Transitioning From

Medical School

to Residency

Tips from doctors who have been through it before

Keep Reading or Download the PDF ↓

minute read

Skip Ahead

Hello new residents!

Congratulations, you’ve made it to this point! There is so much to celebrate — completing medical school, matching into a residency program, and more.

You and thousands of others are about to start the next step of your journey to becoming practicing physicians. For many, residency is the final phase of training before you are able to practice as an attending.

As you are in the transition period between medical school and residency, we hope you are taking time to rest and recharge, but there are preparations to be made before you begin your residency program.

It’s no secret that residency can be stressful. Long hours and strenuous work can often leave little time to spend with loved ones, practice self-care, and conquer the tasks of daily life.

By planning ahead, you can take some of the stress of those daily tasks off of your plate. As physicians who have been through residency ourselves, we know what we’re glad we did and what we wish we had done before residency.

So, we’re sharing tips to help you be ready for residency, including financial habits, managing student loans, buying vs. renting, and more. Let’s get started.

Thinking about your finances prior to residency

When it comes to finances, we often see doctors with two different mindsets: ignore them altogether or assume they are experts.

As medical students or residents, it’s easy to fall into the “ignore” category because you are trying to balance so much, but it is never too early to start practicing good financial habits.

We know that you may be in a high cost of living area or supporting your family, but even if you aren’t able to save hundreds of dollars each month or pay off substantial chunks of your student loan debt, there are small steps you can take to set yourself up for success.

Let’s fight the tendency to ignore our finances and learn some of these small tips that can make a big difference down the road.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Financial priorities & habits

Get your priorities in order first

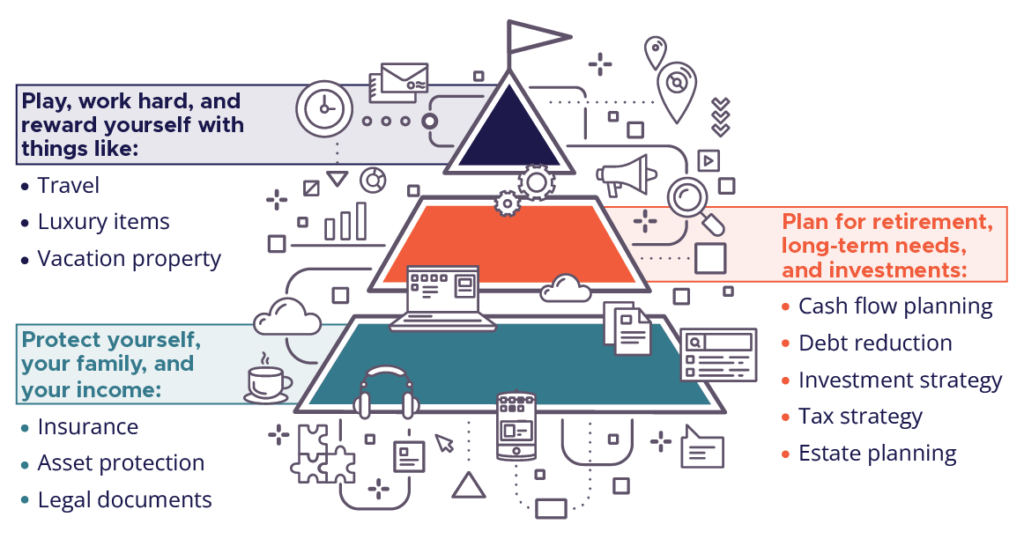

As you prepare to enter residency, we recommend getting your priorities in order, so you know how to manage your money and debt in the years ahead. Focus on protecting yourself, then planning for the future, and finally, playing, or treating yourself.

PROTECT

Protect yourself, your family, and your income with things like:

- Insurance

- Asset protection

- Legal documents

PLAN

Plan for retirement, long-term needs, and investments with:

- Cash flow planning

- Debt reduction

- Investment strategy

- Tax strategy

- Estate planning

PLAY

You’ve worked hard, so you may want to reward yourself with things like:

- Travel

- Luxury items

- Vacation property

Start good financial habits in residency

Starting and maintaining good financial habits throughout residency can make your life simpler. By streamlining aspects of your finances, you can spend less time worrying about if your bills are paid and more time focusing on your patients.

Let’s start by looking at four habits that may help you as you move into training:

- Know your monthly income

- Create a budget

- Prioritize saving

- Keep track of spending

1. KNOW YOUR MONTHLY INCOME

First, you want to know when you will be paid and how much you will actually take home.

When will you be paid? Understand that you won’t be paid right away. If you start July 1, you may not get paid until two weeks later or the end of the month. Some programs pay every two weeks, while others pay once a month. Be sure to know when your program pays so you can plan for expenses in the time before you receive your first paycheck.

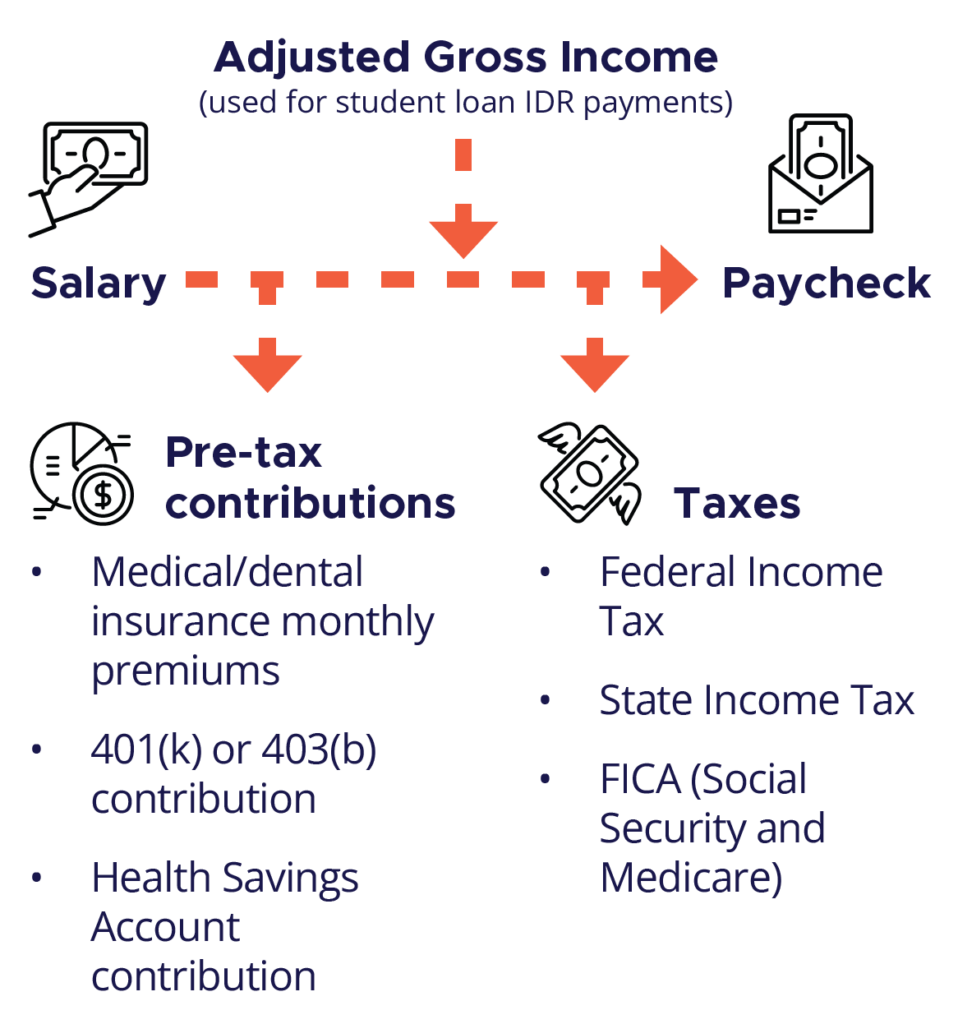

How much will you actually take home? There’s a difference between what’s on your contract, your salary, and what you actually take home, your paycheck. Pre-tax contributions and taxes are taken out of your salary before it comes to your bank account.

Pre-tax contributions

- Medical/dental insurance monthly premiums

- 401(k) or 403(b) contribution

- Health Savings Account contribution

Taxes

- Federal Income Tax

- State Income Tax

- FICA (Social Security and Medicare)

Tip: Use a take-home calculator to find a rough estimate of how much you will earn each paycheck. Try it now.

Another aspect of your finances you need to know is your Adjusted Gross Income. This number is used to calculate your student loan payments if you plan to enroll in an Income-Driven Repayment plan. Your AGI is the amount after your pre-tax contributions and before taxes are taken out.

Pre-tax contributions

Does your residency program match your 401(k) or 403(b) contributions? If so, we recommend taking advantage of this essentially free money. Your employer’s match means you will earn extra toward retirement as you contribute.

If you are reading this before going through the Match process, consider asking the residency programs you interview with if they match retirement contributions. This may be a factor to consider as you create your rank list.

2. CREATE A BUDGET

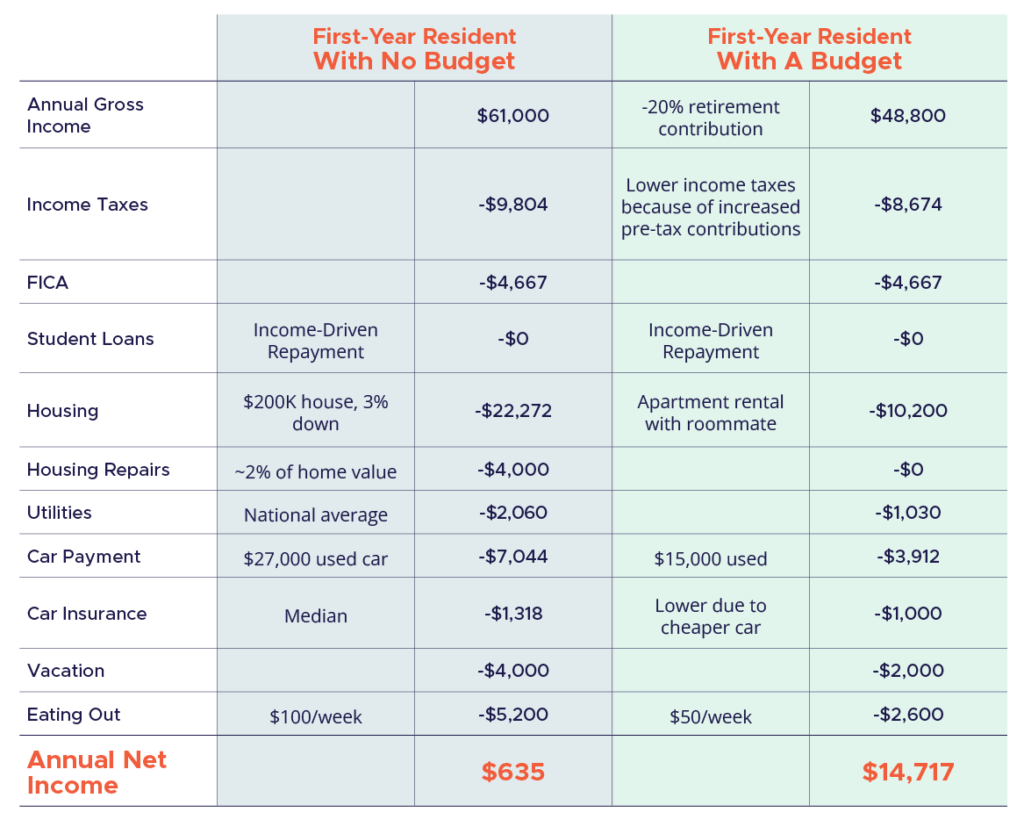

Once you find your take home pay, you will be able to create a more accurate budget. Let’s take a look at how budgeting and being aware of your spending can impact your bottom line.

As you can see, small changes can make a big difference. Even purchasing a cheaper (yet still reliable) car, contributing to retirement (which provides a long-term benefit to you), or being a little more budget-friendly on your well-deserved vacation can allow you to save and have more flexibility.

We know this will not work for everyone. You may live in a higher cost of living area or be supporting your family. We don’t expect you to adhere to every single one of these suggestions, but rather, we wanted to illustrate the importance of being intentional with your budget in small ways.

Mapping out your budget can look different for different circumstances, but you should know how much you’re getting paid, how much you’re taking home, and set a budget with these main categories: housing, transportation, food, student loans, insurance, etc.

The last thing you want to do is have your finances so thin that when you have an unexpected medical bill or car repair, you have to put it on a credit card at a high interest rate. Optimizing your budget, even in small ways, can afford you the wiggle room to adjust to unexpected needs.

Find more tips for budgeting while in residency.

3. PRIORITIZE SAVING

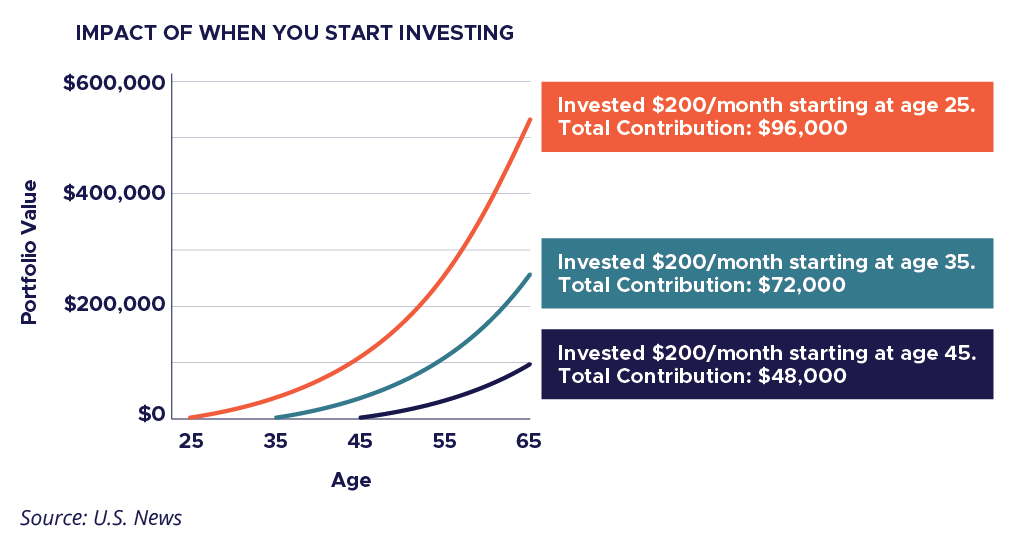

It’s easy for new residents to look at saving as something that will happen once your income grows. Some residents may not be able to save as they start their training, and that’s okay! But, the earlier you can save, the better.

Many doctors have to start saving later. Most are in residency until their early- to mid-30s, meaning they may not be making enough to build significant savings until after that time.

Saving early and making regular contributions means you can take advantage of compounding interest. If you don’t start saving until after residency, you will need to save more to catch up to the savings you need long-term.

Saving earlier is better but if you can’t, don’t sweat it. You can start later, just know you will need to be intentional about contributing more.

Learn how a high-yield savings account can help you save money faster.

4. KEEP TRACK OF SPENDING

Once you have created your budget, it’s important to keep track of your spending so you know if you are sticking to your plan. When it comes to managing your finances in residency, the more you can automate, the better.

There are countless budgeting apps that can automatically track your spending, so you can simply check your app to see if you are following your budget. Check out Goodbudget and You Need A Budget.

Tips For Budgeting, Benefits & Expenses During Residency From Physicians

The transition from medical school to residency can be a challenging task, especially with limited income to cover living expenses and other needs. With long...

Why Monthly Budgeting Is Critical For Doctors-In-Training

Stress around your personal finances can negatively impact your ability to put patient care first. Financial stress has been identified as the second highest cause...

How A High-Yield Savings Account Can Help Doctors Save Money Faster

A high-yield savings account is a simple concept: You save money faster due to a higher rate. There are a few key considerations when choosing...

Buying vs. renting: Deciding where to live

Another important consideration when transitioning from medical school to residency is where you will live. Many new residents are moving to new cities or states to begin their training, so a big question is, “Should I rent or buy during residency?”

Renting is now cheaper than buying a home in the 50 largest U.S. metros, according to 2024 data from Realtor.com. Homeownership comes with a lot of extra costs, both time and money. Repairs, upkeep, and more can introduce planned and unplanned costs that can affect your finances.

Learn what doctors had to say about renting vs. buying in residency.

Pros and cons of renting vs. buying

RENT

Pros

- Flexibility to move more easily

- Less responsibility for maintenance and repairs

- Can be financially smarter in the short term

Cons

- Prevents building equity in a home

- Less predictable pricing

BUY

Pros

- Feel secure in a space that you own

- Personalize and customize your home to your needs and style

- Build equity in a long-term investment

Cons

- Significant initial financial investment (down payment, closing costs, renovations)

- Responsible for ongoing repairs and maintenance

Breaking even

Typically, it takes about 5-7 years of homeownership to break even on buying a home. Given the nature of our career paths as doctors, it can be hard to predict where you will be in the next five years. Maybe you’ll decide to pursue a fellowship, get married, or get a job in a different area.

Your life as you finish residency may not be the one you are planning out right now. If you have to move before that five-year mark, you could potentially lose money if you have to sell your home.

Renting can be a safer bet unless you are certain you will stay.

Compare renting vs. buying with this calculator.

How much can I afford?

“How much can I afford?” and “How much should I afford?” are two different questions. You may technically qualify for a larger mortgage loan than may be reasonable for your budget. Though it can be very exciting to purchase an amazing, expensive house, it may not be best for your long-term finances.

Generally, it’s recommended that your mortgage loan be less than twice your annual salary (or the household’s annual salary).

Mortgage loan < twice annual salary

Based on the average resident salary without a spouse’s or partner’s income, that means your recommended mortgage maximum is only about $120,000. Real estate has become increasingly expensive in the past few years, and $120,000 will not be enough to buy a home in many areas.

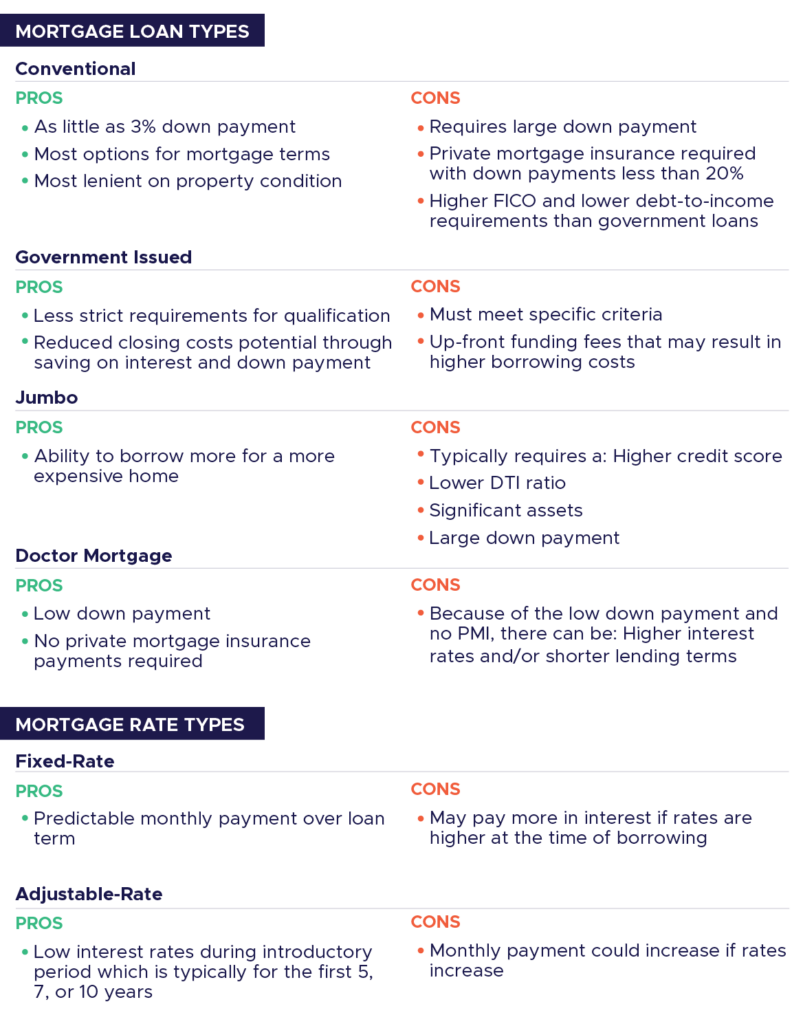

Mortgage types

Mortgage 101 for Doctors: Rent vs. Buy & More

Buying your first home is an exciting milestone. Whether entering residency or already a practicing physician, dentist or veterinarian, making the leap from renting to...

What Is A Doctor Mortgage Loan?

Are you a doctor considering purchasing a home? Becoming a homeowner can be a significant milestone in life, but because of doctors’ unique financial situations...

Mortgage Basics For Doctors: What Is A Mortgage, How It Works & More

Are you considering buying your first home? Homeownership is an exciting part of life that can be representative of your hard work. Homeownership can increase...

Student loan strategy

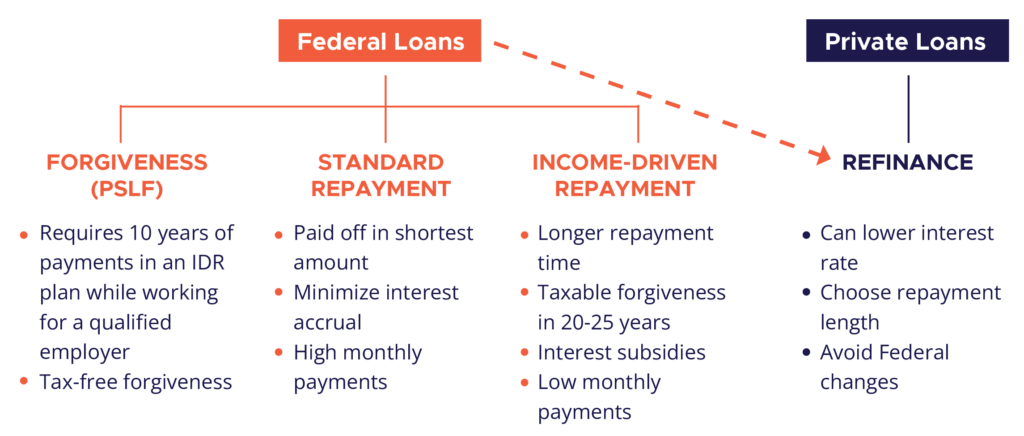

There are two main types of student loans: federal and private. With federal loans, you have four main pathways: forgiveness, standard repayment, income-driven repayment (IDR), or refinance. Private loans can either be repaid or refinanced.

Student loan strategy options

Before you refinance: If you refinance federal student loans, you cannot go back. If your federal student loans later qualify for a new repayment option or forgiveness opportunity after you refinance your loans, you won’t be able to take advantage of these new options for federal student loans.

See how different forgiveness and repayment options can impact your loans with Loan Simulator.

Forgiveness options

Note: At the time of writing, many federal student loan changes are being made or proposed. Stay updated here.

Public Service Loan Forgiveness

By using PSLF, borrowers receive full forgiveness of their remaining balance after 10 years of payments in an IDR plan while working for a qualified employer. This type of forgiveness is not federally taxed as income.

Pros

- Tax free

- Shorter time period

- Easy for some specialties to qualify

Cons

- Restricted by employer type

- Annual paperwork needs to be completed

PSLF TIP: Loans without a grace period

If you have any plan to pursue PSLF, the best time to start is when your residency starts! You can decline the automatic grace period after graduation to get six more months of $0 payments to qualify towards PSLF.

If you do nothing:

Your loans are placed in an automatic 6-month grace period after graduation.

What you can do instead:

Contact your servicer to consolidate federal loans at graduation which triggers repayment. You will submit your employment certification form for IDR and PSLF at the same time.

Expected payments:

Based on expected SAVE amounts, this would add 6 $0 payments towards your 120 qualifying payments.

Note: The SAVE plan is being challenged in federal court and unlikely to be an option for borrowers in the future. Stay updated here.

Learn more about PSLF for doctors.

IDR

IDR allows borrowers to receive full forgiveness of their remaining balance after 20-25 years in repayment. This type of forgiveness is taxable as income.

Pros

- Does not depend on employer

- Do not have to complete annual employer paperwork

Cons

- Could result in a large personal tax bill

- Pay a larger amount over time compared to PSLF

Repayment options

STANDARD REPAYMENT

- Default plan

- Set to pay off in 10 years

GRADUATED REPAYMENT

- Start low and increase every two years

- Set to pay off in 10 years

IDR

- Based off your discretionary income

- Great option for PSLF

Understanding Income-Driven Repayment

INCOME-BASED REPAYMENT (IBR):

- Monthly payments capped at 10% or 15% of your discretionary income

- For new borrowers on or after July 1, 2014, payments are capped at 10% of discretionary income. For borrowers before July 1, 2014, payments are capped at 15%.

- Loan balance is forgiven after 20 years of qualifying payments (for new borrowers) or 25 years (for borrowers before July 1, 2014).

PAY AS YOU EARN (PAYE):

- Monthly payments capped at 10% of your discretionary income and adjusts annually based on changes in income and family size

- To qualify for PAYE, you must be a new borrower as of October 1, 2007, and have received a disbursement of a Direct Loan on or after October 1, 2011.

- Loan balance is forgiven after 20 years of qualifying payments.

SAVING ON A VALUABLE EDUCATION (SAVE):

- SAVE replaces the REPAYE plan

- Monthly payments capped between 5% and 10% of your discretionary income

- Interest not covered by your monthly payment is waived

- Loan forgiveness after 20-25 years of qualifying payments

Note: The SAVE plan is being challenged in federal court and unlikely to be an option for borrowers in the future. Stay updated here.

INCOME-CONTINGENT REPAYMENT (ICR):

- Monthly payments capped at the lesser of 20% of your discretionary income or what you would pay on a fixed 12-year repayment plan, adjusted according to your income.

- Loan forgiveness after 25 years of qualifying payments

Which IDR plan are my loans eligible for?

Understanding Student Loans: Frequently Asked Questions Answered

As the cost of medical, dental and veterinary school continues to rise, many prospective and current doctors find themselves burdened by significant student loan debt...

A Doctor’s No-Nonsense Guide To Student Loans

A Doctor’s No-Nonsense Guide To Student Loans More than 42 million American have student debt, including many doctors Keep Reading or Download the PDF ↓...

Pros & Cons Of Refinancing Student Loans

If you are one of the 43.6 million borrowers with federal student loan debt, you may be seeing advertisements and suggestions to refinance your student...

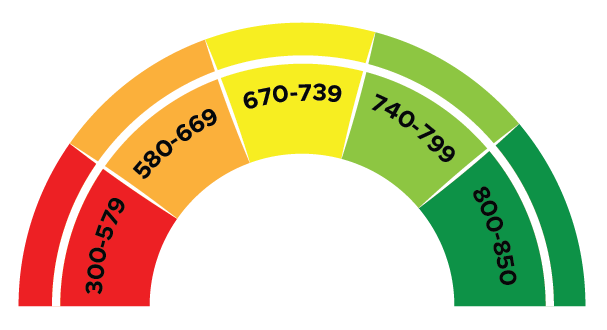

Credit score

Credit scores are an important part of your financial health. Having a low credit score means you may be rejected or receive less favorable terms for financial products like credit cards or loans.

Despite high earning potential, many doctors find themselves with less-than-ideal credit scores due to substantial student loan debt and the financial strain of school and residency. Here are some tips to help you improve your score.

How is a credit score calculated?

PAYMENT HISTORY (35%)

- On-time payments (less than 30 days past due)

- Amount in delinquency

- Number of past dues

- Number of accounts being paid

AMOUNTS OWED (30%)

- Utilization of credit cards (individual and total)

Amount of installment loans owed (car loans, mortgages, personal loans, etc.) - Number of accounts with a balance

LENGTH OF CREDIT HISTORY (15%)

- Age of oldest account

- Age of newest account

- How long since account was used

NEW CREDIT (10%)

- New hard credit checks in the last 12 months

CREDIT MIX (10%)

- The mixture between revolving credit (credit cards) and installment credit (loans)

How do I improve my credit score?

Improving your credit score will take time, but the effort is worth it for lower rates and decreased risk of rejection. Ways to improve credit score include:

PAY BILLS ON TIME

Especially with the busy schedule of a resident, it may be smart to set up automatic payments for all bills, like student loans, credit cards, and utilities, to ensure your accounts stay in good standing and you avoid late fees and penalties.

MANAGE STUDENT LOAN DEBT

High debt balances, including student loans, can increase your credit utilization ratio, affecting your score. To manage the high amount of loans you may have from medical school, explore income-driven repayment plans that align with your cash flow.

Refinancing student loans can also lower interest rates and monthly payments, freeing up cash to pay off other debts or save for future expenses; although refinancing can have drawbacks as well.

LIMIT YOUR CREDIT USAGE

Keep your credit card balances below 30% of your credit limit. If possible, pay off balances in full each month. If you need to carry a balance, spread it across multiple cards rather than maxing out one card.

MAINTAIN OR INCREASE THE LENGTH OF YOUR CREDIT HISTORY

Keep older credit accounts open, even if you no longer use them regularly. This can help lengthen your average credit history, which is beneficial for your score. Be aware that if you don’t use a credit card, that card may be canceled due to inactivity after a certain amount of time. So it may be beneficial to dust that oldest card off once in a while.

BECOME AN AUTHORIZED USER

If you are new to building credit, becoming an authorized user on someone else’s account can quickly improve your credit score by boosting your credit limit, payment history, and length of credit history.

Look for a relative or friend with a high credit limit and a solid history of on-time payments who is willing to add you as an authorized user. You don’t need to use the card for your credit score to improve.

LIMIT HARD INQUIRIES

Be strategic about applying for new credit. Too many inquiries in a short period can lower your score. When shopping for a mortgage or auto loan, try to do your rate shopping within a short period (usually 14-45 days), as these are typically treated as a single inquiry.

How To Improve Your Credit Score For Doctors

Despite high earning potential, many doctors find themselves with less-than-ideal credit scores due to substantial student loan debt and the financial strain of school and...

How To Get An 800 Credit Score As A Doctor

Credit scores are an incredibly important financial tool. Many doctors, especially trainee and early-career doctors, are burdened by a low credit score because of the...

What Doctors Need to Know About Credit Scores

Your credit score plays a big role in your life. Also known as a “FICO score” or “risk score,” your credit score is a tool...

Preparing for residency

We hope these tips will help you feel confident as you begin the next phase of your training and career. Though managing your finances can be stressful and confusing, following these guidelines can help you be a little less stressed and allow you to focus on your work.

Whether you need extra funds for relocation, unexpected expenses, or credit card consolidation, Panacea Financial is ready to help. Our PRN Personal Loans were built with residents’ needs in mind.

Doctors shouldn’t be forced to cover their expenses with high-interest debt. That’s why the PRN Loan has competitive rates, no cosigner requirement10, and no prepayment penalty.

Download the PDF