Despite high earning potential, many doctors find themselves with less-than-ideal credit scores due to substantial student loan debt and the financial strain of school and residency. Here are some tips for improving your credit score.

Understanding Credit Scores

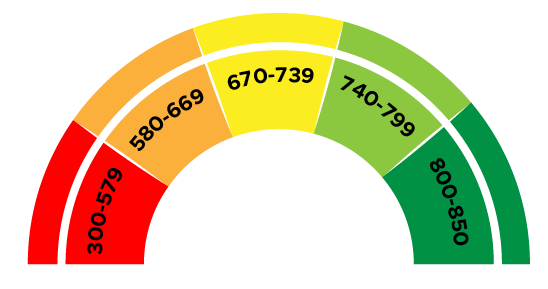

Having a basic understanding of how credit scores work and are calculated can help you know how to improve your score. Credit scores range from 300 (low) to 850 (high). A higher credit score shows lenders that a borrower is lower risk and more likely to make on-time payments and will allow that borrower to receive better rates and a greater chance of approval.

The most widely used credit score type is FICO credit scores. FICO scores fall into five categories:

- Very poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Excellent: 800 to 850

How Credit Scores Are Calculated

FICO credit scores are calculated using credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion.

Factors in FICO Score Calculation

Payment history makes up 35% of your credit score. This takes into account on-time payments, late payments, public records like bankruptcies and foreclosures, and accounts sent to collection agencies.

Amounts owed make up 30% of your credit score. This factor looks at the total amount of credit and loans you are using compared to your total credit limit. High credit utilization can indicate that you are over-relying on credit.

Length of credit history makes up 15% of your credit score. This considers the length of time each of your credit accounts has been open, the age of your oldest and newest accounts, and the average age of all of your accounts. A longer credit history can positively impact your score.

Credit mix comprises 10% of your credit score. This reflects the variety of credit accounts you have, such as credit cards, retail accounts, and mortgage loans. A diverse mix can be beneficial as it shows you can manage different types of credit responsibly.

New credit also makes up 10% of your score, including recent credit inquiries and newly opened accounts. Opening several new credit accounts in a short period can lower your score, as it may suggest higher risk.

Learn more about the credit score breakdown from this short webinar clip.

Strategies For Improving Your Credit Score

Once you know the factors that influence your credit score, you can use that knowledge to take action to improve your score. Here are some tips to get you started:

Pay Bills On Time

Because payment history makes up the biggest part of your credit score, it is important to prioritize on-time payments. Especially with the busy schedule of a doctor or trainee, it may be smart to set up automatic payments for all bills, like student loans, credit cards, and utilities, to ensure your accounts stay in good standing and you avoid late fees and penalties.

Manage Student Loan Debt

High debt balances, including student loans, can increase your payment history and credit mix, affecting your score. To manage the high amount of loans you may have from medical, dental, or veterinary school, explore income-driven repayment plans that align with your cash flow. Refinancing student loans can also lower interest rates and monthly payments, freeing up cash to pay off other debts or save for future expenses; although refinancing can have drawbacks as well.

Limit Your Credit Usage

Keep your credit card balances below 30% of your credit limit. If possible, pay off balances in full each month. If you need to carry a balance, spread it across multiple cards rather than maxing out one card.

Maintain Or Increase Your Length Of Credit History

Keep older credit accounts open, even if you no longer use them regularly. This can help lengthen your average credit history, which is beneficial for your score. Be aware that if you don’t use a credit card, that card may be canceled due to inactivity after a certain amount of time. So it may be beneficial to dust that oldest card off once in a while.

Become An Authorized User

If you are in school or residency and new to building credit, becoming an authorized user on someone else’s account can quickly improve your credit score by boosting your credit limit, payment history, and length of credit history.

If interested, you can look for a relative or friend with a high credit limit and a solid history of on-time payments who is willing to add you as an authorized user. You don’t need to use the card for your credit score to improve.

Limit Hard Inquiries

Be strategic about applying for new credit. Too many inquiries in a short period can lower your score. When shopping for a mortgage or auto loan, try to do your rate shopping within a short period (usually 14-45 days), as these are typically treated as a single inquiry.

Refinance Credit Card Debt

Refinancing credit cards with a personal loan can improve your credit score. By replacing credit card debt (revolving credit) with a personal loan (installment credit), you diversify your credit mix. Additionally, paying off credit card balances with a personal loan significantly lowers your credit utilization ratio, as revolving debt is reduced, which can lead to an improved credit score.

Improving Your Credit Score

Improving your credit score as a doctor involves managing your unique financial challenges with strategic planning and disciplined financial habits. By doing so and improving your credit score, you can have greater financial flexibility and opportunities throughout your career and personal life.

If you need help paying off toxic credit card debt or need a loan for an upcoming expense, Panacea’s PRN Personal Loans can help you find the funds you need. Learn how our personal loans can support your financial needs here.