This article was published on January 4, 2021, and was updated on April 4, 2024.

- To pursue refinancing, you’ll need to obtain a Loan Payoff Statement from each of your student loan servicers. See the section below on determining who services your student loans.

- Obtaining a Loan Payoff Statement often requires you to call your servicers directly and request the information. This can be a challenge given your busy schedule. However, this information cannot be requested by anyone else. See the section below for information on obtaining your Loan Payoff Statement from different servicers.

You’ve spent years in medical, dental, and veterinary school, residency, and maybe even fellowship, and now it’s time to start making decisions about what to do with your student loans. If you don’t plan on pursuing Public Service Loan Forgiveness, refinancing your student loans may benefit your debt situation.

When you refinance your student loans, you may be able to secure a lower interest rate, consolidate multiple loans under one payment, and get better terms and payments that fit your salary and financial plans.

Jump to the sections below on How do I find my loan servicer or How to find your loan payoff statement, or read on to learn more about student loan refinancing.

What does it mean to refinance my student loans?

Refinancing is the process of taking out a new loan to pay off outstanding debt. When you received a student loan to cover your medical, dental, or veterinary school tuition, there was no negotiation. The rates and terms you were given are set by the government in the federal loan system.

Unfortunately, this is a common occurrence in the medical profession: over 70% of medical students take out student loans, with an average debt at graduation of $200,000, and dental and veterinary students have similar loan balances. Frustratingly, the federal system does not value a medical, dental, or veterinary student’s future long-term earning potential, and instead, federal loans charge higher interest rates the more money you borrow.

When it’s time to refinance, traditional banks normally use two main factors to decide what loan terms to offer: your income history and debt-to-income ratio. This means that until you are an attending doctor with several years of practice (and high income), you are likely to be turned away, need a cosigner, or be offered high-interest rates and unfavorable terms.

Refinancing with the right banking partner can be incredibly beneficial. A partner like Panacea Financial recognizes the investment you made to become a doctor and doesn’t punish you for it. With doctor-specific underwriting criteria, you can secure a lower interest rate and also consolidate multiple loans under one payment, making it easier to manage, monitor, and pay down your debt.

Before applying to refinance your student loans, you’ll need to know whether refinancing is right for you.

When you’ve decided to refinance and you’re ready to apply, you’ll need to obtain your loan payoff statement.

How do I find my student loan servicer?

Student loan servicers are companies that oversee the administration of your student loans. These are the companies that take your payments, send you monthly statements, and are responsible for sending you tax documents at the end of the year. You may have one or multiple servicers. You also may have public or private loan servicers, depending on how your education was financed. To add more confusion, these servicers sometimes sell your loans, so you could have started with one servicer and been moved to another.

Your refinancer will need to know all of your loans and have a payoff amount statement from each of your student loan servicers.

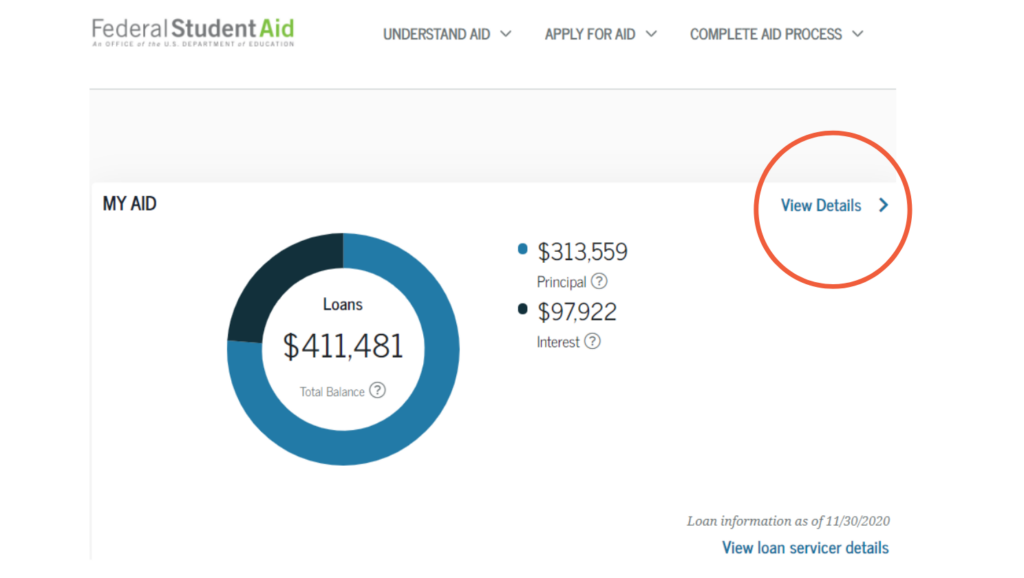

If you have federal student loans, you can go to studentaid.gov, and click on “View Details” under the My Aid section of your Account Dashboard.

Privately serviced loans do not appear on studentaid.gov, so you will need to know who you have been making payments to. If you have set up autopay, you can check your bank statements. Alternatively, look for contact information on the monthly statements your servicer has sent you.

Why does my loan payoff amount change?

Now that you know the benefits of refinancing your existing student loan debt, it’s time to learn how to refinance.

Your loan payoff amount—otherwise known as the 10-day payoff amount—is the amount your new bank will pay your current lender to refinance your loan.

Why ten days? Two reasons: daily interest accrual and clerical time. Your loan payoff amount isn’t the same as your “current balance.” Interest accrues daily on your loan, so your new lender will need to ensure the amount paid off is accurate in the near future— 10 days in the future, to be exact. On average, it takes that amount of time for your new servicer to process paperwork, distribute a check, and close out your current loans.

Note that your loan payoff amount may also include unpaid penalties or fees, if you owe any.

How do I obtain my loan payoff statement?

Your loan payoff amount is one part of what your new servicer needs. In total, they need the following, in the form of a loan payoff statement:

- Your total loan payoff amount

- Good-through date (i.e., 10 calendar days ahead)

- Your account number(s)

- Any individual loans and their payoff amounts

- Instructions about how to pay off your current servicer

Your current servicer has this data and is obligated to give it to you upon request.

Requesting this information will not change any aspect of your current loan, including your payment plan, IDR, or PSLF eligibility. Many lenders will not make it easy. Most require a phone call, and you may have to be insistent. You can also request that this letter is sent to you electronically (by email or online messaging portal), so you will not have to wait for one to arrive in the mail.

Some servicers enable access to this information via an online user account portal. If yours doesn’t, then it will take a phone call. We’ll repeat it here—your servicers are obligated to give you this information and to send it to you electronically.

Here is a list of federal and private student loan servicers, links to their websites, and tips on how to get the information you need:

Federal loan servicers

- AES—Call (800) 233-0557 to receive your payoff statement.

- Fedloan Servicing (PHEAA)—Call (800) 699-2908 and they will email you a payoff statement.

- Edfinancial/HESC—Call (855) 337-6884 to request a payoff statement. You can find the amount by selecting “Make a Payment” from the “Home” page of MMA. Click on “Payoff Quote” under the “Payment Amount” field. Please select 10 days in the future.

- MOHELA—Call (888) 866-4352 to request your payoff statement. You can find your 10-day payoff amount by logging in to your account, selecting “Payoff Calculator” under “Payment Assistance.” Choose “mail” for your payoff method, and set a payoff date 10 days in the future.

- Navient—Call (800) 722-1300 if you have Department of Education Loans, or (888) 272-5543 if you have FFELP loans, and request a payoff statement. If you have a federal loan, you can find your 10-day payoff amount in the Loan Payoff Calculations section. Choose “Tools & Requests,” then “Interest Accrual Estimator.” Add this accrual estimate to your current loan balance, and this is your 10-day payoff amount.

- Nelnet—Call (888) 486-4722 and request your payoff statement. You can also request your payoff amount through your Nelnet.com account. In the Payment Amount section, select Payoff Quote.

- OSLA Servicing—Please login to your account to find contact information. Call this servicer for your payoff amount.

- ECSI—Call this servicer at (866) 313-3797 to receive your payoff statement.

Private student loan servicers

- Sallie Mae—Call 800-4-SALLIE for your final payoff statement.

- SoFi—You can request your payoff amount through your online account at sofi.mohela.com.

- Earnest—Email [email protected] or call their service line.

- Citizens Bank—Call (866) 259-3767 to receive your payoff statement.

- CommonBond—These loans are serviced by Firstmark, so you will need to call (888) 538-7378 to receive your payoff statement.

- Discover Private Student Loans—Call (800) 788-3368 to receive your payoff statement.

Refinancing for doctors

Despite your future earning potential, traditional lenders try to force doctors into models that don’t fit us. This is why we founded Panacea Financial: to create a bank that values the investment you made in becoming a practicing physician, dentist, or veterinarian.

As doctors ourselves, we understand the financial complexities involved in your path through medicine. When you’re ready to apply for school loan refinance, we’re here to help.

If you’d like to pursue refinancing, you can learn more about refinancing your loans through Panacea here, or start your application here.

Panacea Financial, a division of Primis. Member FDIC.