The Financial Platform

Built for Doctors

Loans, banking, payments and contract review – built by doctors for every stage of your careeer.

Simplify Your Finances

Get up to $50K when you need it most.

Personal loans built for you

Get up to $50K when you need it most.

- Fixed rates

- No cosigner required9

- No prepayment penalties

- Reduced payments while in training4,5,6

Reach your savings goals fast.

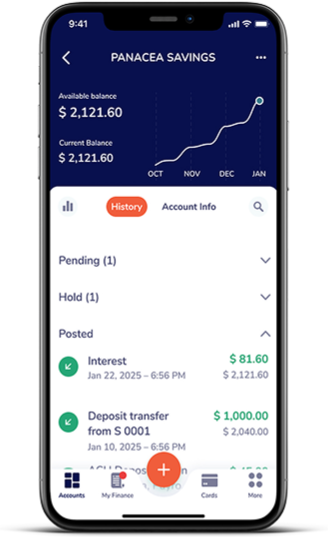

Fee-free checking and savings

Reach your savings goals fast.

- Earn 3.15% APY on every dollar

- No minimum balance required

- Unlimited, free ATM use nationwide1,2

Simplify Your Student Loan.

Student loan refinancing

Simplify your Student Loan.

- Lower your monthly payments

- Simplify your loans

- Save thousands over time

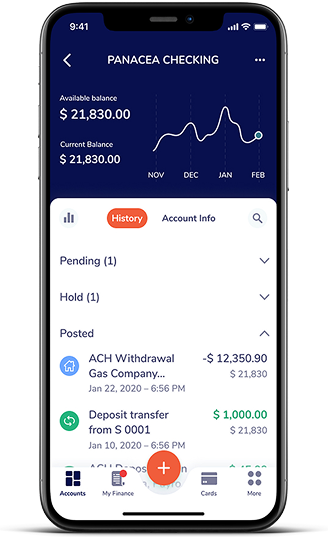

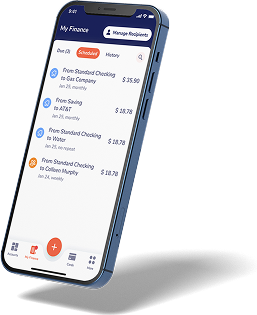

One App To Manage It All

One App To

Manage It All

Access all your accounts, make transfers, deposit checks, pay bills, set up alerts, and track spending—anytime, anywhere, all in one place.

Grow Your Career & Practice

Bring your practice plans to life.

Customized practice loans

Bring your practice plans to life.

- Specialized credit structures

- Competitive pricing

- Experienced advice

Simplify your practice’s finances.

Fee-free checking and savings

Simplify your practice’s finances.

- Next-day remote deposits

- Merchant services

- Unlimited domestic wires

- Robust fraud protection1,2

No Surprise Fees.

Ever.

Your focus should be on caring for your patients, not navigating complicated fine print. That’s why our services are designed without hidden fees, unnecessary charges, or surprises.1,2,4

Your focus should be on caring for your patients, not navigating complicated fine print. That’s why our services are designed without hidden fees, unnecessary charges, or surprises.1,2,4

Maximize Your income.

Maximize your income.

- Standard Contract Review

- Compensation Review

- Contract Review + Negotiation on your behalf10

As seen on

About Us

We built Panacea because doctors deserve a financial platform that fits the arc of our careers: the training years, the first contract, the practice acquisition, the path to retirement. One platform, built around how doctors live and work.

Resources

Panacea Financial Announces Fifth Annual Match Day 2026 Giveaway to Support Medical Students Transitioning to Residency

LITTLE ROCK, Ark. — Panacea Financial, the financial technology platform built exclusively for doctors and their practices, today announced its fifth annual Match Day Giveaway...

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...