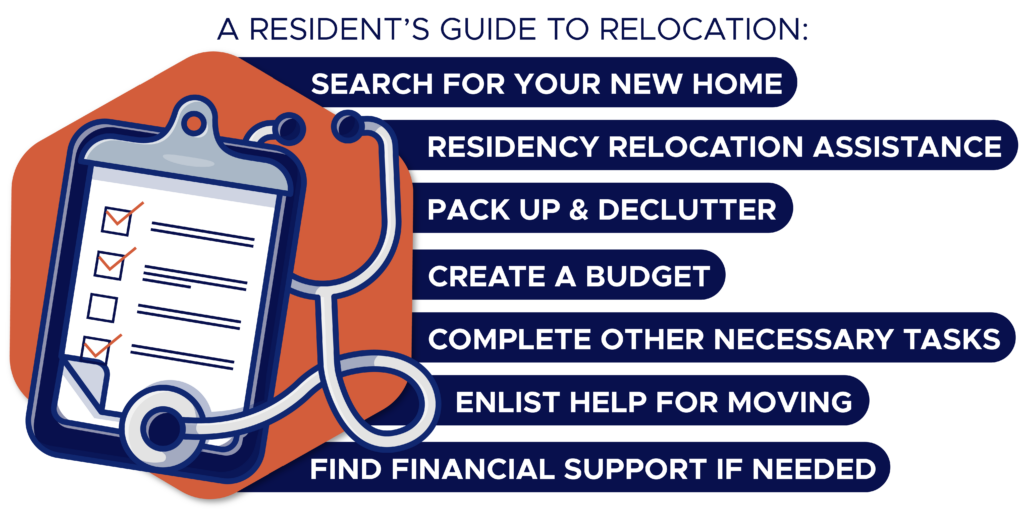

Are you relocating for residency? If so, there’s plenty to do between Match Day and the start of your residency program. Relocating can be one of the most complex and arduous steps in the process. Here’s your to do list for residency relocation:

- Search for your new home

- Take advantage of residency relocation assistance

- Pack up & declutter

- Create a budget

- Complete other necessary tasks

- Enlist help for moving

- Find financial support if needed

1. Search for your new home

After finding out where you matched for residency, we recommend starting the search for your new home quickly. Especially if moving to an in-demand city, it could take time to find an apartment or home that fits your needs.

As you begin your search, make a list of your must-haves: location, school district, proximity to residency program, home size, apartment vs. home, etc. Use this as a guide to inform your search and decisions.

2. Take advantage of residency relocation assistance (if provided)

Though residency programs don’t typically cover the expenses that come with moving, some do offer relocation assistance. If offered, this could help save time and stress by providing logistical support with moving guides, realtor/mover/etc. suggestions, administrative assistance, and more.

Some residency applicants ask about these programs during the interview process, but if you didn’t ask and you aren’t sure what your program offers, just ask! Speak with the residency coordinator or your program contact to see what assistance they offer, if any.

3. Pack up & declutter

For most new residents, there are about three months between Match Day and the start of their program. That’s not much time to get all of your belongings packed up, moved, and unpacked.

Once you learn where you will be training, it may be a good idea to begin the process of cleaning out and packing up. As you pack, go through your things to find items to donate or throw away, so you aren’t moving more than you have to (this is a money saver). Be sure you are labeling each box to make the unpacking process a little easier.

As you finish packing, set aside the items you will need within the first week so it doesn’t get stuck in a container transport or a box you can’t find!.

4. Create a budget

Moving and settling into a new place can be expensive. The average cost for a long distance move is between $2,200 and $5,700. Create a budget so you can have a sense of how much you will spend and help you know what things you should buy now and what you may want to wait for.

Some things you may need to include in your budget:

- Moving expenses (Truck rental, container fees, moving company)

- Boxes and other packing materials

- Startup cable and internet costs

- Gas (if driving a vehicle)

- Meals while traveling

- Accommodations while traveling

- Cleaning supplies

- Grocery staples

5. Complete other necessary tasks

Though finding a home and moving are two of the biggest aspects of transitioning to your residency program, there are many other small tasks that need to be done during this time. Here are some other things you may want to think about:

- Set up/disconnect utilities

- Update your mailing address for subscriptions, bills and accounts

- Notify your bank and other important accounts that you are moving

6. Enlist help for moving

Whether hiring movers or taking a DIY approach to moving to your new home, it’s important to have a plan for this laborious part of the transition. If you have friends or family in your current area or the one you’re moving to, it doesn’t hurt to save a few dollars by enlisting their help. Sometimes residency programs may have discounts for moving companies (ask your program director)!

If you aren’t able or don’t want to do all of the heavy lifting — literally — you have a couple different options. Hire a moving crew to load and move your belongings or consider container moving services, where you fill a container then the container company will transport it to your new home (this option could be cheaper).

7. Find financial support if needed

As made evident by the preceding list, moving is expensive, and it can be an even greater financial burden for medical students who likely have little savings and high student debt. Though you are about to receive your first paycheck as a resident, you will be taking on a lot of expenses in a very short amount of time prior to getting paid. Also, keep in mind you may not get paid for several weeks into residency.

There are many different options for extra funds during this time. Credit cards are a common choice but could have a negative effect on your finances if not paid off immediately. Personal loans could be another good option.

Panacea Financial was created to give doctors and doctors-in-training the financial solutions they deserve. Learn how Panacea can help you secure financing quickly to help with your residency relocation here. Apply for a PRN Personal Loan here.

More residency resources

We have resources to help you through every stage of your career. Check out some of our residency-specific articles here:

- How to Get a Loan for Residency Relocation

- What Happens Between Match Day and Residency? We’ve Got Your To-Do List

- How to Cover Expenses During Medical Residency

- Practical Financial Planning Tips for Residents and Fellows

- 10 Tips for New Residents