High-Balance Deposits

SECURED BY THE FDIC

Insure balances up to $125 million per tax ID, for free!

Digitally Streamlined Application Process

Fast Access To Protection

24/7 Availability Of Our Concierge Desk

Protect Your Deposits With Extended Coverage

Higher deposit balances require more protection! The FDIC protects up to $250,000 per depositor per insured bank for each account ownership category.

Panacea offers a free program to protect your deposits above $250,000, for both your consumer and commercial accounts.

Insured Cash Sweep

For Balances Above $250,000

Insure Your Money

Insured Cash Sweep (ICS) accounts protect your deposits, up to $125 million per tax ID. Whether you have money in personal or business accounts, you get it protected today.

Access Funds

Make unlimited withdrawals on any business day using the ICS demand option.

Earn Interest

Put excess cash balances to work by placing funds into demand deposit accounts using the ICS demand option, or into savings accounts using the ICS savings option.

Rest Assured

Make large deposits eligible for multi-million dollar FDIC insurance. This protection is back by the full faith and credit of the federal government.

Save Time

Works directly with your Panacea Financial accounts, so you can track account activity, balances, and other information online. Set up electronic statements from a single account, rather than multiple banks or accounts.

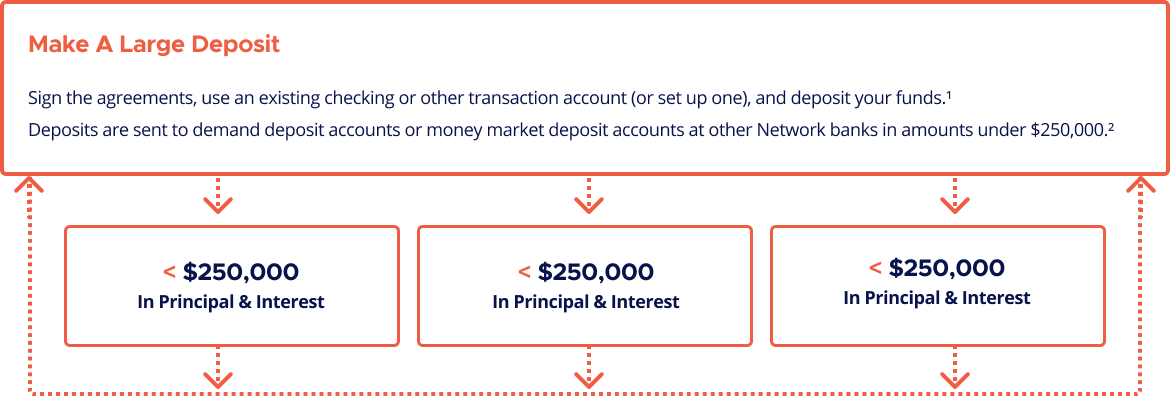

How ICS Protects Your Deposits

FAQs

What is ICS?

ICS (Insured Cash Sweep) is a method of offering our retail and commercial clients additional FDIC insurance, over and above the $250,000 FDIC insurance per Tax ID or Social Security Number.

How does it work?

ICS pools Primis' FDIC Insurance with that of other banks. For example, if Jane Doe has $500,000 with Primis, all balances above $250,000 would not be insured by the FDIC. If ICS were used to insure Ms. Doe’s funds, then the additional $250,000 would be ‘pooled’ with that of another bank, in exchange for Primis doing the same thing. For more information, see our resource article.

What kind of accounts can be collateralized?

Money Markets, CDs, Savings Accounts, and DDAs (in certain cases) can all be collateralized.

How long will it take to add this protection?

Once the contracts are signed, your funds are typically fully protected within the next 3-5 business days.

Is there a minimum dollar amount to protect?

Typically we see this used on accounts about $250,000, although we can establish this at lower dollar amounts if you think your deposits will grow above the amount protected by the FDIC.

What are the costs of this program?

As a service to our customers, Panacea offers this completely free on checking account balances over $250,000. For savings account balanes over $250,000 the ICS program reduces the savings rate by 0.125%.