Just the facts

- A number of federal student loan servicers have announced their withdrawal from this role by the end of 2021. This shift could affect around 16 million federal student loans.

- Only federal student loans are affected by this and the servicers are required to transfer loans to a different servicer.

- Income-based repayment plans or forgiveness plans like the Public Service Loan Forgiveness (PSLF) program will continue to be accessible.

- Impact to individual loan holders should be small, but dentists, veterinarians, physicians and doctors-in-training who have affected loans should do due diligence: save account and payment records as soon as possible to avoid losing data during servicer transfers.

Changes in Federal Student Loan Servicers: Will Your Loans Be Impacted in 2022?

Physicians, dentists, and veterinarians with federal student loans are likely to be impacted by upcoming changes among loan servicing companies. Some of the largest servicers that currently manage federal student loan payments, including Navient and Fedloan Servicing, are opting out of the business and transferring their portfolios to other companies.

That means the way you pay your loans could likely change in the coming months. On top of that, there’s also the chance for technical and clerical errors as federal student loans are passed from one servicer to another. The Consumer Financial Protection Bureau (CFPB) has warned since August that some loans may be transferred across multiple servicers, causing potential disruptions.

Find out if your loans are going to be affected by these upcoming changes, what to do if they are, and how to protect yourself from any potential disruptions.

What is a student loan servicer?

The federal government offers student loans to eligible borrowers with competitive rates and terms. But once you take out the loan, a private company oversees the payment process. This is also called student loan servicing.

All of your loan payments are made through your student loan servicer. You also work directly with your servicer anytime you need to use a benefit of your federal student loans, like enrolling in public service forgiveness or an income-based repayment plan.

Like many borrowers with medical school, dental school, or veterinary school debt, you may have taken advantage of the pause on federal student loan payments throughout the COVID-19 pandemic. However, the extensions on the program are set to expire on January 31, 2022. Starting in February, payments will resume.

Upcoming changes to federal student loan servicing

Many major federal student loan servicers have recently announced their plans to exit this role by the end of 2021. Currently, Navient, Fedloan, and Granite State are the core group of servicers who plan to transfer their federal student loan portfolios to other servicers. The Department of Education hasn’t announced any definitive timeline for any of these transfers yet, though FedLoan recently came to an agreement with the Department of Education to extend its servicing contract through December 2022.

Navient is one of the largest servicers and recently received approval from the U.S. Department of Education to transfer its loan portfolio and stop servicing federal student loans. Navient loans will be acquired by Maximus, which has a loan servicing division called Aidvantage. Its primary line of business is debt collection on delinquent federal student loans and historically has not directly serviced federal student loans.

President Biden recently extended Navient’s contract by two years, but Maximus will take over that contract. This switch is estimated to impact 5.6 million loans from Navient alone. In total, 16 million federal student loans could be affected by changes in servicers, more than one-third of all borrowers.

Why are Navient and Fedloan Servicing going away?

Navient and Fedloan are not the only two federal student loan servicers who have announced upcoming changes, though they are among the most important because of the several million student loans they service. There are several potential reasons for why servicers are making this move so close to the end of the year, but increased state and federal government scrutiny of student loan servicers seems to be the common theme.

The CFPB sued Navient in 2017 for “failing borrowers at every stage of repayment”, and several state governments have made similar allegations against the loan servicer. Needless to say there have been some concerns on their ability to adequately serve federal borrowers, exacerbated by the challenges associated with the end of the CARES Act student loan forbearance and resumption of payments.

How to find your federal student loan servicer

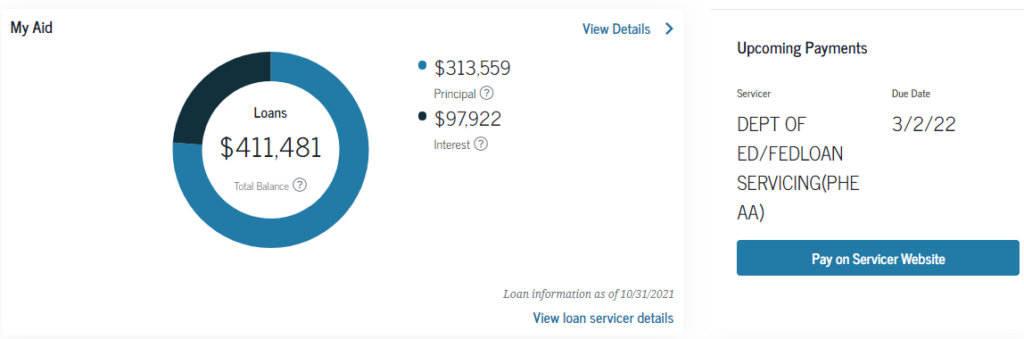

It’s easy to find out your current federal student loan servicer. The easiest option is to log into your StudentAid.gov account. Under the “My Aid” section, you’ll see an option for “View Loan Servicer Details.” Click on the text to see if your servicer is one of those with plans to transfer your loan.

Alternatively, you can also call the Federal Student Aid Information Center to find out your servicer details.

How servicing changes could impact your medical, dental, or veterinary school loans

Note that these changes only apply to certain companies servicing federal student loans, not private loans. There is the potential for disruption, but the Department of Education and the relevant loan servicers are doing their best to make the transition smooth. If you have one of these servicers, you will likely be paying a different servicer after the transition.

Expect plenty of communication from both your old and new student loan servicers, so remember to open all of the mail and online messages you receive. You should still have access to your payment history with the previous servicer and your login information should remain the same before the transition.

If you are enrolled in the Public Service Loan Forgiveness program (PSLF), your current terms will transfer directly to your new servicer. You don’t have to worry about any changes in your eligibility for PSFL, income-driven repayment plans, deferment, or forbearance.

What should I do if I have a federal student loan affected by this?

Once you’re notified that your federal loan will be impacted by a servicer switch, take the following three steps:

- Confirm your current servicer has your updated contact information. Everything will be transferred to the new servicer and you want to make sure you receive all relevant news and action items regarding your loan.

- Print your statement history before the switch occurs. Then double check that the new statements match previous ones in terms of loan balance, interest rate, payment history, and qualifying payments towards PSLF if applicable. There’s definitely the potential for clerical errors so stay on top of these details and quickly address any mistakes with your new loan servicer.

- Read new loan rules. While your loan terms stay the same, new rules may apply to your loan agreement. Carefully read new paperwork when you receive it to find out details on things like late payment fees.

Bottom line

A switch in your federal student loan servicer isn’t something to be concerned about over the long term. But it does require you to carefully monitor your account details in the coming months to watch for any potential glitches in the system as your loan is transferred, and to protect yourself against clerical errors by having back ups of the relevant information. Set alerts in your phone to check your accounts on January 1, February 1, and so on, to ensure a smooth transition.

Panacea Financial, a division of Primis. Member FDIC.