A Doctor’s

No-Nonsense Guide

To Student Loans

More than 42 million American have student debt, including many doctors

Keep Reading or Download the PDF ↓

minute read

Skip Ahead

Introduction

Total student loan debt has increased dramatically in the last few decades. In 2006, the total federal student loan balance stood at $480 billion. Since then, the balance has increased 267.1%, or 15.7% annually to $1.639 trillion.

Since 1995, the total cost of four-year public and private college has nearly doubled, even when accounting for inflation. Federal support has not kept up with these dramatically rising costs. While Pell Grants once covered almost

80% of the cost of a four-year public college degree, they now cover under a third.

This debt burden weighs heavily on more than 42 MILLION borrowers, preventing many from building wealth and achieving financial freedom.

For most future doctors, taking on debt is a necessary part of the career path. 73% of medical students graduate with debt, according to the Education Data Initiative. Dentists and veterinarians experience student debt at similar levels.

Medical, dental and veterinary school costs are following the upward trend. According to a report from the Association of American Medical Colleges, medical education costs have been rising at double the rate of inflation. The EDI reports that the average medical student graduates with $264,519 in total student loan debt.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Income-Driven Repayment (IDR) Plans

Today, over 10 million federal student loan borrowers are enrolled in an income-driven repayment (IDR) plan, representing about a third of all borrowers in repayment. Many doctors use these programs to ease the stress of repaying their loans, while working toward forgiveness.

An Overview:

Income-driven repayment plans set your monthly student loan payment at an amount that is intended to be affordable based on your income and family size, according to the Federal Student Aid website. Though these may change, the current plan options are:

SAVE Saving On A Valuable Education

– Formerly REPAYE (Revised Pay As You Earn Repayment Plan)PAYE Pay As You Earn Repayment Plan

IBR Income-Based Repayment Plan

ICR Income-Contingent Repayment Plan

Each plan calculates your monthly payment based on a percentage of your discretionary income, which you pay for a set number of years. Once you complete the total length of payments, the remaining balance is forgiven. To learn more about IDR plans and see how different repayment options would benefit you, visit StudentAid.Gov.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Public Service Loan Forgiveness

Public Service Loan Forgiveness (PSLF) is a federal student loan forgiveness option, but there are benefits and drawbacks of this program. If you are considering taking advantage of PSLF, understanding these factors will better prepare you for what is ahead.

The PSLF program offers forgiveness of qualified federal student loans after 120 on-time payments while employed full time at a 501(c)(3) non-profit or government employer. This can be a great option for those in significant student debt, especially those already considering public service employment.

The majority of PSLF applications are rejected. This is not because the Department of Education is denying those who earned forgiveness but because those applying do not meet the requirements.

To be sure you obtain PSLF, follow these requirements:

Employed full time by a U.S. federal, state, local, or tribal government or not-for-profit organization (federal service includes U.S. military service)

Direct Loans or consolidate other federal student loans into a Direct Loan

IDR – repay your loans under an income-driven repayment plan

120 Qualified Payments (does not have to be consecutive)

Benefits of PSLF:

REAP SIGNIFICANT FINANCIAL BENEFITS

The financial benefits of PSLF are the most significant advantage, especially for those with high student debt balances. PSLF can erase a majority of your initial debt balance tax-free.

GET A HEAD START IN RESIDENCY

Many residency programs are 501(c)(3) organizations which allow physicians to start making qualified payments as soon as their residency begins. Through IDR, residents can make low monthly payments during their years in training.

Depending on your family size and income, you may even qualify for $0 monthly payments while in training. By the time you finish residency, you will only have a few more years to fulfill the requirements.

To increase the number of qualifying payments you accrue in residency, start planning during your final year of medical school. All student loans are put into an automated 6-month deferment following graduation, however you can call your loan servicer and decline this deferment. This means you can add the first 6 months of your residency as $0, or nearly $0, monthly qualifying payments.

EASY CHOICE FOR 501(C)(3) EMPLOYEES

For those already planning to work for a 501(c)(3), participating in the PSLF program is an easy decision. Employment by these organizations doesn’t have to be consecutive, simply 120 months cumulatively. It should also be noted that you can apply for PSLF and get credit for qualifying payments retroactively.

Drawbacks of PSLF:

LIMITED EMPLOYMENT OPTIONS

As previously mentioned, those eligible for PSLF have to work full-time for a non-profit or government employer. Finding a qualifying employer can be especially difficult for dentists and veterinarians and for the medical specialties that are typically private practice based or aren’t commonly found in nonprofits.

PRIVATE LOANS AREN’T ELIGIBLE

Only direct federal loans qualify for PSLF. This means private loans or loans refinanced with a private lender cannot be forgiven. Be completely sure you do not want to pursue PSLF before you refinance your loans as you cannot later qualify for this program after you have refinanced with a private company.

MANAGING FEDERAL LOAN SERVICERS

As with many government programs, working with the program’s servicers can be tedious and there have been numerous complaints about the administration of PSLF. You will have to complete annual forms and be sure your payment count is being tallied correctly. You will want to keep meticulous records because even a single month of extra payment unnecessarily could cost you thousands of dollars.

GIVE UP HIGHER INCOME

Nonprofit and government jobs often pay less than private practice employers. Paired with the 10-year time commitment, you may benefit more by taking a higher income and paying the loans yourself. Discuss with a financial planner who understands doctors and PSLF in order to determine what is best for your personal and professional needs.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Student Loan Refinancing

Student loan refinancing means a private lender pays off your existing loan, then gives you a new loan with new terms. This can provide you with a longer repayment term — with lower monthly payments — or it can mean you pay less over time because of a lower interest rate (or both!).

Refinance:

Refinancing your student loans can be incredibly beneficial. Every situation is

different; these scenarios demonstrate how it could help:

- You qualify for a lower interest rate than your current one. Interest rates are determined in different ways. For federal student loans, interest rates are set once per year for the different loan types. Private student loans or student loan refinance are determined by the loan company themselves. A private student loan rate can be dependent on things like credit score, total debt, or income level. If you are able to refinance your loans at a lower rate than your current loans, you may want to consider refinancing.

- You have a variable interest rate, but you want a fixed interest rate. Some private student loans have variable interest rates that could increase based on market trends. Refinancing to a fixed interest rate could create a more predictable interest expense that won’t change during the loan.

- You want to reduce your number of monthly payments. If you have multiple monthly student loan payments, you may want to simplify your bills into just one monthly payment through refinancing.

Avoid Refinance:

Student loan refinancing can be beneficial to many but should be avoided in some cases. These scenarios demonstrate why you should avoid refinancing student loans:

- You are considering Public Service Loan Forgiveness. If you plan to or are working at a nonprofit, government agency or other qualified employer in pursuit of PSLF, you should not refinance your federal student loans as this automatically disqualifies you from forgiveness.

- Your new interest rate would be higher. If a lender offers you a higher interest rate than your existing one, it would likely be more beneficial to not refinance.

- You are or will in the future use an IDR plan. Refinancing federal student loans prevents you from using IDR plans.

Refinancing Factors:

Different lenders use different metrics to determine your eligibility and interest rate for refinancing. Lenders may consider:

CREDIT SCORE

Credit score is often the most important factor in being approved for and determining rate for student loan refinancing.

INCOME

Lenders assess income to determine if you have the financial stability to repay your loan and won’t fall behind on payments during a time of financial stress.

DEBT-TO-INCOME RATIO

Your earnings may be compared to your debt to determine if you have enough to repay your loan.

LOAN BALANCE

Certain lenders will only refinance loans up to a certain amount.

COSIGNER

Cosigners are required for certain borrowers who lenders may consider higher risk. This could limit your options.

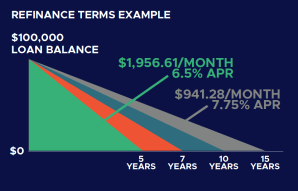

LOAN TERMS

Loan terms can make a big difference when refinancing your student loans. If you choose a shorter loan term, your interest rate will likely be lower, but your monthly payment will be higher.

For example, if you are a practicing physician, dentist or veterinarian refinancing $100,000 of student loan debt, you can choose a 5, 7, 10 or 15 year term. If you choose a 5-year term at an interest rate of 6.50% APR, your monthly payment would be $1,956.61. If you choose a 15-year term at an interest rate of 7.75% APR, your monthly payment would be $941.28.

When It’s Time to Refinance:

Once you’re ready to refinance, you’ll need to obtain your loan payoff statement. Here are two steps to find your loan payoff statement.

FIND YOUR STUDENT LOAN SERVICER

Student loan servicers are the companies that take your payments, send you monthly statements, and are responsible for sending you tax documents at the end of the year. You may have one or multiple servicers.

You also may have public or private loan servicers, depending on how your education was financed. To add more confusion, these servicers sometimes sell your loans, so you could have started with one servicer and been moved to another.

Your new refinancer will need to know all of your loans and have a payoff amount statement from each of your student loan servicers.

If you have publicly held loans, you can go to studentaid.gov, and click on “View Details” under the My Aid section of your Account Dashboard.

Privately serviced loans do not appear on studentaid.gov, so you will need to know who

you have been making payments to. If you have set up auto-pay, you can check your bank statements or look for contact information on the monthly statements your servicer has sent you.

Note: Your loan payoff amount may also include unpaid penalties or fees, if you owe any.

Why does my loan payoff amount change?

Your loan payoff amount—otherwise known as the 10-day payoff amount—is the amount your new bank will pay your current lender to refinance your loan.

Two reasons: daily interest accrual and clerical time. Your loan payoff amount isn’t the same as your “current balance.” Interest accrues daily on your loan, so your new lender will need to ensure the amount paid off is accurate in the near future—10 days in the future, to be exact. On average, it takes that amount of time for your new servicer to process paperwork, distribute a check, and close out your current loans.

OBTAIN YOUR LOAN PAYOFF STATEMENT

Your loan payoff amount is one part of what your new servicer needs. In total, they need the following, in the form of a loan payoff statement:

Your Total Loan Payoff Amount

Good-Through Date (i.e., 10 Calendar Days Ahead)

Your Account Number, Or Numbers

Any Individual Loans And Their Payoff Amounts

Instructions About How To Pay Off Your Current Servicer

Your current servicer has this data and is obligated to give it to you upon request.

Requesting this information will not change any aspect of your current loan, including your payment plan, IDR, or PSLF eligibility. Many lenders will not make it easy. Most require a phone call, and you may have to be insistent. You can also request that this letter is sent to you electronically (by e-mail or online messaging portal), so you will not have to wait for one to arrive in the mail.

Some servicers enable access to this information via an online user account portal. If yours doesn’t, then it will take a phone call. We’ll repeat it here—your servicers are obligated to give you this information, and to send it to you electronically.

Federal Loan Servicers:

AES (800) 233-0557 to receive your payoff statement

CORNERSTONE Cornerstone transferred it’s loan portfolio to FedLoan Servicing in October 2020.

FEDLOAN SERVICING All FedLoan borrowers have been transferred to either MOHELA, Edfinancial, Aidvantage, or Nelnet. Go to studentaid.gov if you need help finding your new servicer.

EDFINANCIAL/HESC (855) 337-6884 to request a payoff statement. You can find the amount by selecting “Make a Payment” from the “Home” page of MMA. Click on “Payoff Quote” under the “Payment Amount” field and select “10 Days In The Future”.

MOHELA (888) 866-4352 to request your payoff statement. You can find your 10-day payoff amount by logging in to your account, selecting “Payoff Calculator” under “Payment Assistance.” Choose “Mail” for your payoff method, and set a payoff date “10 Days In The Future”.

NELNET Call (888) 486-4722 and request your payoff statement. You can also request your payoff amount through your Nelnet.com account. In the Payment Amount section, select Payoff Quote.

ECSI (866) 313-3797 to receive your payoff statement

Private Student Loan Servicers:

SALLIE MAE 800-4-SALLIE for your final payoff statement

SOFI request your payoff amount through your online account at sofi.mohela.com

EARNEST email [email protected] or call their service line

CITIZENS BANK (866) 259-3767 to receive your payoff statement

FIRSTMARK (888) 538-7378 to receive your payoff statement from Firstmark

DISCOVER PRIVATE STUDENT LOANS (800) 788-3368 to receive your payoff statement

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Managing Private or Refinanced Student Loans

Tips for Paying Back Your Private or Refinanced Student Loans:

1. UNDERSTAND YOUR LOAN TERMS

The first step in repaying private or refinanced student loans is to familiarize yourself with the terms of your loan agreement. Understand the interest rates, loan duration, and any potential penalties for late payments or early repayment. Knowing these details will enable you to create a realistic repayment plan and avoid any unexpected surprises down the road.

2. CREATE A BUDGET

A well-structured budget is a fundamental tool for managing your finances effectively. List all your sources of income and track your expenses to identify areas where you can cut back.

Allocate a portion of your monthly income toward loan repayment, ensuring that you meet the minimum payments to avoid penalties. By sticking to a budget, you can prioritize loan repayment while still meeting your other financial needs.

3. PRIORITIZE HIGH-INTEREST LOANS

If you have multiple student loans held by private lenders, one option is to prioritize paying off those with the highest interest rates first. Tackling high-interest loans early can reduce interest expenses in the long run and accelerate your overall debt reduction. Focus on making additional payments towards the principal of these loans to chip away at the debt faster.

Tips for Refinancing Private or Previously Refinanced Student Loans:

Refinancing student loans can be a smart financial move if done strategically. Here are some essential tips to consider when refinancing your student loans:

1. IMPROVE YOUR CREDIT SCORE

A strong credit score is crucial for getting the best refinancing terms (i.e. lowest rate). Work on improving your credit by paying bills on time, reducing credit card debt, and correcting any errors in your credit report.

Find tips for improving your credit score here.

2. COMPARE MULTIPLE LENDERS

Don’t settle for the first offer you receive. Shop around and compare refinancing offers from multiple lenders. Look for competitive interest rates, reliable customer support, and repayment options that suit your financial goals.

3. CONSIDER FIXED VS. VARIABLE RATES

Choose between a fixed interest rate, which remains constant throughout the loan term, and a variable rate, which may fluctuate with market changes. Fixed rates offer stability, while variable rates at times may start lower but carry the risk of increasing over time.

4. EVALUATE REPAYMENT TERMS

Look for lenders that offer flexible repayment terms, such as different loan durations and monthly payment options. Longer repayment terms may result in lower monthly payments but could lead to higher overall interest costs.

5. CHECK FOR PREPAYMENT PENALTIES

Avoid lenders that charge prepayment penalties. This way, you can pay off your refinanced loan early without incurring additional fees, allowing you to save on interest.

6. CUSTOMER SERVICE & SUPPORT

Look for a reputable lender that offers excellent customer service and support. A responsive and helpful lender can make the refinancing process smoother and address any questions or concerns that may arise.

7. UNDERSTAND THE IMPACT OF REFINANCING

Before committing to refinancing, thoroughly understand the terms and conditions of the new loan. Assess how it will affect your monthly budget, long-term financial goals, and overall debt management strategy. A very important point is that once you refinance a federal loan you cannot go back to the federal system.

8. MAINTAIN GOOD FINANCIAL HABITS

Even after refinancing, continue to practice responsible financial habits. Make consistent, on-time payments, avoid unnecessary debt, and keep monitoring your credit score to stay on track towards financial success.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Repayment Strategies

If you don’t plan to refinance your loans or seek loan forgiveness, the third option for managing your student loans is repayment. Below we share some tips for repayment and answers to frequently asked questions.

How Can I Reduce My Total Student Loan Cost?

Different people have different student loan repayment strategies based on their financial goals, like paying the lowest monthly payment, paying it off as quickly as possible, paying it off by a certain date, or paying the least amount over time. If your goal is to pay the least over time, here are tips to help you accomplish just that.

1. UNDERSTAND YOUR LOAN TERMS

Before diving into repayment strategies, be sure you know the loan types and interest rates of your loans. Knowing these factors and how they impact your total student loan cost with no changes can give you a baseline to compare other options to.

2. MAKE EXTRA PAYMENTS

If you aren’t aiming for forgiveness, making extra payments toward your loans can reduce the total interest paid over time. Finding extra money to put towards loans can be challenging but not impossible.

Even making just one extra payment per year can have an impact on the total interest paid over the life of the loan, but if you plan to use PSLF or IDR to achieve forgiveness, making extra payments is not recommended. Doing so will only increase your total payment amount in the long term (and lowering the amount that would be forgiven). This strategy would be most beneficial to borrowers with private or refinanced student loans.

3. CHOOSE A SHORTER REPAYMENT TERM

Another strategy for lowering your total student loan cost is choosing a shorter repayment term. A shorter term will result in a higher monthly payment but will reduce the total interest paid in the long run. This is another strategy that would be beneficial to those with private or refinanced student loans but most likely will not be an option for those still in training.

4. ENROLL IN AUTOMATIC PAYMENTS

Most federal student loan servicers offer a 0.25% reduction in your interest rate if you set up automatic monthly payments. This discount can make a difference in total interest paid over the life of your loan.

Comparing the Impact of These Options

Let’s take a look at how some of these options would impact total student loan cost.

Note: Unless otherwise stated, we used the StudentAid.Gov Loan Simulator with a starting total loan amount of $234,597 (the average medical school student debt according to EducationData.Org) at a 8.08% interest rate (the current average for graduate loans). We used the “lowest total paid over time” goal and set annual income at $63,395 (the average income for a medical resident according to the 2024 Residents & Fellows Survey Report).

These are just simplified calculations that don’t take into account different loan types, increased income post-training, and other factors. These calculations are meant to illustrate the way various forgiveness programs and repayment strategies can benefit your total loan payment.

HOW EXTRA PAYMENTS CAN LOWER YOUR TOTAL STUDENT LOAN COST

Let’s understand how an additional monthly payment could impact total interest paid for someone not pursuing a PSLF or IDR forgiveness option.

If a borrower were to just pay an extra $50 per month, they would save over $4,000 over the life of the loan. The total interest saved increases as you increase your additional monthly payment.

Increasing your monthly payment may not be possible, especially during residency or fellowship, but if you are able to add even $50 per month or contribute more monthly after training, you will be able to save more long-term.

| Repayment Plan* | Term (Estimated) | Total Interest (Estimated) | Difference In Term (Compared To Standard) | Difference In Total Interest (Compared To Standard) |

|---|---|---|---|---|

| Standard Repayment Plan | 10 years & 1 month | $108,167 | - | - |

| With An Additional $50 Payment Per Month | 9 years & 9 months | $105,044 | 4 months | $3,123 |

| With An Additional $100 Payment Per Month | 9 years & 6 months | $102,103 | 7 months | $6,064 |

| With An Additional $300 Payment Per Month | 8 years & 8 months | $91,868 | 1 year & 5 months | $16,299 |

| With An Additional $500 Payment Per Month | 7 years & 11 months | $83,549 | 2 years & 2 months | $24,618 |

*Calculations found using Calculator.net’s Student Loan Repayment Calculator

HOW AUTOMATIC PAYMENTS CAN LOWER YOUR STUDENT LOAN COST

With automatic payments, borrowers can save thousands of dollars over the life of their loans. In Standard Repayment, borrowers can save over $3,000 in interest paid by taking advantage of a 0.25% interest rate discount.

| Repayment Plan | Monthly Payment | Estimated Total To Be Paid | Pay Off Date |

|---|---|---|---|

| Standard Repayment Plan (without AutoPay discount - 8.08% APR) | $2,856 | $342,764 | February 2035 |

| Standard Repayment Plan (with AutoPay discount - 7.83% APR) | $2,820 | $339,363 | February 2035 |

Should I Pay Off My Student Loans Early?

Does it make sense for a doctor to pay loans off early? Let’s weigh the pros and cons of paying off student loan debt early to determine if it is the right financial decision for you.

BENEFITS OF EARLY STUDENT LOAN REPAYMENT

- Interest Savings: Pay less over time by reducing total interest.

- Financial Freedom: Free up your budget for goals like investing or saving.

- Improved Credit Score: Reducing debt can positively impact your credit score.

- Emotional and Psychological Benefits: Less stress and more control over your finances.

DRAWBACKS OF EARLY STUDENT LOAN REPAYMENT

- Opportunity Cost: Extra payments could earn more if invested.

- Loss of Tax Deductions: You may lose the student loan interest deduction.

- Cash Flow and Liquidity Concerns: Fewer funds available for emergencies or big expenses.

- Possible Loan Forgiveness: Paying early may forfeit potential loan forgiveness.

FACTORS TO CONSIDER BEFORE PAYING OFF STUDENT LOANS EARLY

Now that you know what type of interest and rates you have, what your repayment plan is, and the advantages and disadvantages of early repayment, the final and most important things you will want to consider are your financial goals and current situation.

Determining Your Financial Goals as a Doctor

Understanding your short-and long-term financial goals are key components to deciding whether or not early repayment makes sense for you. You may need that money for other purposes. Here are some questions to consider:

- Is acquiring or creating a practice something you are interested in?

- Are you hoping to buy into a practice?

- Are you interested in pursuing further education?

- Are you looking to relocate?

- Do you want to buy a home?

Contemplate how repayment will affect your credit history in the eyes of a financial institution if any of these questions apply to you.

Assessing Your Current Financial Situation

You can begin to assess your current financial situation with the following questions:

- Do you have funds on hand in case of an emergency? This can apply to auto repairs, unexpected medical costs, home improvements, etc.

- Do you have existing debt and the cash flow needed to cover it?

- Do you have the income stability you need?

While early repayment can be beneficial, you don’t want it to set you back if it doesn’t suit your goals or overall financial situation.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

One Thing Financial Planners Wish Doctors Knew About Student Loans Debt

There is plenty of information and advice accessible on the internet about student loan debt, but we asked three financial planners what is one thing they want to share with doctors about student debt. Answers have been edited for brevity and clarity.

Benjamin Bush, CLU, ChFC

Managing Partner at Northeast Sequoia Private Client Group

The one thing I think that I would like for them to understand and try to appreciate is that student loans are an investment. Student loans are an investment in your ability to have a not just a little bit higher income but a much larger income on average. Yes, you have to pay them off, but that ability to have an

increased income through your education was an investment. As long as you manage that system correctly, it’s going to pay off for you in

spades.

Also, I wish they just knew all of the options available. Without financial education, most of them are getting online. They’re trying to find what they can do and piecemeal or talk with other physicians, but there are a lot of professional resources out there to help manage student loans.

Knowing all the refinance options that are available in the marketplace is also huge. There’s a whole subset of people that have no idea that they can refinance their student loan debt out of the federal loans. I just think the lack of knowledge and understanding of the entire system is troubling. Frankly, we’re talking about kids taking on loans, starting when they’re 17, 18 years old for the next 8 to 12 years without understanding any of the parameters, rules or options around them.

I wish they knew that there are a lot of resources available and often those resources are not expensive or could be free that can help them navigate this conversation so they’re not doing it on their own and trying to figure out the entire American financial system on a trial and error basis.

Josh Lantz, CRPC®

Chief Investment Officer & Financial Advisor at MD Financial Advisors

Know that there are other programs besides PSLF. A lot of doctors are unaware that there are state sponsored programs for example. Many states provide these programs. They tend to lean more primary care but not always.

The other thing I would mention is a lot of doctors are very ambitious and want to get done with these debts so fast that they get too aggressive with the loan pay-down. They take a five year note when they really should do a 7 or 10.

So, they go into practice, they get that five-year note, and they get bigger payments because those payments are condensed into five years. Suddenly, they have kids, the bills go up, and they’re paying for the nanny.

And they’re over their skis, and they can’t afford things. What’s the first thing they’re going to cut? Well, it’s the retirement savings, so they wait to save for retirement. And that just prolongs how long they’re going to have to work. In many cases, it means that they don’t have enough for retirement later on in life.

Meredith Jones, DVM, CSLP®

Associalte Financial Planner at Vincere Wealth & Veterinarian

The biggest one is that student debt doesn’t have to affect your career decisions. No matter how much debt you have, there is a plan out there that is going to work for you. There’s a lot of really comprehensive and valuable help out there for people who are looking for a student debt repayment strategy.

There’s a lot of value to meeting with a student loan consultant or meeting with a financial planner familiar with student loans. It’s 100% worthwhile to talk with an expert about your student loans so you’ll have peace of mind that you’re on the right plan.

You may spend a few hundred dollars to have a consultation like that if it’s just for student loans, or if you’re meeting with a financial planner, then it may be more. I’ve heard stories from student loan consultants of folks who saved tens of thousands of dollars by meeting with a consultant because they were actually not on an optimal plan for their student debt.

Pros & Cons of Moonlighting During Residency & Fellowship

Moonlighting is a common way for residents and fellows to supplement their income, gain more clinical experience, or explore other practice settings. But as tempting...

Deal Spotlight: When Common-Sense Practice Loans Make All the Difference

Dr. D had spent years caring for patients and building trust as an associate at a thriving dental practice. When the chance came to purchase...

Don’t Make The Financial Mistakes I Made As A Younger Doctor

While very few doctors will say that money was a primary motivator for their career choice, most of us were reassured that it was a...

Student Loans Can Be Tricky

Navigating the world of student loans can be daunting, but with the right information and understanding of your options, you can make informed decisions about financing your education.

Reminder: Education is an investment in yourself, and with careful planning, you can set yourself up for success in both the short and long term.

Interested in refinancing or looking for more student loan resources? Panacea Financial has you covered. Panacea allows you to refinance with no cosigner requirement, transparent rates, no maximums, and no fees. Explore refinancing options.

Find student loan updates and tips in our Resource Library of articles and webinars. Visit panaceafinancial.com to learn more.

Download the PDF