When you place your money in your bank account, you more than likely assume it will be safe, but what happens when a bank fails? Bank failures aren’t common, but recently, a few banks have been closed by regulators, including Silicon Valley Bank (SVB).

Account holders are wanting to keep their funds safe. Taking appropriate precautions to protect your money is incredibly important. Here’s what you need to know about making sure your funds are insured.

What does being FDIC-insured mean?

The FDIC, or Federal Deposit Insurance Corporation, is a federal agency created by Congress to maintain stability and public confidence in the nation’s financial system. Standard insurance at a FDIC-insured bank is $250,000 per depositor, per issued bank, for each account ownership category.

You don’t have to purchase this deposit insurance. If you open an account at a FDIC-insured bank, you are automatically covered.

How does FDIC insurance work?

If a bank is unable to meet its deposit obligation, the FDIC will pay insurance to depositors up to the insurance limit ($250,000). This normally happens within a few days of the bank closing either by:

- Providing each depositor with a new account at another insured bank in an amount equal to the insured balance of their account at the failed bank

- Issuing a check to each depositor for the insured balance of their account at the failed bank

Additionally, as the FDIC sells/collects the assets and settles the debt of the failed bank, depositors with uninsured funds (over the $250,000 limit) may recover a portion of these from the proceeds of the sale. This process could take years.

How to insure deposit accounts with balances over $250,000

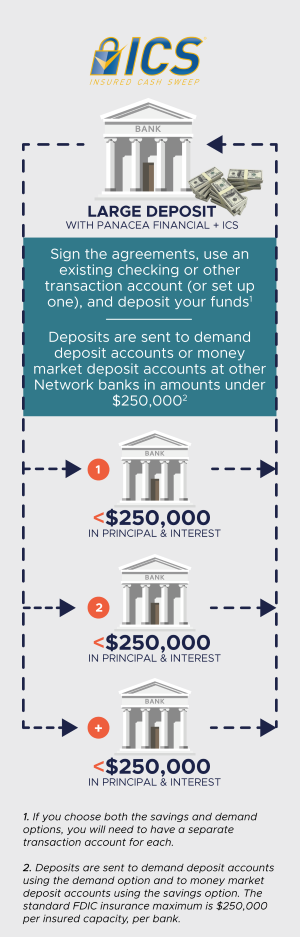

If you have more than $250,000 in your bank account, you likely want to ensure all of your funds are protected. Spreading your money across several financial institutions is one way to do this, but Panacea makes it easier.

This makes your funds eligible for FDIC protection. As a result, you can access FDIC insurance coverage from many institutions while working directly with just us, an institution you already know and trust. Learn more about ICS here.

Whether you have a personal or a business account, or both, we can make sure your money is protected. Learn how to insure your deposits above the $250,000 limit here.

If you are over the FDIC limit at another bank and want to move your funds to a more secure place, we have personal and business checking and savings accounts for all individuals and businesses in all industries. And it’s free to wire money in from another bank!

Take advantage of high savings rates on personal high-yield savings accounts (4.00% APY) and business savings accounts (3.00% APY), while knowing your money is safe. Learn more about our personal and business accounts.

Panacea Financial is a division of Primis, Member FDIC.

- $25 minimum opening deposit. Cannot transfer balances from existing accounts. ATM Refunds of foreign transactions will be refunded within five business days after the statement cycle ends. External wire fees refunded up to $35 per wire for a wire over $10,000.

- APY = Annual Percentage Yield. The advertised APY is effective 2/23/2023 and subject to change thereafter. No minimum balance required to obtain the APY. The minimum to open a Panacea Savings Account is $25. Fees may reduce earnings. Offer is subject to change without notice and may be withdrawn at any time. Up to six transfers or withdrawals per statement cycle.

- FDIC Insurance limit is $250,000, per depositor, per ownership category.

Placement of your funds through the ICS service is subject to the terms, conditions, and disclosures set forth in the agreements that you enter into with us, including the ICS Deposit Placement Agreement. Limits and customer eligibility criteria apply. Program withdrawals are limited to six per month when using the ICS savings option. ICS, Insured Cash Sweep, and Bank Safe, Bank Smart are registered service marks of Promontory Interfinancial Network, LLC.