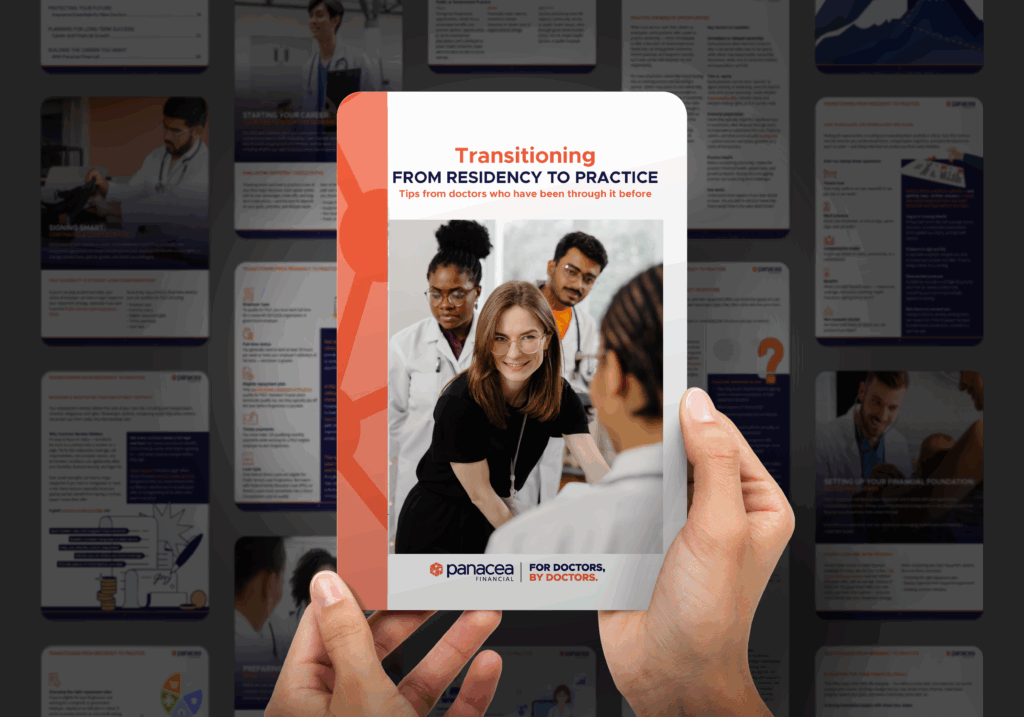

A Doctor’s Guide to

Transitioning from

Residency to Practice

The right preparation can make all the difference.

Keep Reading or Download the PDF ↓

minute read

Skip Ahead

Introduction

Finishing residency marks the end of one journey — and the exciting start of another. For the first time, you have the freedom to shape your career, finances, and future on your terms. But with that freedom comes a wave of tricky decisions.

From evaluating job opportunities to strengthening your financial footing, the decisions you make now create momentum that carries into every stage of your career. The right preparation can make all the difference. Here’s what to expect — and how to navigate the early decisions with confidence.

We’re All in This Together: Why Mentorship Matters in Medicine

From the day you decide to become a doctor, whether as a precocious toddler or as a mid-career professional looking for a sense of fulfillment...

Beyond the Interview: How Doctors Can Maximize Site Visits Before Signing a Contract

As new academic years and new contract terms begin, many doctors start to think about their next steps. It can be difficult to know how...

What is the Average Ob/Gyn Physician Salary?

About 4.5% of all active physicians in the U.S. are obstetricians/gynecologists, according to the Association of American Medical Colleges. Whether considering the specialty during medical...

Starting Your Career: Your First Steps After Residency

Your first post-residency job is your entry point — not just into practice, but into the kind of life and work you want to build. Evaluating it with intention now can pay off for years to come. That’s why it’s worth stepping back and thinking carefully about a career path that fits your goals — including whether you want to pursue ownership or partnership in the future.

Evaluating Different Career Paths

Choosing where and how to practice is one of your first major decisions. Each option comes with its own advantages, trade-offs, and long-term implications — and the best fit depends on your goals, priorities, and lifestyle needs.

Each of the following settings offers a different path, and understanding the distinctions gives you clearer direction:

PRIVATE PRACTICE

- Pros: Greater earning potential, more autonomy, opportunity for future ownership

- Cons: Less administrative support, more business and operational responsibilities, potentially higher financial risk, possibly higher daily patient volume, which may lead to increased documentation burden, fewer opportunities to engage in academic or scholarly work (depending where you are)

- Best fit for: Doctors who value independence, entrepreneurship, or want to build toward practice ownership, those who prefer closer continuity with patients, and the ability to tailor care models without institutional constraints

ACADEMIC HEALTH SYSTEM EMPLOYMENT

- Pros: Opportunities for research, teaching, mentorship, or academic leadership; strong collegial environment; better loan forgiveness eligibility

- Cons: Lower average salaries compared to private practice; more structured promotion pathways, potential for competing demands between clinical, teaching, and research responsibilities

- Best fit for: Doctors passionate about education, research, or long-term academic advancement

NON-ACADEMIC HEALTH SYSTEM EMPLOYMENT

- Pros: Stability, benefits (health insurance, retirement, malpractice coverage), fewer administrative responsibilities

- Cons: Less autonomy, limited input on scheduling and operations, productivity-based compensation models

- Best fit for: Doctors who want structure, consistent income, and fewer business management duties

PUBLIC OR GOVERNMENT PRACTICE

- Pros: Strong loan forgiveness opportunities, steady hours, predictable benefits and pension options, opportunities to serve underserved populations and contribute to public health initiatives; lower administrative burden in some settings.

- Cons: Potentially lower salaries; sometimes limited resources or slower pace of organizational changes

- Best fit for: Doctors prioritizing work-life balance, community service, or public health impact; often through government-funded clinics, the VA, Indian Health Service, or public hospitals.

Practice Ownership Opportunities

While most doctors start their careers as employees, some positions offer a path to practice ownership — either immediately or after a few years of clinical experience. Ownership can bring greater autonomy, income potential, and long-term security, but it also comes with financial risk and responsibility.

For many physicians, ownership means buying into an existing practice and becoming a partner. Others may aspire to solo ownership, either by purchasing a practice outright or building one from the ground up. If ownership is one of your long-term goals, look for roles that support that path — whether through a formal partnership track or opportunities to gain business experience and mentorship.

Understanding what practice ownership involves — and whether it’s the right fit — empowers new doctors to make more informed decisions from day one.

Factors to consider:

- Immediate vs. delayed ownership: Some practices allow new hires to buy in after a set period (often two to five years), while others may expect earlier ownership discussions. Make sure to clarify the timeline and expectations up front.

- Title vs. equity: Some practices use the term “partner” to signal seniority or leadership, even if it doesn’t come with actual ownership. Clarify whether a partnership offer includes equity and decision-making rights, or if it’s purely a title.

- Financial preparation: Ownership typically requires a significant buy-in investment, often financed through loans. It’s important to understand the cost, financing options, and what you’re actually buying into — patient volume, real estate, goodwill, or a share of the business.

- Practice health: Before considering ownership, review the practice’s financial health, patient base, and growth prospects. Buying into a struggling practice can create long-term challenges.

- Exit terms: Understand what happens if you later decide to leave. Are you able to sell your ownership share easily? How is the value determined?

Practice ownership can be a rewarding path — but it’s not for everyone. We recommend connecting with someone who has experience evaluating or purchasing a practice. Hearing firsthand about their decision-making process and challenges can offer valuable insights beyond the financials.

If you’re interested, gain clinical experience first, strengthen your financial footing, and connect with trusted advisors to evaluate your options.

Tips for Transitioning to Dental Practice Ownership

For many dental associates, the dream of practice ownership represents both professional independence and financial opportunity. Owning a practice allows dentists to make decisions about...

12 Tips for Starting Your Own Dental Practice

Starting a dental practice from scratch can be one of the most challenging and rewarding paths to ownership. With the right planning, financing, and strategy...

Buying a Dental Practice: Weighing the Pros, Cons, & Financial Considerations

For many dentists, practice ownership is a long-term goal. One of the fastest ways to get there is by purchasing an existing practice. Instead of...

Signing Smart: Contracts & Compensation

Understanding your contract is a smart, early investment in your financial future. Your employment agreement can shape everything from your paycheck and benefits to your ability to manage student loans, plan for growth, and protect yourself legally.

PSLF Eligibility and Student Loan Considerations

If you’re carrying student loan debt, your job decision can have a major impact on your repayment strategy — especially if you plan to pursue Public Service Loan Forgiveness (PSLF).

Several requirements determine whether your job qualifies for PSLF, including:

- Employer type: To qualify for PSLF, you must work full-time for a nonprofit (501(c)(3)) organization or government employer.

- Full-time status: You generally need to work at least 30 hours per week or meet your employer’s definition of full-time — whichever is greater.

- Eligible repayment plan: Only income-driven repayment (IDR) plans qualify for PSLF. Standard 10-year plans technically qualify too, but they typically pay off the loan before forgiveness is possible.

- Timely payments: You must make 120 qualifying monthly payments while working for a PSLF-eligible employer to earn forgiveness.

- Loan type: Only federal Direct Loans are eligible for Public Service Loan Forgiveness. Borrowers with Federal Family Education Loan (FFEL) or Perkins Loans must consolidate into a Direct Consolidation Loan to qualify.

Not all hospital systems and clinics are nonprofits — even if they provide community care — so it’s critical to verify your employer’s eligibility before assuming PSLF will be an option.

If PSLF isn’t an option, refinancing could be a smart move. Doctors who join for-profit hospitals or private practices often refinance to lower their interest rates and pay off loans faster. Some doctors take a hybrid path: they work for a nonprofit early on to maximize PSLF eligibility, then shift toward private practice after forgiveness is secured.

The optimal strategy depends on your total debt, salary prospects, and long-term goals. Aligning your first job with your loan repayment plan may reduce long-term costs — and potentially save tens or even hundreds of thousands of dollars.

Signing Bonuses & Contract Incentives

Signing bonuses, relocation assistance, and loan repayment offers can boost the appeal of a job offer. But while these incentives can add meaningful value, they often come with fine print that’s easy to overlook.

Before you accept an offer, it’s important to understand the structure and any conditions attached to these benefits:

- Signing bonuses: Most signing bonuses are tied to a minimum service commitment — typically two to three years. If you leave early, you may be required to repay part or all of the bonus, sometimes with interest. According to AMN Healthcare’s 2023 Review, the average signing bonus for physicians was $37,473.

- Relocation assistance: Many employers offer a moving stipend, typically reimbursed based on actual expenses. Like signing bonuses, relocation payments are often subject to repayment if you leave before the agreed-upon term. The same report indicates that 63% of physician job offers included relocation assistance, with an average allowance of $12,778.

- Loan repayment programs: Some employers offer direct loan repayment incentives, typically for roles in private practice or for-profit settings. Unlike PSLF, these benefits are employer-funded and tied to a multi-year service commitment. In 2023, 18% of physician job offers included loan repayment, with an average amount of $98,665. Most repayment contracts required at least a three-year term.

- How long must I stay to keep the signing bonus, relocation assistance, or loan repayment benefits?

- What happens if I leave early — is repayment prorated, full, or interest-bearing?

- Are incentives paid upfront, annually, or through salary installments?

- For loan repayment programs: Will payments go directly to my lender, or be paid to me as taxable income?

Knowing exactly how incentives work makes it easier to assess your offer’s total value — and to avoid surprises if your circumstances change down the road. In many cases, these incentives are also negotiable, so it’s worth having a conversation before signing.

How to Evaluate Job Offers & Spot Red Flags

Finding job opportunities is exciting but evaluating them carefully is paramount. Your first contract sets the tone for your professional future, compensation trajectory, and work-life balance for years to come — and being informed can protect you from early mistakes.

Start by asking these questions:

- Patient load: How many patients are you expected to see per day or per week?

- Work schedule: What’s the breakdown of clinical days, admin days, and call shifts?

- Compensation model: Is your pay based on salary, productivity, or a combination?

- Benefits: What’s included beyond salary — malpractice coverage, retirement matching, health insurance, signing bonus terms?

- Non-compete clauses: Are there restrictions on where you can practice if you leave?

- Vague or missing details: If important terms like call coverage, bonus structure, or productivity expectations aren’t spelled out clearly, proceed with caution.

- Pressure to sign quickly: A reputable employer will give you time to review and consider the offer. If you’re being rushed, it’s a red flag.

- Mismatched promises: Sometimes recruiters and legal documents don’t line up. Always confirm that everything you’re promised verbally appears in writing.

- Reluctance to connect you: Talking to doctors already working there can reveal a lot. If the employer hesitates to make those connections, consider it a warning sign.

Reviewing & Negotiating Your Employment Contract

Your employment contract defines the rules of your new role, including your compensation, schedule, obligations, and rights. Reviewing it carefully, and getting expert help when needed, can protect you from costly misunderstandings later.

WHY CONTRACT REVIEW MATTERS

It’s easy to focus on salary — but there’s far more to a contract than a number on a page. Terms like malpractice coverage, call responsibilities, non-compete clauses, and termination conditions can significantly affect your flexibility, financial security, and legal risk.

Even small oversights can lead to major headaches if you need to renegotiate or leave a role. Many doctors — especially those just getting started — benefit from having a contract lawyer review their offer.

A good contract review partner can:

- Spot hidden risks and suggest improvements

- Explain complex language in plain terms

- Help you identify what’s negotiable

- Advise you on where you have leverage

- Provide peace of mind before you sign

Not every contract needs a full legal overhaul, but nearly every doctor benefits from knowing exactly what they’re agreeing to — and what could be changed before they sign.

We’re All in This Together: Why Mentorship Matters in Medicine

From the day you decide to become a doctor, whether as a precocious toddler or as a mid-career professional looking for a sense of fulfillment...

Beyond the Interview: How Doctors Can Maximize Site Visits Before Signing a Contract

As new academic years and new contract terms begin, many doctors start to think about their next steps. It can be difficult to know how...

What is the Average Ob/Gyn Physician Salary?

About 4.5% of all active physicians in the U.S. are obstetricians/gynecologists, according to the Association of American Medical Colleges. Whether considering the specialty during medical...

Preparing to Practice: What to Tackle Before Day One

Before you can start seeing patients, there are several administrative and regulatory steps to complete. From scheduling your board exam to navigating credentialing and licensure, planning ahead helps you avoid delays and start your new role with confidence.

Your Start Date & Board Certification

As you evaluate job offers, you’ll also need to plan your transition from residency or fellowship into full-time practice. A key question is how to time your start date around board certification — and how to manage the financial gap if you delay.

Board exam timing and financial considerations:

If you choose to take time off to study, make sure you have savings or bonus funds available to cover living costs for a few months. Be aware that income-driven repayment plan updates or refinancing may be needed if your income changes significantly during this gap period.

Licensure, Credentialing, and Privileges

Securing your medical license, hospital privileges, and payer enrollments is essential before you can start practicing independently. These steps often take longer than expected — and delays can affect both your start date and your first paycheck.

To set yourself up for a smooth transition, begin your application as soon as you know where you’ll be practicing. Some states have processing windows of three to six months. If you’ll be prescribing controlled substances, you’ll need an active Drug Enforcement Administration (DEA) license tied to your new practice location.

CREDENTIALING & PRIVILEGES

If you’re joining a hospital or large healthcare system, you’ll need to go through credentialing to verify your education, training, and qualifications. This process can take 90–180 days to complete. Credentialing with insurance companies, including Medicare, Medicaid, and private insurers, is separate from hospital credentialing, and often takes just as long. Without payer enrollment, you can’t bill for your services.

What is the Average Ob/Gyn Physician Salary?

About 4.5% of all active physicians in the U.S. are obstetricians/gynecologists, according to the Association of American Medical Colleges. Whether considering the specialty during medical...

Should Doctors Own or Lease Their Medical Office Space?

When it comes to setting up a medical practice, one of the key decisions doctors face is whether to lease or buy their office space...

10 Tips for New Residents

Everything you’ve heard about residency is true. It’s intense, exhausting, and, at times, very rewarding. In your new reality of 80+ hour work weeks and...

Setting Up Your Financial Foundation: Budgeting & Loans

That first paycheck will likely be your biggest yet, and it comes with new opportunities, responsibilities, and risks. Setting up a strong financial strategy early on lays the groundwork for financial security and less stress down the road.

A solid financial plan starts with two areas: managing student loans and building a sustainable budget.

Student Loan Debt After Residency

Student loans remain a major financial challenge for many new doctors. In fact, 74% of residents and fellows said they carry student loan debt, with an average balance of $296,540. The good news? With your new salary, you have more options — and a lot more control over your repayment strategy.

When comparing your loan repayment options, focus on these core areas:

Staying organized with repayment paperwork: For PSLF, annual employer certification forms are required to verify your qualifying payments. Missing paperwork can delay forgiveness or disqualify payments you’ve already made. Set reminders to complete forms before deadlines pass — and keep copies for your own records.

Avoiding common mistakes: Jumping into refinancing too soon can accidentally disqualify you from PSLF if you’re eligible. On the flip side, staying in an IDR plan when forgiveness isn’t an option can cost you more through accumulated interest. Reviewing your options as your income and job setting change is key.

No two doctors’ loan strategies look exactly the same. Matching your repayment plan to your career path — and adjusting as needed — can save you thousands and help you achieve stronger financial footing.

Explore Student Loan Refinancing

Budgeting for Your Financial Goals

That initial salary often feels life-changing — but without a clear plan, new expenses can quickly outpace your income. Building a budget lets you stay ahead of your finances, make faster progress toward your goals, and avoid unnecessary stress later on.

A strong foundation begins with these four steps:

- Start with your fixed obligations: Account for major, recurring expenses first: student loan payments, rent or mortgage, insurance premiums, utilities, credit card debt, and any professional fees. Knowing your essential costs helps you set a realistic foundation for the rest of your spending.

- Plan for savings from the beginning: Treat savings like a monthly bill. Prioritize building an emergency fund, contributing to retirement accounts, and setting aside cash for short-term goals like relocation, board exam fees, or planned time off.

- Be realistic about lifestyle upgrades: After years of delayed gratification during training, it’s tempting to immediately upgrade everything — from housing to cars to vacations. There’s nothing wrong with celebrating your success, but a gradual approach keeps lifestyle creep in check.

- Leave room for changes: Your budget isn’t static. As your income grows, loans are paid down, or life changes happen (moving, marriage, practice ownership), continually revisit and adjust your financial plan.

Lifestyle Creep & Future Wealth

Lifestyle Creep & Future Wealth

Lifestyle creep happens when your spending rises along with your income — often without conscious planning. It’s a common financial pitfall for doctors early in their careers, and being aware of it from day one can significantly impact your financial future.

It’s natural to want to enjoy your success. But frequent upgrades — such as a larger home, a luxury car, or more expensive vacations — can quickly absorb your new income and limit how much you can save, pay off, or invest.

You can stay grounded as your income grows by:

- Being intentional about upgrades. Choose one or two meaningful ways to celebrate milestones, while keeping other areas of your spending steady.

- Anchoring your lifestyle to savings goals. Instead of upgrading with every raise, prioritize boosting your savings rate — whether it’s retirement contributions, emergency funds, or investments.

- Defining what financial freedom means to you. For many, financial freedom means having the security to weather challenges and the flexibility to pursue what matters most.

Avoiding lifestyle creep now gives you a massive advantage later — and leaves you with more options as your career evolves.

What is the Average Ob/Gyn Physician Salary?

About 4.5% of all active physicians in the U.S. are obstetricians/gynecologists, according to the Association of American Medical Colleges. Whether considering the specialty during medical...

What is APY & Why It Matters for Doctors

As a doctor, you know the value of working smarter. The same applies to your money. Whether you’re building an emergency fund or saving for...

Should I Pay Extra On My Mortgage Or Student Loans?

Doctors face a unique set of financial challenges and opportunities. From managing the hefty burden of student loans to planning for retirement, financial decisions can...

Protecting Your Future: Insurance Essentials for New Doctors

As you move from residency into practice, insurance plays a crucial role in protecting everything you’re building — from your income to your health to your family’s future. The right coverage gives you peace of mind, helping you focus fully on your goals with a strong safety net in place.

Three types of coverage deserve special attention early in your career: disability, malpractice, and life insurance:

Why Disability Insurance Matters Early

Your income potential is your most valuable financial asset. Disability insurance protects that asset by providing income if an illness or injury prevents you from working. While it’s easy to put off thinking about insurance during a busy professional transition, securing coverage early is necessary for lasting protection.

Disability insurance premiums are based on your age and health when you apply. Locking in a policy during training or early in your career when you’re young and healthy can save you money over the life of your coverage and protect you against future health changes that might limit your options.

- Own-occupation coverage: This protects your capacity to work in your specific specialty. If you can’t practice in your trained specialty due to illness or injury, you’ll still receive benefits, even if you’re able to work in another capacity.

- Residual or partial disability coverage: This can provide benefits if you experience a partial loss of income due to illness or injury.

- Future purchase options: Some policies allow you to increase coverage as your income grows, without requiring new medical underwriting.

Disability insurance might feel like an extra expense early on, but it remains a powerful way to protect your income and stability.

What to Know About Malpractice Coverage

Malpractice insurance protects you financially if a patient files a claim against you for alleged errors, omissions, or negligence in your care. While it’s often provided by your employer, it’s important to understand the details and make sure you’re properly protected before you start practicing.

Remember that employer-provided coverage isn’t always enough. Many employers include basic malpractice insurance, but the type and limits can vary. Some policies only cover claims made while you’re employed, meaning you could be exposed if a claim is filed after you leave. This is where tail coverage becomes important.

Two malpractice insurance terms to know before signing a contract: claims-made and occurrence-based coverage:

- Claims-made policies protect you only while the policy is active. If you leave a job, you’ll likely need to purchase tail coverage to remain protected from future claims.

- Occurrence-based policies, while less common, cover any incident that happened while the policy was active — even if the claim is filed later.

If your employer’s malpractice coverage doesn’t include tail coverage, you may need to purchase it yourself — and it can be expensive. Always clarify what type of policy is offered and who is responsible for covering the cost of tail coverage if you leave.

- What type of malpractice policy do you offer — claims-made or occurrence?

- If it’s claims-made, who pays for tail coverage when I leave?

- What are the coverage limits?

Understanding your malpractice policy helps you avoid unexpected financial exposure — and ensures you’re protected during every stage of your career.

Thinking Ahead with Life Insurance

Life insurance might not feel urgent early in your career, but it’s a foundational part of protecting your loved ones and financial future. If you have a spouse, children, or anyone who depends on your income, life insurance helps ensure they’re supported if something happens to you.

Term life insurance is often the first choice for physicians. It provides coverage for a set number of years (typically 10, 20, or 30) and is more affordable than permanent policies. Term coverage is ideal for replacing lost income, paying off debts, or covering major expenses like a mortgage or college tuition.

Permanent life insurance, such as whole or universal life, offers lifelong coverage and includes a cash value component. While typically more expensive, it may support long-term financial goals for those who’ve already maximized other retirement savings options.

- Coverage amount: Consider your income, debts, and dependents’ future needs.

- Policy type: Choose term or permanent based on your financial goals.

- Group vs. individual coverage: Employer plans may be limited or non-portable.

- Underwriting: Expect health history and lab work as part of the application.

- Riders and updates: Evaluate add-ons and reassess your coverage over time.

Starting early can lock in lower premiums and provide peace of mind as your responsibilities grow.

Confused About Disability Insurance? Here’s What You Need to Know

Guest post – In collaboration with Alex D. Spiller, CFP®, at Treloar & Heisel Don’t let insurance jargon keep you from protecting your income. If...

Opening a Second (or Third) Location? Here’s How That May Affect Your Insurance Needs

Guest post – In collaboration with John A. Adcock, CLU®, ChFC®, CFP®, at Treloar & Heisel As a doctor running your own practice, you likely...

Do I Need Cyber Insurance As A Doctor?

Guest post – In collaboration with John A. Adcock, CLU®, ChFC®, CFP®, at Treloar & Heisel, our insurance partner In today’s fast-paced, technology-driven world, many...

Planning for Long-Term Success: Career & Financial Growth

Starting strong is important — but building a professional and financial life you love takes ongoing planning. As your experience, goals, and responsibilities evolve, staying intentional about your next steps supports continued growth personally, professionally, and financially.

Two areas to focus on as you look ahead:

- How your compensation compares to peers

- Setting a foundation for long-term growth

Benchmarking Your Salary

Benchmarking Your Salary

Reliable data gives you leverage at the negotiating table. It ensures you’re valuing your skills appropriately and helps you advocate for compensation that matches your specialty, region, experience level, and practice setting.

Numerous resources offer valuable, trustworthy benchmarking data:

- Medical Group Management Association (MGMA): Widely considered the gold standard for physician compensation data, MGMA reports offer detailed benchmarks based on specialty, geography, and type of practice — but access is often gated or expensive for individuals.

- Employer-provided data: Some hospitals or healthcare systems may share regional salary data during the hiring process, but it’s important to cross reference with independent sources when possible.

- Panacea Legal1: Panacea Legal offers benchmarking support specifically for doctors transitioning from residency and fellowship — making it easier to understand how your offer compares without paying for full MGMA access yourself. Their Compensation Review service includes a specialty- and region-specific MGMA report, a personalized pay analysis, and a 30-minute call with a contract lawyer — all for a flat fee.

- Median base salary for your specialty and region

- Median productivity (Relative Value Unit, or RVU, targets if applicable)

- Common bonus structures and incentives

- Typical benefits and retirement match percentages

- Non-clinical responsibilities (ie: teaching, admin time) and whether they’re compensated

- Travel expectations and reimbursement: If you’ll be rotating between clinics or satellite locations, ask whether travel time and mileage are reimbursed — particularly if you’re expected to commute long distances during the workday.

Benchmarks like these turn contract negotiation into a data-driven conversation — and help you advocate for fair compensation.

Setting the Stage for Long-Term Success

Your first few years of practice set the tone for what’s to come and adopting the right mindset now can lead to more freedom and opportunity later. As you gain momentum as a newly employed doctor, here are a few strategies for building long-term stability and growth:

Focus on building financial flexibility: Prioritize saving for an emergency fund, paying down high-interest debt, contributing to retirement accounts, and protecting your income through insurance. Early habits compound over time — and small steps now can open big opportunities later.

- Invest in professional development: After your board certification is complete, continuing education, leadership training, and professional memberships can help you stay competitive and expand your career options. Some employers offer Continuing Medical Education (CME) stipends to support long-term growth. Take advantage of CME stipends, conferences, and hospital-based training programs where available.

- Think about your five-year plan: You don’t need to have every step mapped out, but it’s helpful to think about where you hope to be in a few years. Will you want to buy into a practice? Move into a leadership role? Pursue academic or research opportunities?

Knowing what you’re working toward can guide your decisions today — and steer you away from mismatched roles that don’t fit your long-term goals. Early momentum matters, and being proactive sets you up for a stronger, more flexible future both personally and professionally.

We’re All in This Together: Why Mentorship Matters in Medicine

From the day you decide to become a doctor, whether as a precocious toddler or as a mid-career professional looking for a sense of fulfillment...

Beyond the Interview: How Doctors Can Maximize Site Visits Before Signing a Contract

As new academic years and new contract terms begin, many doctors start to think about their next steps. It can be difficult to know how...

What Is The Average Dermatologist Salary?

According to the Association of American Medical Colleges, there are over 13,000 practicing dermatologists in the United States. Whether considering dermatology during medical school/training or...

Building the Career You Want with Panacea Financial

Transitioning from residency to practice is one of the biggest milestones of your career — and one of the most exciting. With the right preparation, you can move forward with certainty, protect your future, and begin building a life that reflects your goals, values, and hard work.

The choices you make when you’re starting out — from job selection to loan repayment — compound over time. Panacea Financial is here to guide you through each one, with tools built for doctors at every stage.

Visit PanaceaFinancial.com to learn more — and take the next step toward a stronger, more confident start to your career.

1. Panacea Legal Services partners with Panacea Financial Holdings to assist with administrative and consultative services. The delivery of legal services will be the exclusive responsibility of Panacea Legal Services. Panacea Legal Services does not have a relationship with Primis Bank. ATTORNEY ADVERTISING. PRIOR RESULTS DO NOT GUARANTEE A SIMILAR OUTCOME. ANY COMPLAINTS ABOUT THIS ADVERTISEMENT OR THE REPRESENTATION OF ANY LAWYER MAY BE DIRECTED TO THE SUPREME COURT COMMITTEE ON PROFESSIONAL CONDUCT, C/O CLERK, ARKANSAS SUPREME COURT, 625 MARSHALL STREET, LITTLE ROCK, ARKANSAS 72201.

Download the PDF

Lifestyle Creep & Future Wealth

Lifestyle Creep & Future Wealth Benchmarking Your Salary

Benchmarking Your Salary Focus on building financial flexibility: Prioritize saving for an emergency fund, paying down high-interest debt, contributing to retirement accounts, and protecting your income through insurance. Early habits compound over time — and small steps now can open big opportunities later.

Focus on building financial flexibility: Prioritize saving for an emergency fund, paying down high-interest debt, contributing to retirement accounts, and protecting your income through insurance. Early habits compound over time — and small steps now can open big opportunities later.