Buying your first home is an exciting milestone. Whether entering residency or already a practicing physician, dentist or veterinarian, making the leap from renting to buying can be daunting.

If you’re not sure if you’re ready, this short guide will help you weigh your options, financially prepare for this step, and know how big of a mortgage you can afford. Here’s what you should know.

Should I rent or buy?

Deciding between renting and buying is dependent on your individual circumstances, finances, and lifestyle. Let’s look at the pros and cons of both options.

Pros & cons of renting

| Pros | Cons |

|---|---|

| Flexibility | No asset appreciation |

| You know what you are paying (rent and utilities). | Leases can be hard to get out of, or break. |

| If something breaks, it’s not your problem. | You’re paying a mortgage… it’s just not yours. |

| May be more affordable |

Pros & cons of buying

| Pros | Cons |

|---|---|

| Build net worth through equity | You are the landlord, so repairs, renovations, and other issues require your time and money. |

| Flexibility to make it your own | You are financially locked-in to one location for 5-7 years in one location to breakeven on your investment. |

| No lease to break | Could be more expensive monthly |

| Good way to start a rental portfolio |

Learn more: Renting vs. Buying A Home For Doctors

What is the cost difference between renting & buying?

When deciding between renting and buying, some may only consider the cost of rent compared to the monthly mortgage payment amount, but there are many other factors that contribute to your total expense.

According to Realtor.com, the cost of renting is now cheaper than buying in the 50 biggest cities. Here are the costs you should factor into cost comparisons:

| Cost of renting | Cost of buying |

|---|---|

| One time - Deposit + last month’s rent (depending on rental agreement) | One time - Down payment, Inspection, Origination fee, Closing costs |

| Recurring- Rent | Recurring - Principal + interest, Property taxes, Homeowner insurance, Private Mortgage Insurance, Repairs and maintenance |

Learn more: How Much Down Payment Do I Need To Buy A House?

Considering buying a home as a resident or fellow?

Many residents and fellows opt to rent while in training. Renting allows trainees to focus on their work and their learning without worrying about the potential risks or time commitments that come with being a homeowner.

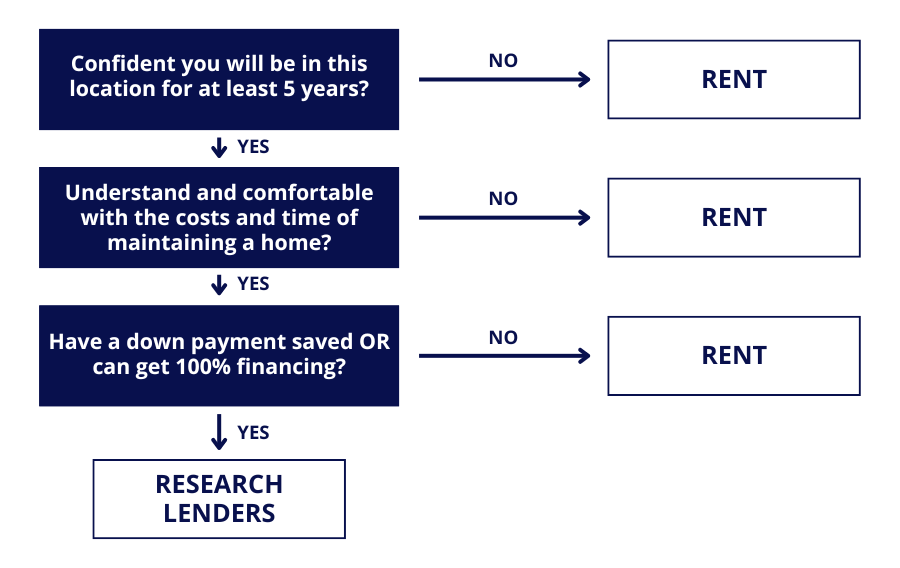

If you would prefer to buy in training, be sure you understand your budget and the additional costs that come with homeownership. Here is a simple flowchart to help you decide if buying is right while in residency or fellowship.

Learn more: Renting Vs. Buying & Other Tips For New Residents, From Physicians

Should I buy a home as a resident?

How to financially prepare to buy

What does a lender look at when considering you for a mortgage? Here are two ways to prepare as you consider homeownership.

Optimize your credit

- No late payments: Setting up automated payments can prevent future late or missed payments.

- Keep credit card balances low: Try not to utilize more than 25% of your credit limit on a credit card.

- Settle any collections: The balance of a collection is irrelevant to your credit score but the history is—removing these can boost credit 60-100 points.

Learn more: How Doctors Can Improve Their Credit Score & Other Common Credit Score Questions

Prepare for financial evaluation

When considering you for a mortgage, a bank will typically look at these four aspects:

- Credit score: Over 680 is where you want to be, but some lenders have options for people under that threshold.

- Income and employment history: Be ready to supply residency contracts or W2.

- Assets: This includes things like bank statements and investment accounts.

- Debt-to-income ratio (DTI): This is a measurement of how much in monthly debt payment you make to your monthly gross income. Banks typically want to see DTI less than 36%.

Learn more: Understanding How Debt-to-Income Ratio Impacts Your Mortgage & How To Improve It

How much can I afford?

As you compare renting to buying, here are some tips for knowing how much you can afford.

Know your monthly income

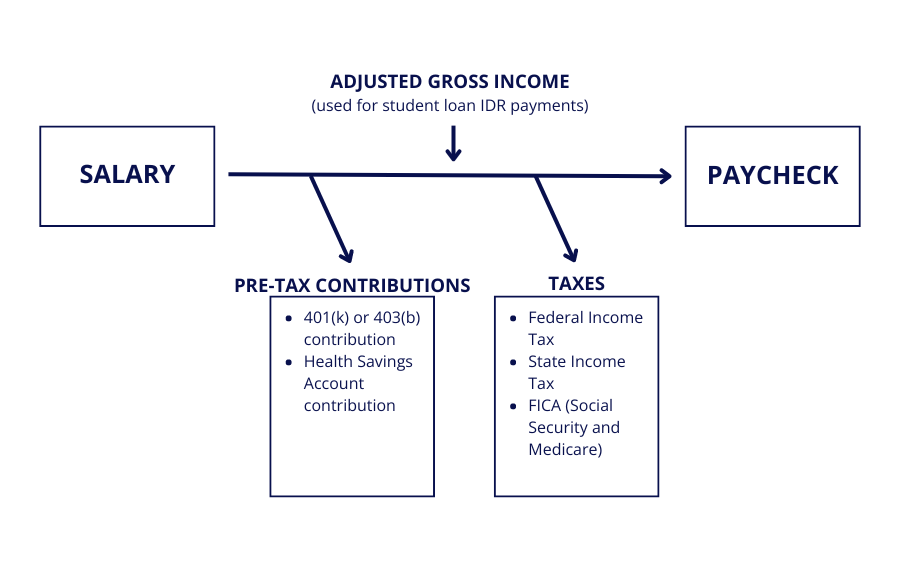

Your salary is very different from what you are actually taking home. Understanding how much you will earn on your paycheck will help you know how much you can afford when it comes to buying or renting.

To know your monthly income, start with your salary. Then subtract pre-tax contributions, like 401(k) or 403(b) and Health Savings Accounts, and taxes, like federal and state income and FICA (Social Security and Medicare). After all of those contributions and taxes are taken out, you have your paycheck.

Use a take-home pay calculator to get a good estimate of what your paycheck, or take-home pay, will be.

How much should I spend on a mortgage?

The general rule of thumb when considering a mortgage based on salary is that the house purchase price should be no more than 2-3 times the household’s annual gross income. When considering a mortgage based on your take-home pay, mortgage plus insurance and utilities typically should not be more than 25% of your paycheck.

These are both general guidelines and can differ based on your unique circumstances. In high-cost-of-living areas, there may not be homes available that fit within these guidelines based on your income, especially if you are a resident or fellow.

When considering home options and looking at your mortgage options, understand that a mortgage lender may qualify you for a higher mortgage than this guideline. While it may be exciting to use the full extent of this loan and buy a nicer, newer, or bigger home, it doesn’t mean you should. Go into the home buying process with a clear budget and stick to it to avoid buying more than you can comfortably afford.

Understand a potential monthly mortgage payment

Use a calculator to estimate your principal, interest, insurance, tax and potential PMI.

How much should I spend on rent?

Similar to general mortgage guidelines, it is recommended that your rent be no more than 25% of your take-home pay.

Mortgage options

Once you decide to buy and are ready to look for a mortgage, there are four main options depending on your needs: conventional, government-issued, jumbo, and doctor mortgages. Let’s take a look at the pros and cons of each.

| Mortgage type | Pros | Cons |

|---|---|---|

| Conventional/Conforming | Down payment could be as little as 3% | More mortgage term options | Most lenient on property conditions/repairs | Requires more money down | Requires PMI if down payment is less than 20% of purchase price | Higher FICO and lower debt-to-income requirements than government loans |

| Government-issued (FHA/VA) | Less strict requirements for qualification (Low FICOs are okay) | The potential for reduced closing costs by saving on interest and down payment. | Must meet specific criteria | Up-front funding fees that may result in higher borrowing costs |

| Jumbo | Lending in the millions to help you get your dream home | Typically requires a higher credit score, lower DTI ratio, significant assets, and may require a larger down payment |

| Doctor mortgage | Requires less of a down payment and most do not require monthly PMI payments | Because of the lower down payment and no PMI, there can be higher interest rates and/or shorter lending terms | Higher FICO requirements |

Learn more: What is a doctor mortgage loan?

How does a doctor loan compare?

Doctor mortgages can be great options for young doctors who may not have a down payment saved up. Let’s look at how they compare to conventional loans:

| Doctor mortgage | Conventional loan | |

|---|---|---|

| Down payment | 0-10% | 3-20% |

| Private mortgage insurance | No | Yes, if equity is less than 20% |

| Interest rate | Higher than conventional | Lower than doctor mortgage |

| FICO minimum | 720 | 680 |

Learn more: Physician Mortgage Loan Vs. Traditional Loan

What kind of mortgage can I get with a low credit score?

Ready to find a mortgage

Once you have decided buying is the right decision for you, it’s time to research lenders. As you interact with lenders, consider the help they provide. Choosing a lender who is happy to listen to you and offer advice without trying to convince you to buy or use their services before you are ready is often an indication of how your relationship with them will continue should you decide to use their loan services.

Learning about home loans can seem like a huge task, but Michael Jerkins, MD, M.Ed, breaks down the basics in our on-demand webinar, “Mortgages 101 for Doctors.” Watch the full webinar now!

The information and advertised terms, including interest rates, are from Primis Mortgage Company (www.nmlsconsumeraccess.org NMLS# 1894879; Equal Housing Lender). Mortgage applications can only be submitted in those states that Primis Mortgage is approved to lend. Panacea Financial is not a mortgage lender in any transaction and does not make mortgage loans, mortgage loan commitments or lock-rates related to mortgage loans. All credit decisions for mortgage loans, including loan approval and the conditional rates and terms offered, are the responsibility of Primis Mortgage Company and will vary based upon the loan requested, the borrower’s financial situation, and criteria determined by Primis Mortgage Company. Not all consumers will qualify for the advertised rates and terms. All information provided is subject to verification. Other terms and conditions may apply. Panacea Financial does not guarantee that Primis Mortgage Company will make you a conditional loan offer and nothing herein or on this website is considered a commitment to lend. Panacea Financial is a division of Primis Bank and Primis Mortgage Company is a subsidiary of Primis Bank.