having a business broker on your side can help tremendously in these negotiations and by reviewing the final document. Once both buyer and seller agree to the negotiated terms, the LOI can be duly signed, and the buyer and seller will move to due diligence.

The Ins & Outs Of Physician Practice Loans

Physician practice loans are built to help doctors start, build or grow their practices. When preparing for practice ownership, understanding the ins and outs of...

Finding A Practice Lender & Bank: Choosing Wisely Today For Your Practice Tomorrow

Choosing a practice lender and banking partner for your acquisition, startup or any other practice-related transaction is a very important decision. More than just rate...

A Letter From Our Founders Ned Palmer, MD MPH November 2020 Thanks for checking out Panacea Financial and reading about our story. My name is...

From due diligence to closing

Further Due Diligence

FINANCIAL DUE DILIGENCE

With your CPA or buyer transition specialist, assess the following items:

- Past three years of financial statements and tax returns

- List of discretionary expenses

- Year-to-date profit & loss statement and balance sheet for the current year

- Current fee schedule – Pay attention to the fees relative to industry norms and insurance reimbursements.

- Percentage of revenues used for overhead

- Breakdown of employee expenses – Assess salaries, benefits, payroll taxes, retirement, etc.

- Production/collections by procedure report

- Production and collection reports for each dentist and hygienist

- Reimbursement structure relative to number of employees – These will help you determine the practice’s cash flow, or how much money you’ll take home at the end of the day.

- What equipment or parts of the facility need to be upgraded or replaced?

CLINICAL DUE DILIGENCE

- Number of active patients – Include those who have had appointments in the last 12 to 18 months.

- Number of new patients each month

- Chart audits

- Is the patient flow consistent throughout the month? If not, why?

- What type of advertising is done?

- Patient demographics – Consider age, area code, etc.

- Most popular procedures

- Highest-yielding procedures

- Outgoing dentist’s treatment philosophy

EQUIPMENT/FACILITY DUE DILIGENCE

- Equipment inspection as needed

- IT and computers due diligence

- Review real estate lease/purchase review

- If purchasing: Due diligence on the facility – Consider environmental/survey needs with an attorney. Inspect the building and HVAC system.

INSURANCE DUE DILIGENCE & CREDENTIALING PROCESS

- Insurance payor mix review

- Fee schedule review

OTHER DOCUMENTS TO REVIEW IN DUE DILIGENCE

- Employment documentation and handbook

- Current employee benefits

- Purchase agreement

- Current practice insurance policies

- Payment acceptance methods (credit card, patient financing, etc.)

- AR report

What to do from due diligence to closing

Once due diligence is completed and both parties agree to the terms of the transaction, it is time to close the deal. Here’s what you need to work on between approval and closing:

SET A CLOSING DATE

Together with the buyer and your lawyers, determine the closing date, which will represent the day ownership transfers from the seller to you.

DRAFT A PURCHASE AGREEMENT

A purchase agreement is a legal document that transfers ownership from the seller to the buyer. This document contains the terms of the sale like:

- Purchase price

- Non-compete agreements

FORM A LEGAL ENTITY

Form a new entity, like a corporation or LLC, early in this time period. The deal cannot close if the entity is not active at the time of closing.

You will need to obtain an Employer Identification Number early in the process as well. This number is often needed for bank accounts and other business needs.

SECURE A FACILITY OR REAL ESTATE

During the due diligence process, determine how you will secure the facility and/or real estate. If the seller is leasing, plan to assume the lease and learn what the cost and terms are. If the seller is choosing to lease the property themselves, work with them to determine what that will look like. A good rule of thumb is if there is less than five years left on the existing lease, negotiate a lease extension during the purchase.

If the seller chooses to sell the property, work with a commercial real estate advisor and your attorney to carry out that process.

DRAFT A SELLER EMPLOYMENT AGREEMENT

If the seller is remaining with the practice, outline their role and benefits.

DRAFT EMPLOYEE RETENTION AGREEMENTS

Create legal documents that outline the terms under which employees agree to remain with the practice. Include compensation, benefits and job responsibilities. Limit these agreements to associates, with limited exceptions for spouses and other circumstances.

SET UP BUSINESS & PERSONAL INSURANCES

Insurance is essential to protecting you and your practice from potential liability lawsuits and loss of use of equipment. Your insurance consultant can help develop your practice’s insurance plans and assess the types of corporate insurance coverage you may need.

We recommend life, property, workers’ compensation, disability, overhead, liability, and malpractice insurance policies. Disability insurance is especially necessary as a dentist’s hands are your most valuable asset, and any serious injury or ailment would prevent you from working.

SECURE EMPLOYEE BENEFITS

As you review current employee benefits, it’s important to continue existing benefits through the transition period and then look to add additional benefits post-closing. Set up healthcare, retirement and other compensation plans during this time to ensure employees don’t have a period of no insurance coverage or a pause in their retirement savings.

CREDENTIAL WITH INSURANCES

Your practice will not be able to function properly and efficiently without being able to transfer the existing practice’s insurance plans to work with patients’ insurance companies.

Insurance credentialing is a critical aspect of preparing your practice for transition. This multi-step process involves deciding which insurance companies to enroll with, completing provider applications and negotiating fees.

A practice management consultant can help with this potentially complicated process. This process will vary state by state and according to the insurances the practice currently accepts.

SET UP BUSINESS BANKING SERVICES & OPERATIONS

Work with your lender and bank to set up business operations so your practice can run efficiently.

Bank accounts, methods to pay vendors, take deposits, and manage your finances, and other basic financial services need to be set up. Being prepared allows you to work with patients and your new staff from day one as opposed to taking time out of your day to set up these services.

The buyer should set up their banking services and processes like:

- Bank accounts

- Credit card processing

- Purchasing credit card

- Treasury management – Taking deposits, ACH, wire, paying vendors, paying employees, etc.

MEET WITH STAFF BEFORE CLOSING

To create a smoother transition, consider a joint meeting with the staff once the purchase agreement is executed. Together with the seller, meet with the current dental team to explain the transition and answer any questions.

UPDATE TEAM POLICIES/HANDBOOK

While assuming ownership, review the previous dentist’s policies for their employees. If large changes or updates need to be made, consider consulting with the current office manager or select team members that have been identified as leaders by the selling dentist to understand how it will be received.

PLAN FOR TRANSITIONING THE PRACTICE

In the final stage of your transition to practice owner, you will want to make decisions about how the practice will change and begin integrating yourself into the practice.

Begin assessing whether you need to hire new staff, update or purchase equipment, make changes to marketing efforts, and more.

Find tips from the ADA for integrating into your new practice.

Post-closing

Congratulations, you now own a dental practice! Now that the practice is officially yours, it is time to truly make it your own.

Update business processes

CREATE/UPDATE BUSINESS PLAN (optional)

A business plan outlines the practice’s objectives and how you will achieve them. If the previous owner had a business plan, update it to reflect your goals. If the previous owner did not have one, it may be helpful to take the time to write one to help guide you, especially in the beginning of your ownership.

FOSTER NEW PATIENT GROWTH & COMMUNICATION

Prioritize developing good communication with new and existing patients. Establishing good rapport with current patients and staff will help create a smoother transition.

Keep open communication with your dental team. They are the biggest advocates for you and will hear what patients are saying.

PERFORM MARKETING REVIEW & COMMUNITY OUTREACH

Maintaining and creating marketing processes, both internal and external, will help you enhance your practice and patient base.

UPDATE WEBSITE

A website can be one of your greatest assets when marketing your practice. Work with experienced website developers to update or create a clean website that will draw patients to your practice.

BUILD PATIENT REVIEWS & PROMOTE WORD-OF-MOUTH REFERALS

Requesting that patients review and refer is an effective, no-cost external marketing strategy.

Finalize miscellaneous items

Making too many significant changes to the practice too early could be harmful to your relationship with patients and your new dental team. Patients may be nervous about seeing a new dentist and too many changes too fast may alienate them. If you need to make changes, get staff buy-in.

HIRING

When acquiring a new practice, you may recognize the need for additional team members.

EQUIPMENT UPGRADE, UPDATE, OR REPAIR

You may need to update current pieces of equipment or purchase new ones. Working with an equipment advisor can help you make the right decisions for your practice and patients. Learn four things to do before purchasing new dental equipment.

OFFICE UPDATES

Don’t let production or customer acquisition be hindered by dated décor or inefficient layouts. Make updates to your office as it makes sense for you and your budget, mapping out a long-term plan if larger changes are needed.

Dental Practice Transitions: What You Need To Know

Dental practice transitions are complex processes that involve the transfer of ownership or management of a dental practice from one dentist to another. Whether it’s...

Guide To Dental Practice Employee Salaries

Dental practice employees play a vital role in the success of any dental practice. They are responsible for a wide range of tasks, from providing...

What You Need To Know Before Buying New Dental Equipment & Technology

As a dental practice owner, deciding to incorporate new technology and equipment is a step toward improving efficiency and quality of care for your patients. ...

Finding the right lender for your dental practice

Choosing the right lender for your dental practice acquisition is a very important decision. The relationship you create with your lending bank, the support and services they provide, and how their structure allows you to focus on your patients are incredibly important factors that should be considered.

Panacea Financial provides lending and banking services designed with dentists in mind. The Panacea Practice Solutions team has experts who can assess the reasonableness of fair market value sales multiples. Through creative deal structuring and financing, competitive pricing, and experienced advice, Panacea Practice Solutions is ready to help you acquire your dream practice.

Connect with a dental practice specialist.

Panacea Financial is the exclusive practice financing provider for members of the American Dental Association. ADA members can benefit from member-exclusive discounts on any practice loan—acquisition, startup, equipment, commercial real estate, and more.

Download the PDF