Mortgage Basics for Doctors:

What is a Mortgage, How it Works, & More

Are you ready to buy your first home?

Keep Reading or Download the PDF ↓

minute read

Skip Ahead

Introduction

Are you ready to buy your first home? Homeownership is an exciting milestone that reflects your hard work.

Homeownership can build your net worth, offer tax benefits, and provide stability and peace of mind. But it also typically means taking on a significant mortgage, which—if you’re a doctor—can add to the large sum of debt you may already have from student loans.

Navigating the world of home loans can feel overwhelming. With various mortgage options, down payment requirements, and qualification criteria, it’s important to understand the basics. The more informed you are, the more confident you’ll feel when making decisions about becoming a homeowner.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

The Basics

Let’s start from the very beginning—what is a mortgage? A mortgage is a loan that allows you to purchase a home or other real estate without having all of the money upfront.

According to the Consumer Financial Protection Bureau, the definition of mortgage is “an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you’ve borrowed plus interest.”

When you make your monthly mortgage payment, it is split into four parts: principal, interest, taxes, and insurance (PITI).

- Principal is the portion of your loan balance that is paid down with each payment.

- Interest is the added charge per month you owe in addition to principal that is based on the interest rate, or note rate, of the loan.

- Taxes are a monthly portion of your annual property tax bill and are based on the value of your property.

- Insurance can include both homeowners and mortgage insurance. Homeowners insurance protects your property from damages like fire, theft, or natural disasters. Mortgage insurance is typically required if your down payment is less than 20% of the home price and protects the lender in case you default on the loan.

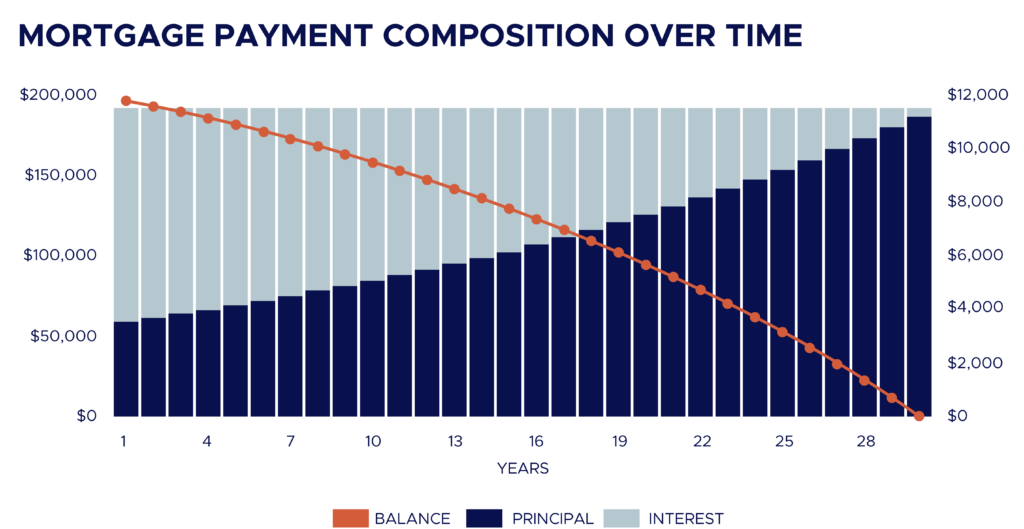

Early in your payments, interest will make up a large portion of each payment, but over time, you will begin paying more of the principal, until the balance is fully paid off, generally after 15 or 30 years.

How Mortgage Interest Rates are Determined

Mortgage rates are determined by a combination of borrower-specific variables and economic factors.

BORROWER-SPECIFIC VARIABLES INCLUDE:

Credit score: Interest rates are lowest for borrowers with credit scores of 740 or higher. In our experience, borrowers with credit scores below 640 typically have much higher interest rates and fewer lending options.

Debt-to-income ratio: This ratio compares a potential borrower’s debt to their income to determine creditworthiness and gauge the level of risk associated with lending to the individual. Most lenders prefer borrowers to have a DTI ratio of 43% or lower (including the new mortgage payment) to qualify for a mortgage.

Loan-to-value ratio: This is a measure of loan amount compared to the home’s value. If you make a $20,000 down payment on a $100,000 home, your mortgage will be $80,000. This means you’re borrowing 80% of the property’s value.

A loan-to-value ratio greater than 80% is typically considered high and represents a greater risk to the lender, which may increase your interest rate or increase the need for mortgage insurance*.

*Mortgage insurance is an insurance policy that protects a mortgage lender or titleholder if the borrower defaults on payments, passes away, or is otherwise unable to meet the contractual obligations of the mortgage. It is important to note that this is insurance that protects the lender, not the borrower. In other words, you are paying an expense to protect the mortgage lender.

Certain lenders understand that many early-career doctors can’t provide a large down payment and offer doctor mortgages. Doctor mortgages don’t require a down payment and allow doctors the ability to buy a home earlier than they could with a conventional loan.

OTHER FACTORS THAT AFFECT YOUR MORTGAGE INTEREST RATE INCLUDE:

Economic factors: Factors like inflation, rate of economic growth, the Federal Reserve’s monetary policy, the bond market, and housing market conditions all have varying impacts on mortgage rates.

Different Types of Mortgages

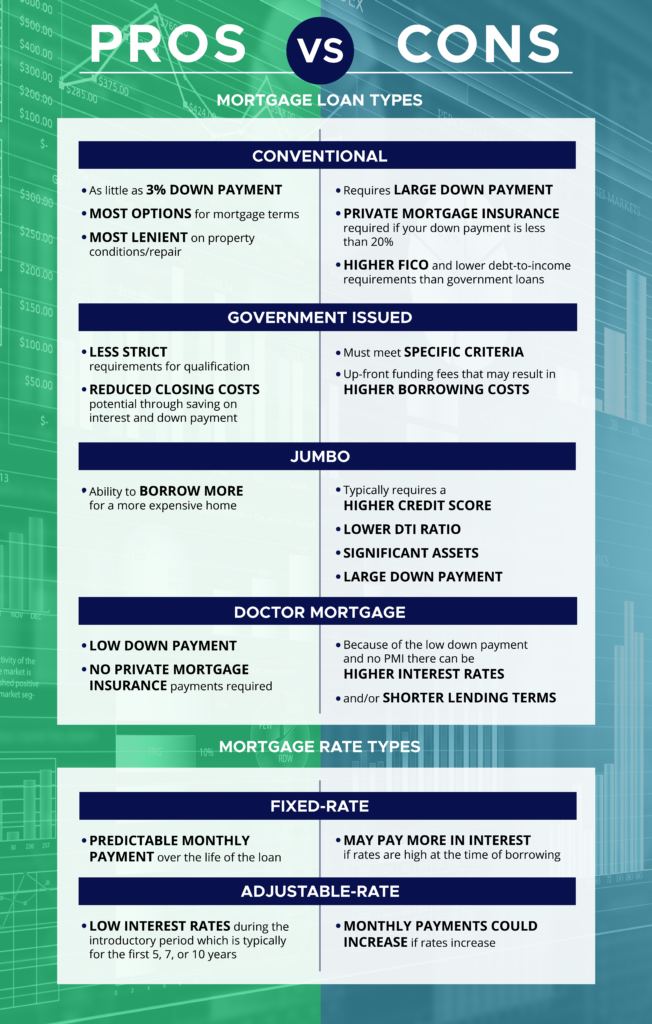

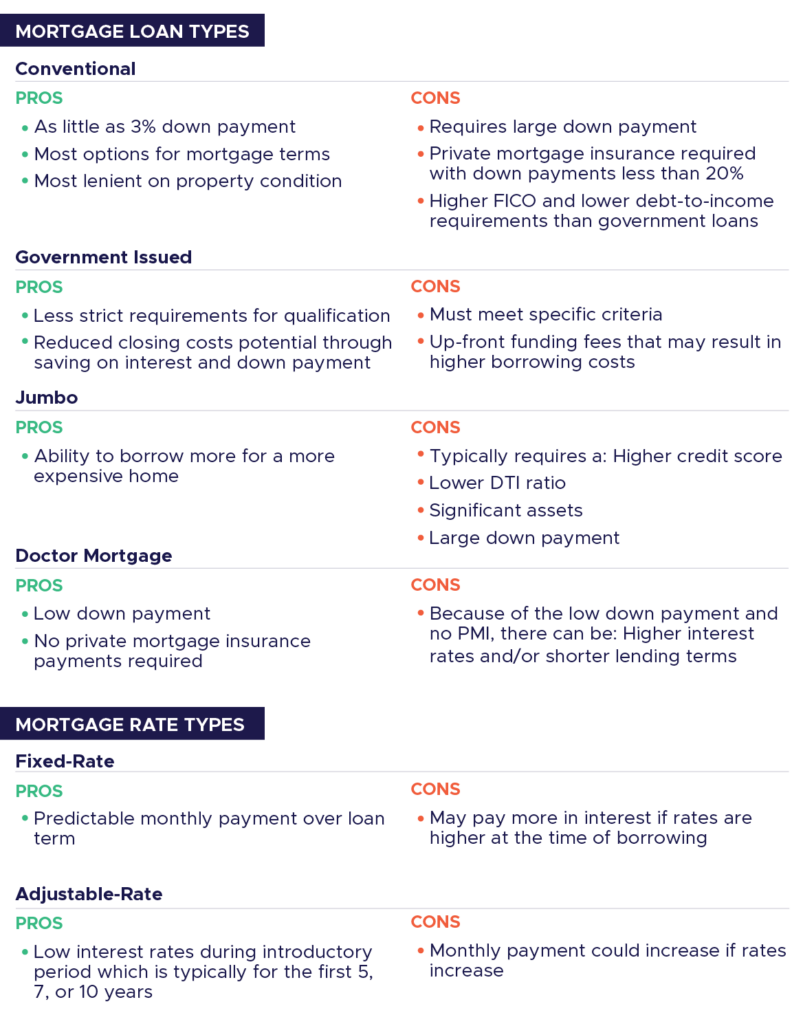

The three main types of mortgages are conventional, government, or jumbo. Depending on the type, you may have a fixed or adjustable-rate loan.

TYPES:

- Conventional mortgages are the most common type of mortgage. These loans often have stricter credit score and debt-to-income (DTI) requirements.

- Government-issued loans are insured by government agencies and include FHA, USDA, and VA loans. You may be able to qualify for a government-backed loan even if you can’t get a conventional loan as they generally allow for lower FICO requirements and higher debt-to-income limits.

- Jumbo loans are used for buying high-value property and can be more difficult to qualify for than other mortgage types. Jumbo loans are for mortgage loan amounts that exceed the conforming loan limit for the area in which you wish to buy. (Most of the country has a conforming loan limit of $806,500 for a 1-unit property).

- Bonus: Doctor loans are mortgages built specifically for doctors — physicians, dentists and veterinarians. These loans often have lower down payment requirements, don’t require private mortgage insurance, allow for higher debt-to-income ratios, and may have favorable terms even with student loan debt.

RATES:

- Fixed-rate loans offer a predictable monthly payment because they have the same interest rate and principal-to-interest payment each month.

- Adjustable-rate loans have interest rates that change with market changes. You will have a fixed rate for the introductory period. After that period, if the market index increases, your rate will rise; if it decreases, your rate could lower. The amount that an adjustable rate, or ARM, could rise or fall depends on the floor or ceiling of that mortgage loan.

Utilizing a Doctor Mortgage Loan

Doctor mortgage loans offer several advantages that make homeownership more accessible for doctors early in their careers.

BENEFITS OF DOCTOR MORTGAGES

- Low or no down payment – Many doctor mortgage loans offer financing options with little to no down payment required.

- No private mortgage insurance – Unlike conventional loans that typically require PMI when the down payment is less than 20%, doctor loans often waive this requirement, reducing your monthly payment obligations.

- Flexible DTI ratios – Lenders offering doctor mortgages often use lenient DTI calculations, increasing the likelihood of loan approval.

- Higher loan limits – Doctor mortgages may provide higher borrowing limits compared to conventional.

DRAWBACKS OF DOCTOR MORTGAGES

- Interest rates – Some doctor mortgage loans may come with slightly higher interest rates or adjustable-rate terms compared to traditional mortgages.

- Credit requirements – Lenders may require higher credit scores for doctor loans than for conventional loans.

- Property restrictions – Doctor mortgage loans often can’t be used to purchase condos and are only for primary residences. Vacation or rental properties can’t be purchased with a doctor mortgage.

- Limited lender options – Not all financial institutions offer doctor mortgage loans, which may limit options when seeking this type of financing

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

How Debt-to-Income Ratio Impacts Your Mortgage Application

When evaluating potential borrowers, lenders consider various financial factors, with debt-to-income (DTI) ratio being a critical component.

For physicians, dentists, and veterinarians, high levels of student loan debt can create challenges when applying for a mortgage. This can be particularly difficult for residents, trainees and early-career doctors, who often have low income or are just starting to earn a higher salary.

Understanding the relationship between DTI and mortgage approval is essential for potential homebuyers and those considering refinancing. Here’s what DTI is, how it influences doctors’ mortgage eligibility, and strategies to improve it.

To calculate your debt-to-income (DTI) ratio, follow these steps:

1. GATHER YOUR MONTHLY DEBT PAYMENTS

Make a list of your monthly debt payments. This includes items like:

- Monthly mortgage payment (if you have one)

- Minimum credit card payments

- Car loan payments

- Personal loan payments

- Student loan payments (minimum required/income-based payments)

- Alimony or child support payments (if applicable)

- Any other monthly loan or debt obligations reported to your credit

2. CALCULATE YOUR GROSS MONTHLY INCOME

Add up all your sources of income that you receive on a regular basis. This can include:

- Monthly salary or wages (before taxes and deductions)

- Rental income

- Freelance or self-employment income

- Alimony or child support received (if applicable)

- Any other consistent sources of income

3. DIVIDE TOTAL MONTHLY DEBT PAYMENTS BY GROSS MONTHLY INCOME

Take the total amount of your monthly debt payments and divide it by your gross monthly income. Then multiply the result by 100 to find the ratio as a percentage.

DTI Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100

For example, let’s say your total monthly debt payments are $1,500, and your gross monthly income is $5,000.

DTI Ratio = ($1,500 / $5,000) x 100 = 0.30 x 100 = 30%

In this example, your DTI ratio is 30%.

How Lenders Use Debt-to-Income Ratio

When you apply for a mortgage, lenders scrutinize DTI ratio to evaluate your creditworthiness and gauge the level of risk associated with lending you money. A high DTI ratio suggests that a significant portion of your income is already allocated towards debt payments, leaving less room for a new mortgage payment. This could be a red flag for lenders, as it increases the likelihood of defaulting on the mortgage.

Most lenders prefer borrowers to have a DTI ratio of 43% or lower (including the new mortgage payment) to qualify for a mortgage. However, some loan programs may allow a higher DTI ratio, but the higher it is, the more challenging it may be to secure favorable terms and interest rates. A lower DTI, on the other hand, is more likely to help you achieve favorable loan terms and lower interest rates.

Using the example above, where current monthly debts are $1500, and gross income is $5000, adding in a $1000 mortgage payment puts the total proposed monthly debt-to-income at 50% ($1500+$1000 / $5000 = .5 x100 = 50%). If a lender allows for total DTI to go up to 50% then your new mortgage payment cannot exceed $1000/month. Sticking with a 43% DTI limit allows for a new mortgage up to $650/month with the same scenario.

How to Improve Your Debt-to-Income Ratio

If you have a high debt-to-income ratio, the two main ways to improve it are to raise your income or lower your debt. Here are some tips:

Increase Your Income: Increasing income is one way to lower your debt-to-income ratio, but it can be difficult for doctors. With already demanding work schedules, taking on another job can be challenging timewise or could lead to decreased mental health due to overwork and lack of down time.

Despite these possible challenges, 37% of physicians have a side gig, like medical consulting, chart review, real estate, and investing.

Reduce Outstanding Debts: If you’re not able to take on more work, lowering your debt load may be the best course of action. Start by tackling high-interest debts like credit cards and personal loans. Create a structured repayment plan to reduce outstanding balances, which will not only lower your DTI ratio but also improve your overall credit score.

Keep in mind that lenders typically use the minimum monthly payment when calculating your DTI ratio, not loan balances, so when tackling debt to free up DTI, it’s best to focus on eliminating or reducing higher monthly payment obligations—even if balances remain on those accounts.

It’s important to note that sometimes closing accounts with a long history and in good standing can actually lower your credit score, so talk to your lender before taking any action to close newly paid off accounts.

Avoid New Debt: Prioritize avoiding any new debt commitments while you’re in the process of applying for a mortgage.

Taking on new loans or credit lines can increase your DTI ratio and raise concerns for lenders—at minimum, the newly opened debts will need to be sourced and explained. At worst, the monthly payment can put your DTI over the limit and suddenly disqualify you mid-transaction. For a smooth mortgage transaction with limited surprises, avoid opening new accounts.

Budget Wisely: Develop a detailed budget to track your monthly expenses and identify areas where you can cut back. By managing your spending prudently, you’ll free up more funds to pay off debts and improve your DTI ratio, and likely as a result, your credit score too.

Consolidate Debt: Consider consolidating multiple high-interest debts into a single, lower-interest loan. Debt consolidation can simplify your repayment process and potentially reduce your monthly debt obligations.

Increase Down Payment: A larger down payment can have a positive impact on your mortgage application. By reducing the loan amount, your DTI ratio will improve, increasing your chances of approval.

Lower Debts & Put Less Down: Gone are the days where you need 20% to put down. Contrary to the previous suggestion, sometimes it can actually be better to allocate some of your funds towards debt reduction and put less down on your mortgage.

Compare both scenarios (20% down versus 5% down and debt reduction) to see which method gives you lower overall debts and a comfortable monthly payment on your new home. Putting less down and reducing debts may also help you qualify for more house, increasing your leverage.

Be Patient: Improving DTI ratio and achieving financial stability takes time. The journey to homeownership may involve some sacrifices, but the long-term benefits of owning a home can make it worthwhile.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

How Much Down Payment You Need to Buy a House

One of the biggest challenges of buying a home is saving for a down payment. A down payment is the amount of cash you pay upfront on a large purchase, like a home or car. It is calculated using a percentage of the total purchase price, and most buyers will take out a loan to finance the remainder of the purchase.

Many homebuyers wonder how much they need to save for a down payment, as it can have a significant impact on their ability to secure a mortgage, the interest rate they qualify for, and their monthly mortgage payments. Lenders may require down payments from 0% to 25% of the purchase price, depending on the loan type and the borrower (their credit score, debt-to-income, and how they will occupy the home).

Down Payment Requirements by Mortgage Type

Down payment requirements can vary greatly based on the type of mortgage. Let’s take a look at how conventional, FHA, and doctor mortgage down payment requirements differ.

CONVENTIONAL MORTGAGE

Conventional loans require as little as 3% down (for first-time home buyers) and up to 20% down (for investment purchases).

With a smaller down payment (less than 20% down), the buyer will often need to pay for private mortgage insurance, which can vary from 0.5% to 1% of the total loan amount per year.

FHA MORTGAGES

FHA mortgages are government loans insured by the Federal Housing Administration and are designed to help first-time homebuyers or those with lower credit scores or income levels. FHA mortgages typically require a down payment of 3.5% of the purchase price of the home.

For example, a $200,000 home would require a down payment of $7,000.

However, it is important to note that similar to conventional loans, borrowers will need to pay for FHA mortgage insurance, which can add to the overall cost of the loan.

DOCTOR MORTGAGES

The down payment requirement for a doctor mortgage can vary depending on the lender, but it is typically around 5% to 10% of the purchase price of the home. Some doctor mortgage lenders offer 0% down payment options.

Benefits of Making a Large Down Payment

Smaller monthly payments – The higher the down payment, the lower the monthly payments a buyer will have to make. If you are trying to purchase a $350,000 home, the difference between 3% down and 20% down at a 6.5% interest rate equates to almost $400 less each month.

Interest savings over time – Not only will your monthly payments be less because of a larger down payment; you will also pay less for the mortgage overall. For the same priced home, you will save almost $60,000 in interest over the course of a 30-year mortgage.

No PMI – Depending on loan terms and down payment amount, you may be able to skip the additional monthly cost of private mortgage insurance or reduce the amount required.

Better terms – With a bigger down payment, a lender may offer you lower rates or you may qualify for a higher purchase price.

Drawbacks of Making a Large Down Payment

Stretching your savings thin – Making a larger down payment to the detriment of your savings account can be a bad position for a new homeowner. It’s important to keep a portion of your savings set aside for emergencies, and cutting into that for a down payment could put you in need of money later.

Delaying your purchase – Saving for a large down payment can delay your time to enter the market. During this time, home prices and interest rates could be rising, which will limit your purchasing power.

Limiting investments or retirement – Some homebuyers will forgo investments and retirement savings to accumulate a higher down payment. Solely saving for a down payment while forgoing other financial goals could affect your finances in the long term.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

How to Get Prequalified for a Mortgage

Mortgage prequalification helps you understand how much you may be able to borrow for a home loan. During this process, a lender reviews your basic financial details and provides an estimate of the loan amount you may qualify for.

It is recommended to complete prequalification before you make an offer on a house. This helps you determine the amount a lender will lend to you and if you are comfortable with the associated monthly payment. It also puts you in a much stronger position with a seller or against other offers on the same home.

How Prequalification Can Help the Home Buying Process

DETERMINE YOUR BUDGET

Before you start shopping for a new home, you need to know how much you can afford. Prequalification helps you set a budget for your home search. Knowing a mortgage loan estimate can help you calculate your monthly payments and decide if you can afford a particular home.

GAIN A COMPETITIVE ADVANTAGE

Mortgage prequalification can give you an advantage in a competitive real estate market. Prequalification shows that you are ready and willing to purchase a home.

SAVE TIME AND ENERGY

House hunting can be exhausting and time-consuming, especially if you don’t have a clear budget. By getting prequalified, you can save time and energy by narrowing your search to homes that fit your budget to avoid falling in love with a home that you can’t afford.

IDENTIFY POTENTIAL ISSUES

During the prequalification process, lenders will review your credit report, income, and other financial information. This process can uncover potential issues that could impact your ability to get a mortgage. For example, if you have a low credit score or high debt-to-income ratio, the lender may require you to take steps to improve your financial situation before approving your loan.

How to Prepare for Mortgage Prequalification

CHECK YOUR CREDIT REPORT

Before you apply for prequalification, check your credit report to make sure there are no errors or issues that need to be addressed. You can request a free copy of your credit report from each of the three major credit bureaus once a year.

RESEARCH LENDERS

Not all lenders are created equal, so it’s important to do your research and find one that you feel comfortable working with. Look for a lender with a good reputation, competitive rates, and a prequalification process that works for you.

BE PREPARED TO ANSWER QUESTIONS

When you apply for prequalification, your lender will likely have questions about your income, employment history, and other financial information. Be prepared to answer these questions honestly and thoroughly to ensure a smooth prequalification process.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

How to Find the Best Mortgage Lender for Doctors

Choosing a mortgage lender is a big decision. You will likely be paying off this loan and working with this lender for the next few decades, so it is important to feel comfortable with the lender and know they are able to help if a need arises. When looking for a lender, consider different places like banks, credit unions, online lenders, and more. Compare their rates, loan terms, down payment requirements, fees, and other factors.

Doctors have unique needs, so there are some specific factors that physicians, dentists, and veterinarians may want to consider. The best mortgage loans for doctors are those that truly keep your needs in mind. Some lenders understand that early career doctors don’t have the savings to dedicate to a sizable down payment and offer 100% financing.

We understand the unique needs of doctors, because we are doctors ourselves. That’s why we have partnered with Primis Mortgage—to bring you excellent service in every step of the mortgage process. We all work together to help you purchase or refinance your home and are available on your schedule to answer any questions, making sure you have what you need to make the best decision.

Download the PDF