PERSONAL LOANS

For Dentists. Made Easy.

Physicians can get up to $50,000 at low rates.1 Panacea has supported doctors with over half a billion dollars in financing to date.

No hard credit check required.

Not ready? Click to speak with a banker about your financial needs.

Loans up to

$50,0001

Quick

Funding

No Cosigner

Required9

Reduced

Payments

How Can A PRN Personal Loan Help?

We get it. We are doctors too. And we know that doctors deserve better than being forced to use high-interest debt. With low rates and quick funding, a PRN Personal Loan can help you with:

Home Improvements

Credit Card Consolidation

Unexpected Life Events

Relocation

No hard credit check required.

Relocation

Real Results

Get To What Matters Faster & Easier

4th Year Dental Students

- Reduced payments during training²

- No cosigner required9

- No prepayment penalty

- Perfect for interviews, boards, or life events!

Borrow up to:

$10,000

Dental Residents & Graduate Students

- Reduced interest-only payments while in training³

- No cosigner required9

- No prepayment penalty

- Perfect for interviews, career transitions, or exams!

Borrow up to:

$20,000

Dentists & Dental Specialists

- Interest-only payments during first 6 months of loan for recent grads or an interruption in practice4

- No cosigner required9

- No prepayment penalty

- Perfect for life events, interruptions in practice, whatever you need!

Borrow up to:

$50,000

No hard credit check required.

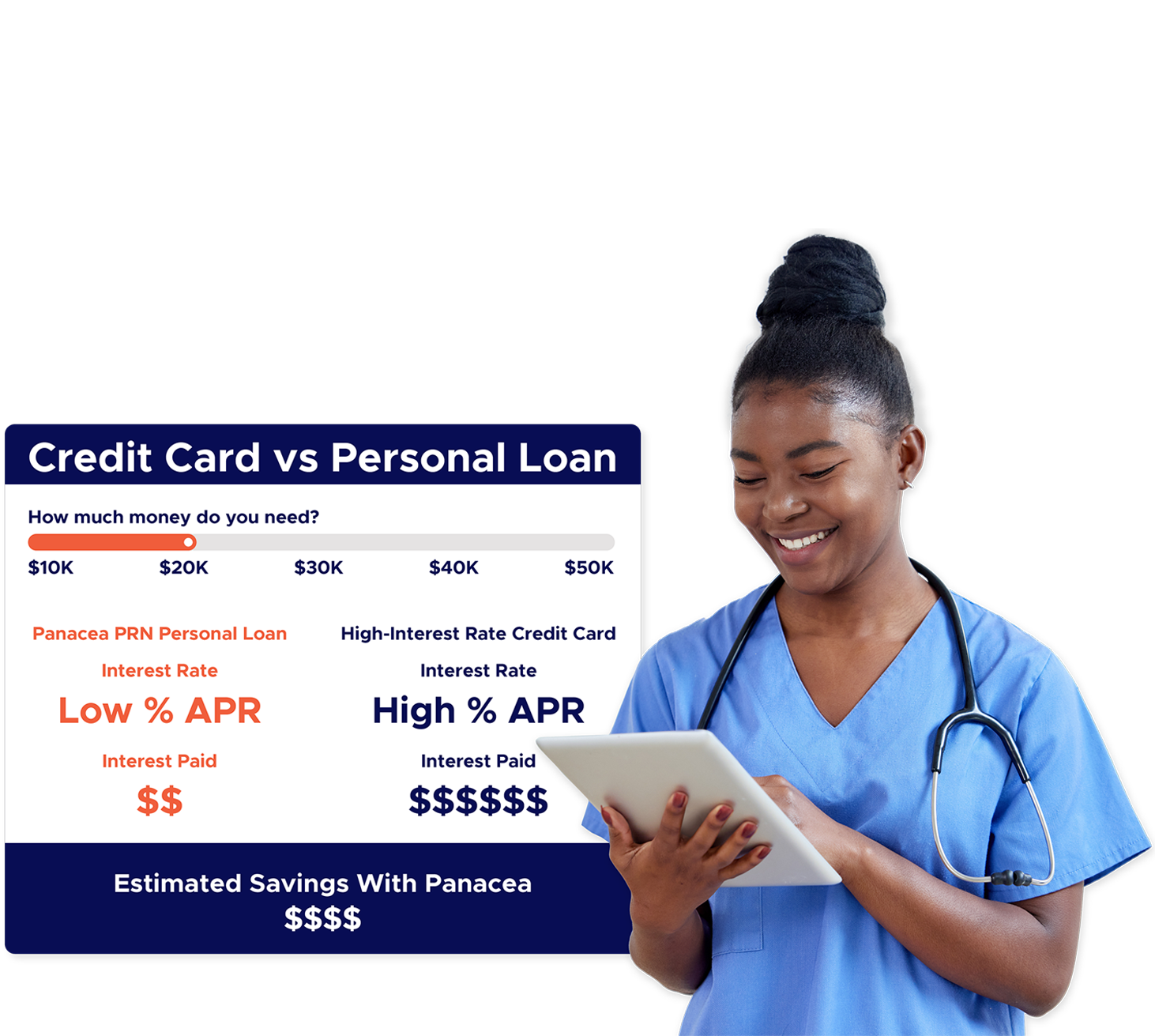

See How Much You Can Save

Using a lower-rate personal loan can save you thousands when compared to a credit card. Don’t take our word for it. Run the numbers yourself with our Personal Loan Vs. Credit Card Calculator.

FAQs

What can I use a Dental PRN Loan for?

A PRN Personal Loan* for Dentists is exactly what it means — your money, as needed. Our PRN Loan can be used for whatever personal expenses may arise. We designed this personal loan product with the mindset that it can help pay for, but not be limited to, interviews, relocation, board examination fees, or to consolidate high interest rate credit card debt.

* PRN Personal Loans cannot be used to pay existing or future educational debt.

Why isn't a cosigner required for a PRN Personal Loan?

We don’t require a cosigner10 for most PRN Personal Loan applicants because we know you are trustworthy and deserve to be treated like an adult. Traditional banks don’t understand the financial lifecycle of doctors, which is why they ask for cosigners in order to get access to their loans.

Who’s eligible for PRN Personal Loans for Dentists?

To be eligible for a PRN Loan, you must be U.S. citizen or permanent resident and one of the following:

- A 4th year student (In-School PRN) in an accredited U.S. based medical, dental, or veterinary school OR

- A resident, fellow, or graduate student (In-Training PRN) after graduation with a MD, DO, DDS, DMD, DVM, VMD, or DPM degree OR

- An independent practicing physician, dentist, or veterinarian (In-Practice PRN) with an active healthcare license.

When does my repayment start?

Your first payment will be due 30 days after receiving your loan. You can tell us what day of the month you’d like to make payments on.

Can I apply for a Dental PRN Loan if I already have a personal loan?

Yes! We set maximum borrower amounts based on your current status: In-School, In-Training, or In-Practice. You can borrow up to the maximum amount for your status. For students that’s $10,000, for residents/trainees, it’s $20,000, and for practicing doctors it’s $50,000. If you take out less than this amount, and find you need more later, your Primary Care Banker will help you re-apply.

No hard credit check required.

Articles & Resources

Explore our collection of advice and tools to help dentists better position themselves for career and financial success.

Personal Loans For Doctors: What You Need To Know

Key takeaways: Personal loans offer doctors money when they need it most for any need — credit card consolidation, application fees, relocation and more. Panacea...

Personal Loan vs. Credit Card: Which Do I Need?

Which is better: a personal loan or a credit card? It depends on what you plan to use it for. As doctors, both of these...

How To Refinance A Credit Card For Doctors

Over half of Americans (61%) have credit card debt. This is a challenge that affects doctors as well. According to Medscape, 25% of physicians are...