2025

Residents & Fellows

Survey Report

Compensation, Debt, Burnout & More

Keep Reading or Download the PDF ↓

minute read

Skip Ahead

Introduction

As those in the healthcare community know, the journey through medical training can be one of the most demanding periods in a physician’s career. As residents and fellows transition from students to healthcare professionals, they face unique challenges—financial stress, grueling work hours, and the pressure of preparing for their future roles.

Building on the insights uncovered in the 2024 Residents and Fellows Survey Report, Panacea Financial set out to delve deeper into the unique challenges faced by trainees. This year’s findings offer a closer look not only at the experiences of residents and fellows but also at distinct differences across various specialties.

We hope these findings will inform and educate the healthcare community, shedding light on the successes and struggles of trainees.

Our goal is to continue the necessary conversations needed to shape a brighter future for residency and fellowship programs.

Key Findings

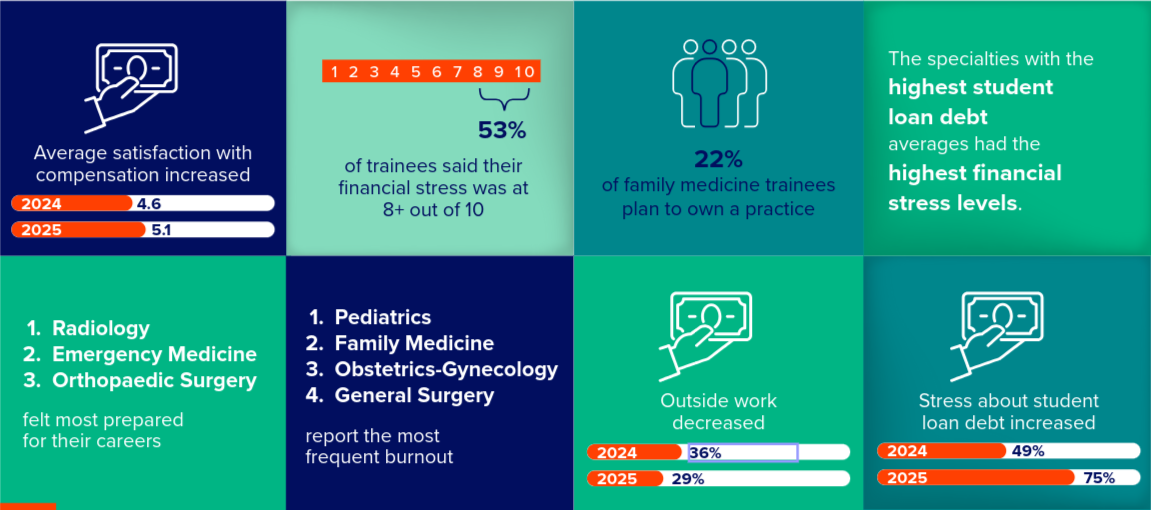

- Average satisfaction with compensation increased.

- 2024 – 4.6

- 2025 – 5.1

- 53% of trainees said their financial stress was at 8+ out of 10.

- 22% of family medicine trainees plan to own a practice.

- The specialties with highest student loan debt averages had the highest financial stress levels.

- Radiology, emergency medicine, and orthopaedic surgery felt most prepared for their careers.

- Pediatrics, family medicine, obstetrics-gynecology, and general surgery report the most frequent burnout.

- Outside work decreased.

- 2024 – 36%

- 2025 – 29%

- Stress about student loan debt increased.

- 2024 – 49%

- 2025 – 75%

Methodology

10-Minute Online Survey

U.S. medical residents and fellows were invited to participate.

Screening Requirements

Respondents were required to be current U.S. medical residents or fellows.

Sample Size

479 respondents met the screening criteria and answered questions in the survey.

Survey Period

January 15, 2025 to February 28, 2025

Sampling Error

The sampling error is 3.8% at a 95% confidence level using a point estimate of 50% (+/-).

Respondents who completed the survey were entered into a sweepstakes for a chance to win 1 of 3 $150 Amazon gift cards.

Compensation

Despite the long hours and intense workload, residents and fellows earn modest salaries during their training years. These physicians-in-training are building specialized expertise, but their pay still doesn’t reflect the value or volume of their work.

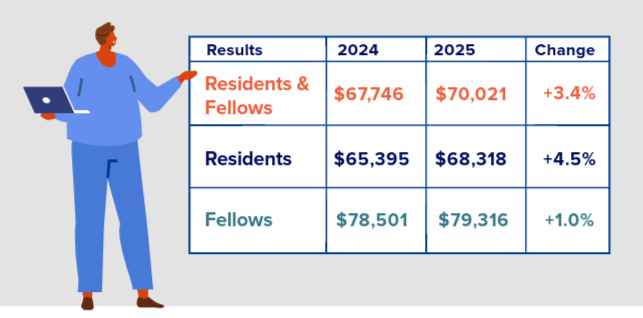

Average salaries for residents and fellows grew slightly from 2024 to 2025, increasing 3.4% from $67,746 to $70,021.

When broken down between residents and fellows, the average salary for residents increased 4.5% from $65,395 to $68,318, and the average salary for fellows increased 1.0% from $78,501 to $79,316.

Average Compensation

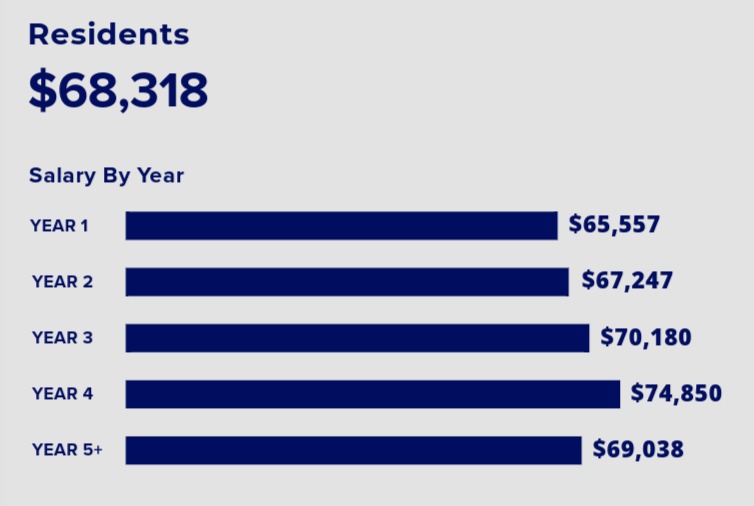

Residents – $68,318

While resident salaries did rise from 2024 to 2025, the year-over-year progression remained consistent with previous trends, offering a less than $10,000 increase between first-year residents and those in their fourth or fifth year.

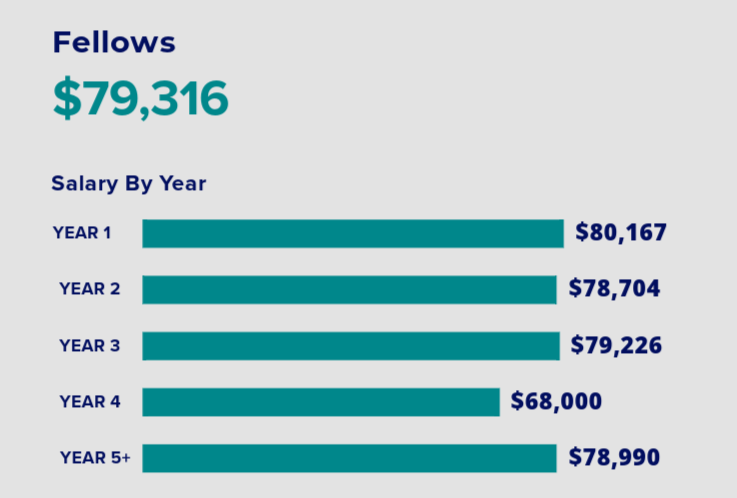

Fellows – $79,316

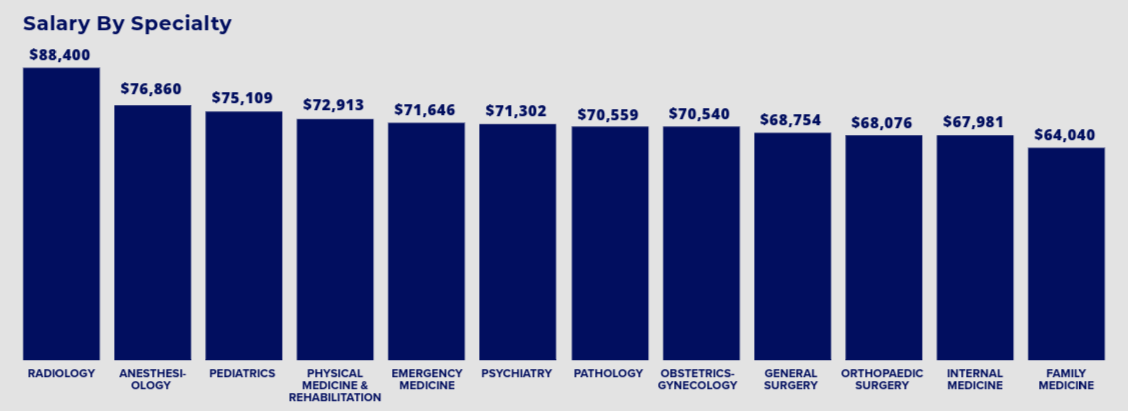

Compensation By Specialty

When divided by specialty, radiology, anesthesiology, and pediatrics had the highest average salaries. Family medicine, internal medicine, and general surgery had the lowest.

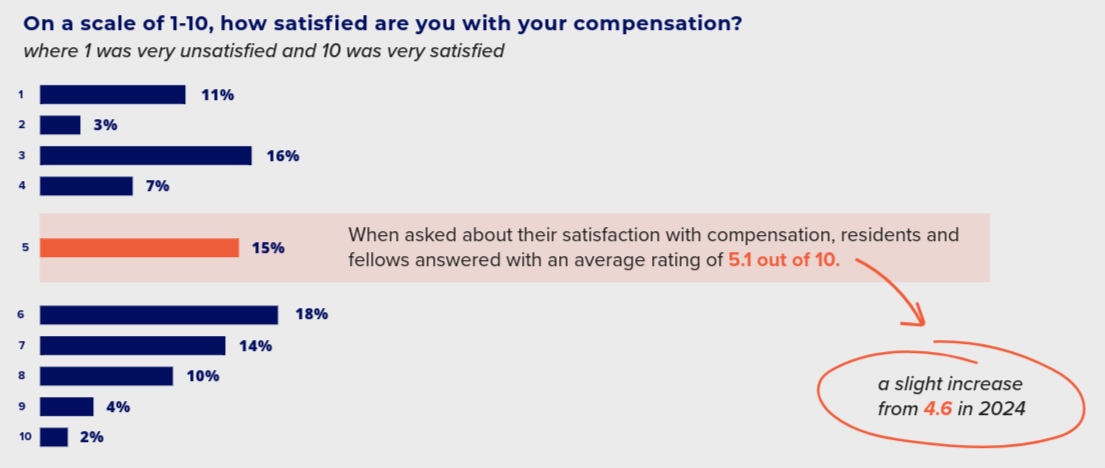

Compensation Satisfaction

When asked about their satisfaction with compensation, residents and fellows answered with an average rating of 5.1 out of 10, a slight increase from 4.6 in 2024.

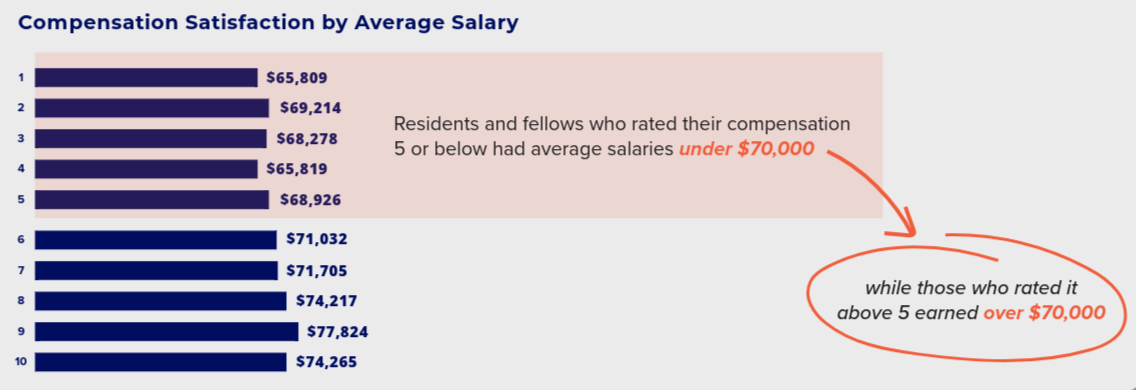

Compensation Satisfaction By Salary

When comparing salary to satisfaction, there was a clear salary difference between those who viewed their salaries favorably and those who viewed their salaries unfavorably.

Residents and fellows who rated their compensation 5 or below had average salaries under $70,000, while those who rated it above 5 earned over $70,000.

Compensation Satisfaction By Age

When broken down by age, compensation satisfaction declined as trainees got older.

Trainees aged 30 or younger reported an average satisfaction of 5.4. Those aged 31–40 averaged 5.1. For trainees 41 and older, satisfaction dropped more sharply to an average of 4.0.

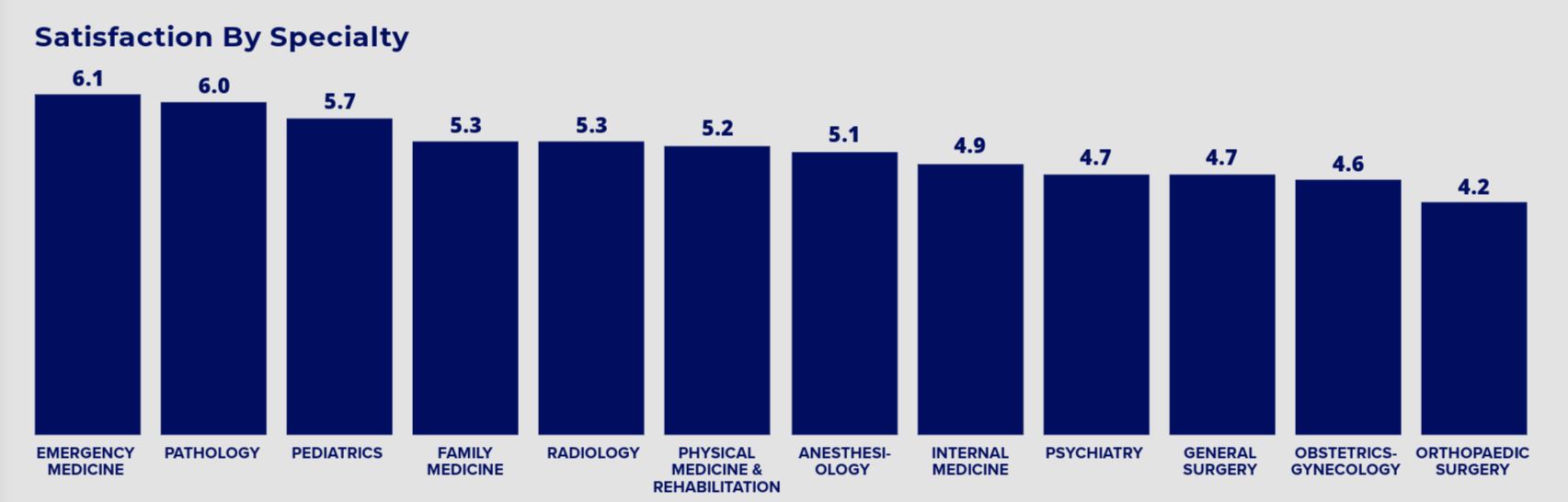

Compensation Satisfaction By Specialty

Compensation satisfaction when broken down by specialty didn’t align with average salary rankings. The two specialties with the highest average compensation satisfaction, emergency medicine and pathology, fell within the middle of average compensation rankings.

Comments About Compensation

“Fellowship compensation should be more; these are doctors who have already completed training. I do not believe we should be compensated as attendings but with inflation, the current salary is not enough.” – First-year fellow in Texas

“I feel well compensated overall for a single person, but my co-trainees with kids spend their entire salary on childcare.” – Third-year resident in Minnesota

“Compensation is not reflective of work performed.” – Fourth-year resident in Texas

“I feel strongly that interns shouldn’t be paid more than they are. At that stage of our training, we really don’t know what we are doing, but by our final year of residency, we are near attending level with the care provided, efficiency, etc., and are poorly compensated for this level of competence.” – Fourth-year resident in Ohio

How Much Do You Make in Medical Residency?

Once you finish medical school, it’s time to embark on the next phase of your career: medical residency. This hands-on experience is a graduate-level step...

Infographic: Medical Residents’ & Fellows’ Compensation

Medical residents and fellows endure rigorous training and long hours to become practicing physicians. Despite their important role in healthcare, they often face financial challenges...

Average Doctor Salary By Specialty

Becoming a doctor requires years of education, training, and dedication. While the noble profession of medicine is often chosen due to a passion for healing...

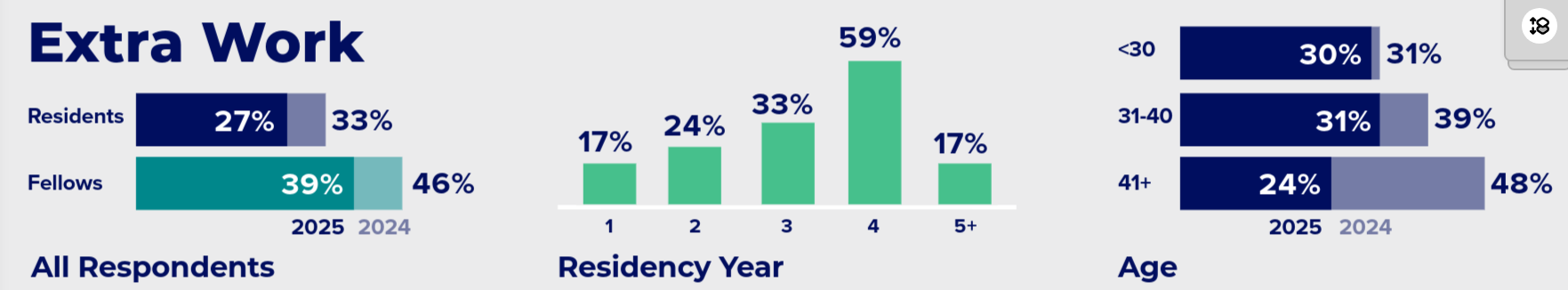

Extra Work

According to survey responses, the percentage of trainees who took on work outside of their training programs decreased from 2024 to 2025. In 2025, 29% of residents and fellows took on work outside of their training, compared to 36% in 2024.

This decrease was seen across both groups. For residents, those who took on extra work dropped from 33% to 27%, while fellows saw a decline from 46% to 39%.

Across the years of residency, we saw a steady increase in the percentage of residents taking on extra work through year 4, followed by a decrease for those in year 5 or later.

Some programs impose restrictions on outside work, particularly during the early years of training, which may explain the gradual rise. As residents gain more experience, they may feel more comfortable finding supplemental work and adding value elsewhere.

When this data was broken down by age, only 24% of trainees aged 41 or older took on external work, which is lower than the percentage for those aged 40 and younger. This differs from the data collected for the 2024 report, where we saw a steady increase in extra work across these age groups.

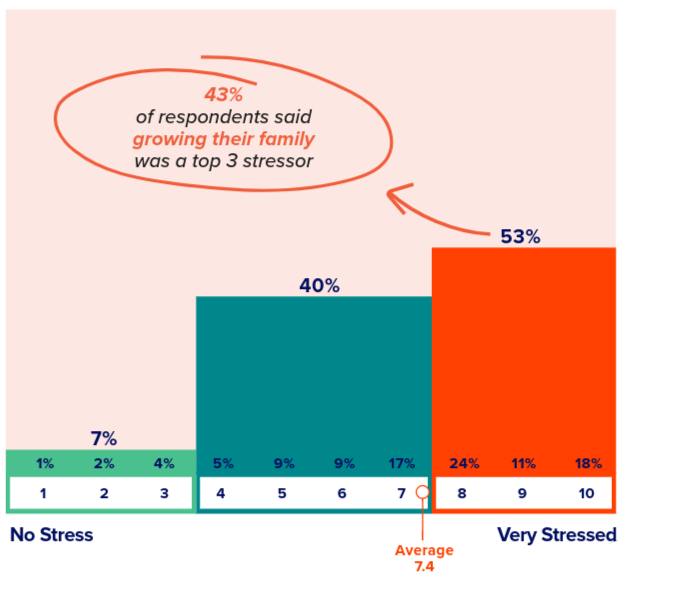

Financial Stress

With low pay, high debt, and long hours, it’s no surprise that many residents and fellows reported significant financial stress, which can impact physical and mental well-being.

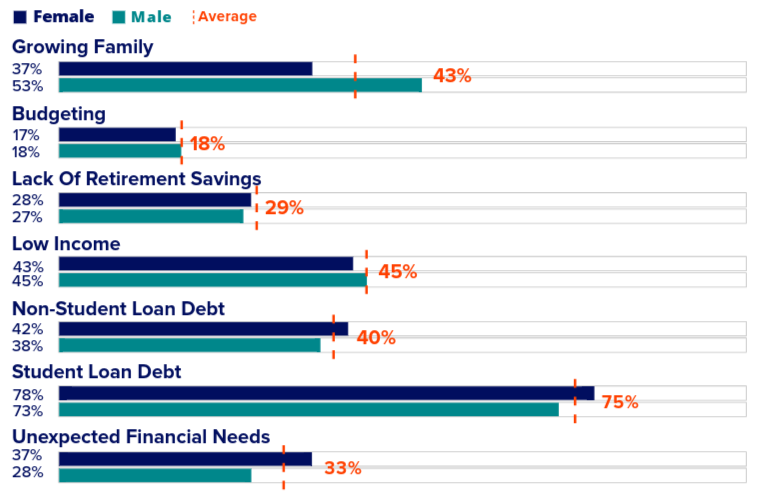

Trainees rated their stress about finances at an average of 7.2 on a scale from 1 to 10 (where 1 was no stress and 10 was very stressed). More than half of trainees (53%) said their stress level was at an 8 or higher.

Of those who rated their financial stress as 3 or higher, top stressors for residents and fellows were student loan debt, low income, and family planning. From 2024 to 2025, we saw a significant increase in the percentage of trainees who were stressed about student loan debt, increasing from 49% to 75%. Conversely, stress about lack of retirement savings dropped from 34% to 29%.

Other:

- No down payment saved up for a home

- Monthly expenses and credit card debt from medical school

- Will be moving to a very high cost of living area later this year

- Helping my family who has no retirement savings

Comments About Financial Stress

“I am married, and my spouse makes a good salary, so my resident salary is not a source of stress.” – First-year resident in Oregon

“I help my family in my home state because my mother is medically disabled.” – Second-year resident in Rhode Island

“I just wish I had more to take care of my family of five as the sole breadwinner for the family.” – Second-year resident in Georgia

“It has become extremely hard to keep up with managing costs for basic living, let alone any life event or medical emergency. We are basically living paycheck to paycheck and have extremely long work hours.” – Third-year resident in Pennsylvania

Tips For Budgeting, Benefits & Expenses During Residency From Physicians

The transition from medical school to residency can be a challenging task, especially with limited income to cover living expenses and other needs. With long...

Why Monthly Budgeting Is Critical For Doctors-In-Training

Stress around your personal finances can negatively impact your ability to put patient care first. Financial stress has been identified as the second highest cause...

The Hidden Costs of Financial Stress in Medical School

Are money worries affecting your overall wellness? Stressing out over how to pay rent and credit card bills, afford residency applications, and still make ends...

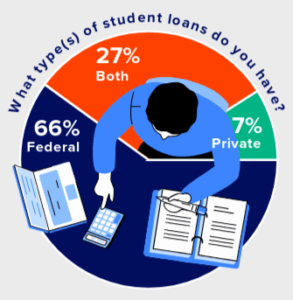

Student Loan Debt

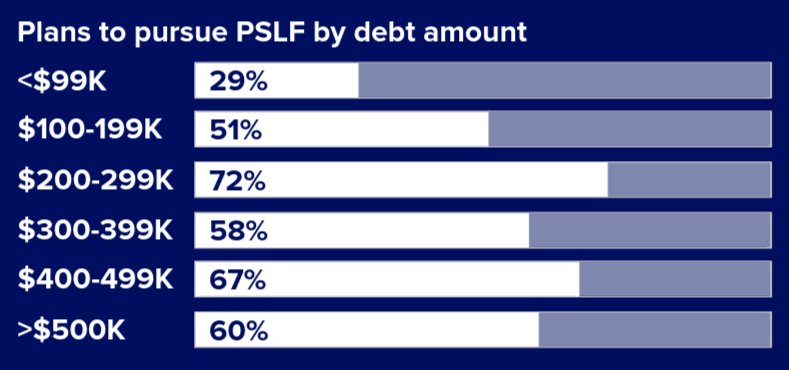

Millions of Americans have student loan debt. This includes many physicians, residents, and fellows. Of our survey respondents, 74% of trainees had student loan debt, with residents slightly more likely than fellows to carry debt (75% vs. 71%).

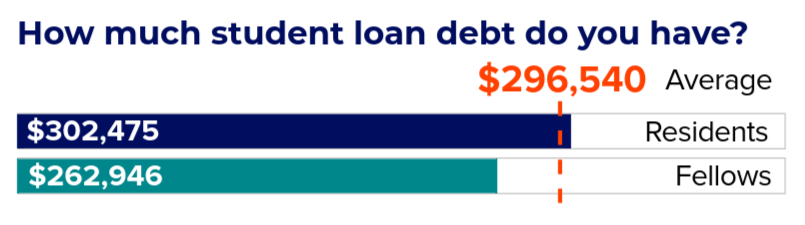

Not only do most trainees have student loan debt, but their balances are significant. Based on survey responses, the average student loan debt for residents and fellows was $296,540, with the highest reported student loan debt balance reaching $700,000.

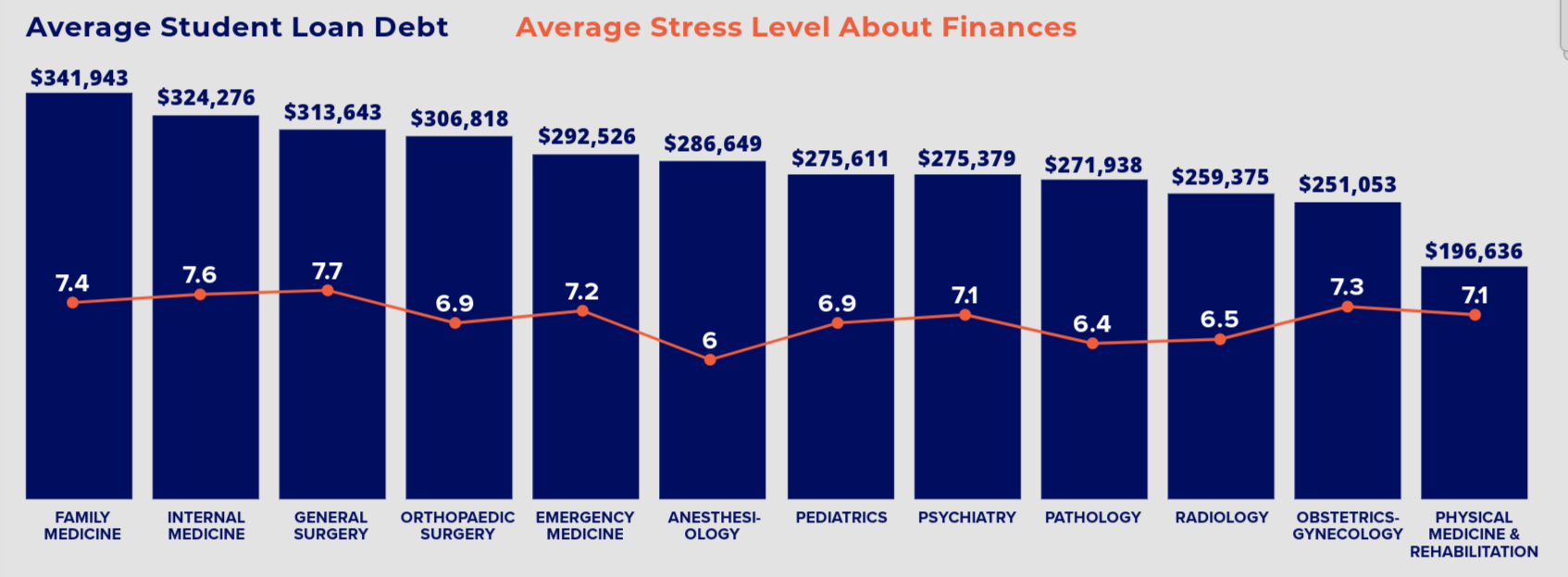

Student Debt By Specialty

When broken down by specialty, the three specialties with the highest student loan debt averages—family medicine, internal medicine, and general surgery—had the highest financial stress levels.

Comments About Student Loan Debt

“I had planned to pursue PSLF, but with uncertainty as to the future of the US, whether PSLF will continue to exist, and having dual citizenship by descent in Canada, I’m wondering if I may be better off practicing in Canada rather than working at least 4+ years in the US after fellowship to qualify for PSLF.” – First-year fellow in California with $250,000 in student loan debt

“The interest rates on private loans are criminal.” – Second-year resident in Missouri with $400,000 in student loan debt

The new changes to the SAVE plan, etc. have been stressful.” – Third-year resident in Minnesota with $250,000 in student loan debt

“With the new presidential administration, the future of PSLF is in question. For relatively lower-paying specialties like pediatrics, this brings a lot of stress.” – First-year resident in North Carolina with $250,000 in student loan debt

Understanding Student Loans: Frequently Asked Questions Answered

As the cost of medical, dental and veterinary school continues to rise, many prospective and current doctors find themselves burdened by significant student loan debt...

A Doctor’s Guide To Refinancing Student Loans

Student loan refinancing is when a private lender pays off your student loans and provides you with a new loan with different terms, often at...

Student Loan Terms Borrowers Should Know: A Comprehensive Guide

Doctors often take on six-figure student loan debt as they make their way through school. To navigate the world of student loans successfully, it’s essential...

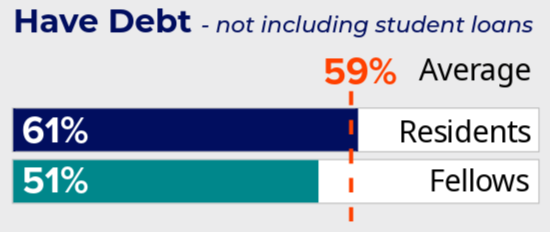

Other Debt

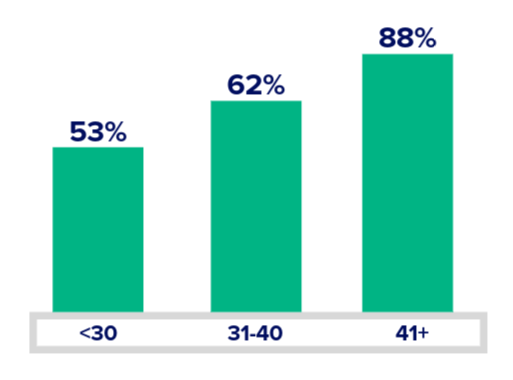

By Age

Trainees aged 41 or older were more likely to have other debt than their younger colleagues.

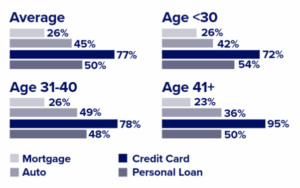

By Type & Age

Trainees over 40 were more likely to have credit card debt, while those under 30 were more likely to have personal loans.

By Stress

For the most part, financial stress increased for those who had non-student loan debt.

Comments About Debt

“I cannot make ends meet. I live paycheck to paycheck and need to put a lot of unexpected costs such as vet bills, moving costs, or groceries on my credit cards.” – First-year resident in Florida

“I’m a first-generation physician who has had to pay (or loan) my way through my career.” – Third-year resident in Georgia

“My wife and I had to pay for IVF treatments, which were well worth it, but did come at a significant cost.” – Third-year resident in Georgia

“I’m worried about being able to stay afloat before I graduate and then having to move afterwards.” – First-year fellow in Massachusetts

How To Pay Off Credit Card Debt For Doctors & Doctors-In-Training

We get it, because we’ve been there. As a doctor or doctor-in-training, you are likely incredibly busy. We know speed and convenience are crucial, so...

Credit Card Vs. Personal Loan Calculator

Credit Card vs. Personal Loan Calculator Save with a low, fixed-rate PRN Personal Loan. When tight on cash, many take on credit card debt. Often...

How Does Debt-To-Income Ratio Affect Doctors?

Medical, dental and veterinary professionals endure years of education and training to be well equipped to serve their patients. Despite the years of learning, doctors...

Post-Training Plans

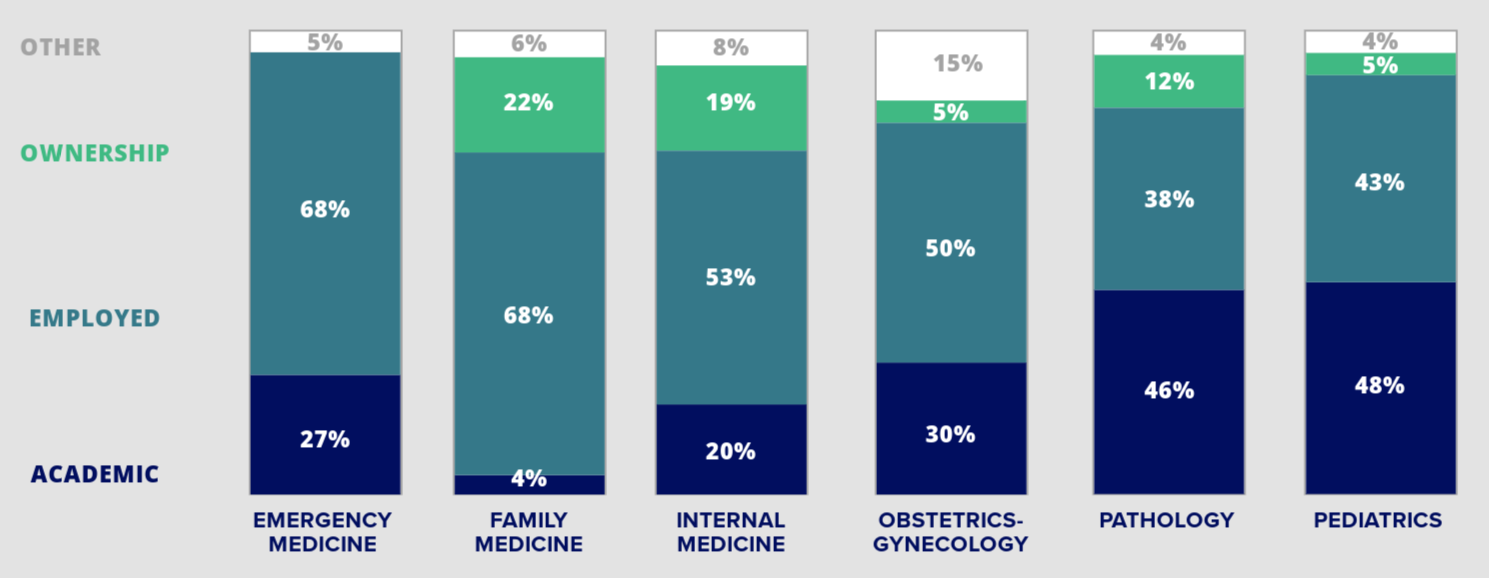

The majority of survey respondents (51%) planned to become employed physicians after completing their training with other plans such as academic medicine and practice ownership being significantly less.

When divided by trainee type, fellows were more likely to anticipate entering academic medicine, 47% vs. 20%, while residents were more likely to plan to become employed physicians, 54% vs. 32%.

Responses differed by gender as well. Men were more likely to plan to become practice owners, 24% vs. 13%.

Plans After Completing Training By Specialty

When compared by specialty, family medicine had the highest percentage of trainees planning for practice ownership (22%). Pathology (46%) and pediatrics (48%) were the specialties most inclined to pursue academic medicine.

Bringing Passion & Purpose to Practice – Customer Spotlight

Dr. Jamine Ifedi, DDS, MBA, opened his Charlotte-based dental practice, Empire Dental Group, with the help of Panacea Financial. What led him to practice ownership...

Considering A Job Change? Here’s What Doctors Should Know

Deciding to leave one job for another can be a big life change. Whether making this decision because of advancement opportunities, desire for a new...

The Changing Landscape Of Medicine: Trends & Key Benefits Of Private Practices

Key takeaways: Private practice employment and ownership is declining. Owning and working for a private medical practice can allow a physician to have greater autonomy...

Burnout and Workload

Burnout

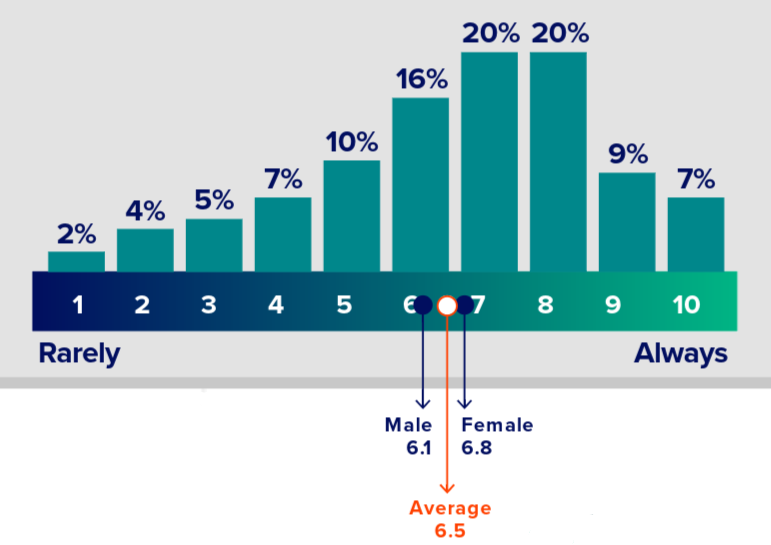

Residents and fellows reported experiencing burnout frequently, with an average rating of 6.5 on a scale from 1 to 10, where 1 is rarely and 10 is always. Fellows (6.8) and women (6.8) reported slightly higher levels of burnout compared to their counterparts, residents (6.5) and men (6.1), respectively.

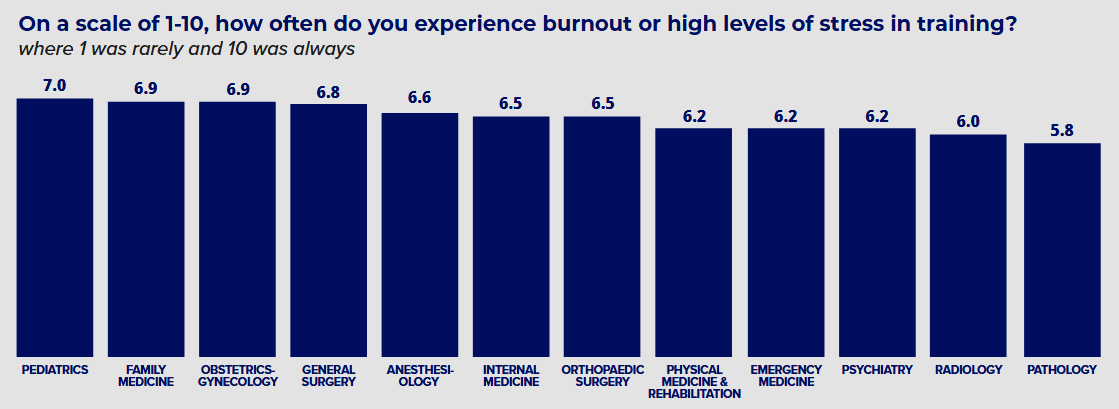

Burnout By Specialty

When looking at specialty, pediatrics, family medicine, obstetrics-gynecology, and general surgery reported the most frequent burnout. Radiology and pathology reported the least frequent burnout.

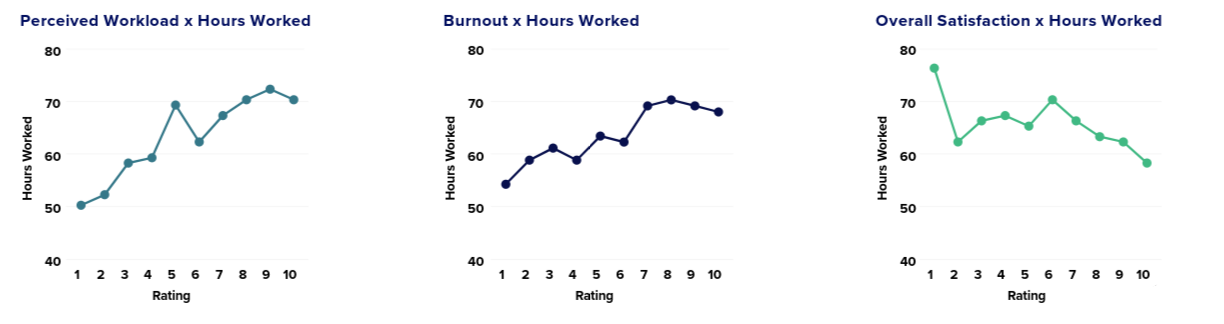

Workload

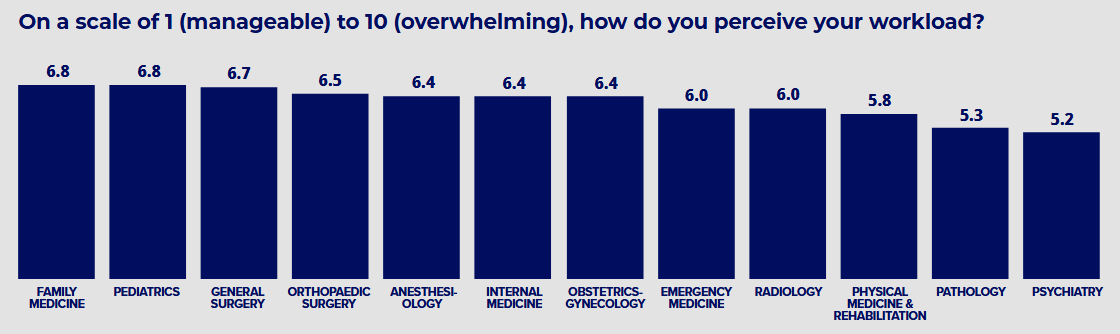

On a scale from 1 to 10 (where 1 was manageable and 10 was overwhelming), residents and fellows surveyed rated their workload at an average of 6.2.

The specialties that found their workloads most overwhelming were family medicine, pediatrics, and general surgery. Pathology and psychiatry were the specialties where trainees felt their workloads were more manageable.

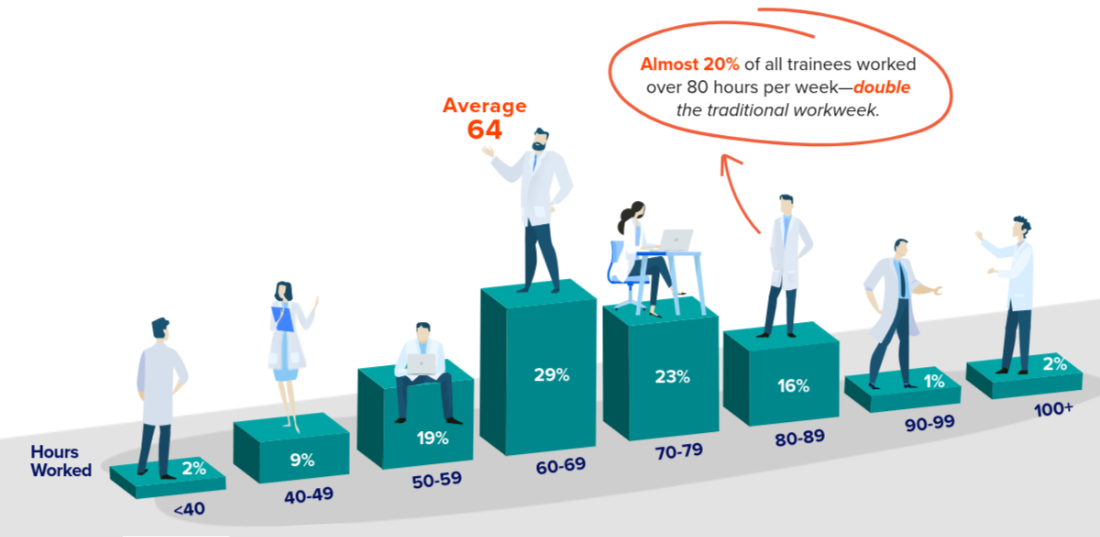

On average, residents and fellows worked 64 hours per week, including on-call duties. Seventy-one percent of trainees worked over 60 hours per week. Almost 20% of all trainees worked over 80 hours per week—double the traditional workweek.

Hours Worked By Specialty

General surgery had the highest average hours worked per week (83.1). Pathology (51) and psychiatry (49.5) had the lowest.

Workload Comparison

As the number of hours worked increased, so did residents’ and fellows’ perceived workload. Individuals who rated their workload as 1 worked 50 hours per week on average, the lowest of all ratings. Those who rated their workload as a 10 worked, on average, 70 hours per week.

Individuals who rated their workload as 1 worked 50 hours per week on average, the lowest of all ratings.

Comments About Burnout & Workload

“Administrative workload is also another form of additional stress to residents.” – Second-year resident in Michigan

“Home call is an exceptional burden and a common way that duty hours are exploited. Programs often do not allow work during “home” call to be reported as part of the duty hours even though there are frequent times where being on home call for the weekend means being actively working in the hospital for up to 84 consecutive hours, often with less than 10 hours of sleep total across those days and nights.” – Third-year resident in Ohio

“The expectations of residents to work 60-80 hours per week, prioritize their wellness, exercise, eat well, do research, attend journal clubs, volunteer, is virtually impossible each week. I feel like I have very little recovery time after difficult rotations and very little time to take care of my own wellbeing.” – Second-year resident in Minnesota

“I believe the format of most residencies/fellowships are prone to burnout considering hours, workload, and a very steep learning curve. Besides altering the format of the program itself, I think a positive culture/environment as well as supportive faculty/administration who are willing and wanting to support residents/fellows as individuals is what can make the training experience manageable.” – Second-year resident in Georgia

Addressing Burnout Among Residents & Fellows

Burnout has long been an issue in the healthcare community, but especially for residents and fellows as they can work long hours with very little...

Doctors With The Best Work-Life Balance

It’s no secret that doctors work hard. Long hours and overnight shifts could make it challenging for physicians to feel satisfied in both their professional...

Best Meditation Apps to Manage Medical School Stress

Struggling with (or afraid of) burnout in medical school? Here are our 4 favorite meditation apps for doctors-in-training. As a doctor-in-training, your most valuable commodity...

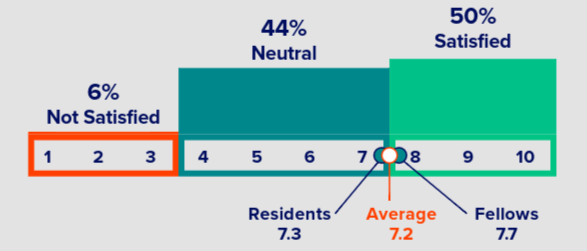

Satisfaction

Most surveyed trainees were fairly satisfied with their residency or fellowship programs, with an average satisfaction rating of 7.3 on a scale from 1 (not satisfied) to 10 (very satisfied). Fellows reported being slightly more satisfied (7.7) than residents (7.2).

Seventy-four percent of survey respondents ranked their satisfaction as 7 out of 10 or higher, while only 15% said their experience ranked at 5 or lower.

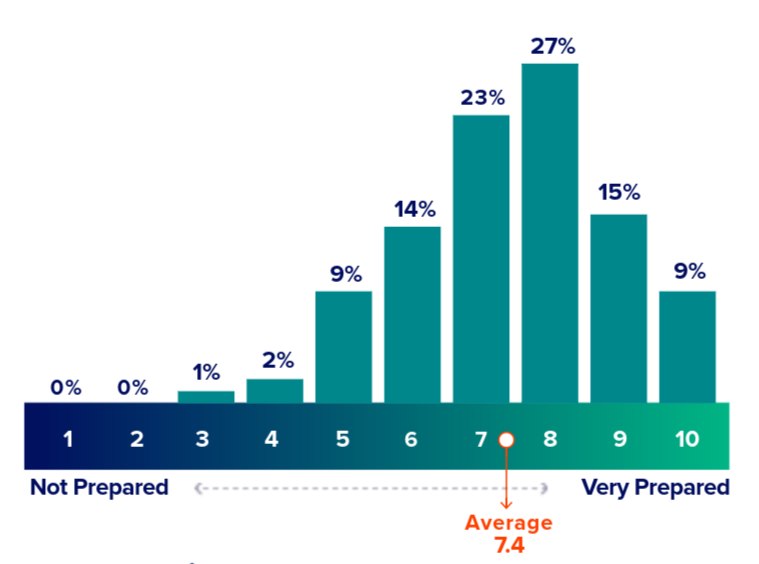

Career Readiness

Residents and fellows interpreted their career readiness positively with an average rating of 7.4 out of 10 (where 1 was not prepared and 10 was very prepared). Seventy-four percent of trainees ranked their preparedness at 7 or higher.

Career Readiness By Specialty

The specialties that felt most prepared for their careers were radiology (8.1), emergency medicine (7.6), and orthopaedic surgery (7.5). Those that felt least prepared were physical medicine and rehabilitation (6.8) and pathology (7.0).

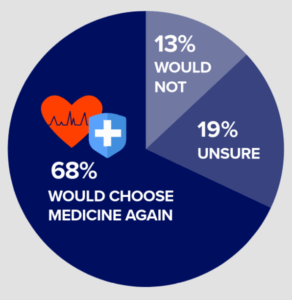

Career Choice

When broken down by age, trainees over 40 were more likely to say they would choose medicine again than their younger colleagues.

Career Choices By Specialty

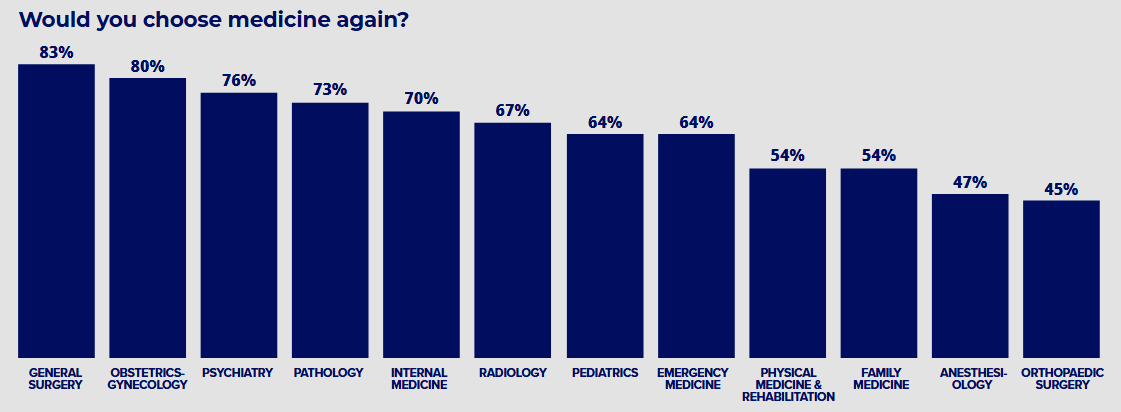

The specialties that were most willing to choose medicine as a career again were general surgery (83%), obstetrics-gynecology (80%), and psychiatry (76%). Those least likely to choose medicine again were orthopaedic surgery (45%) and anesthesiology (47%).

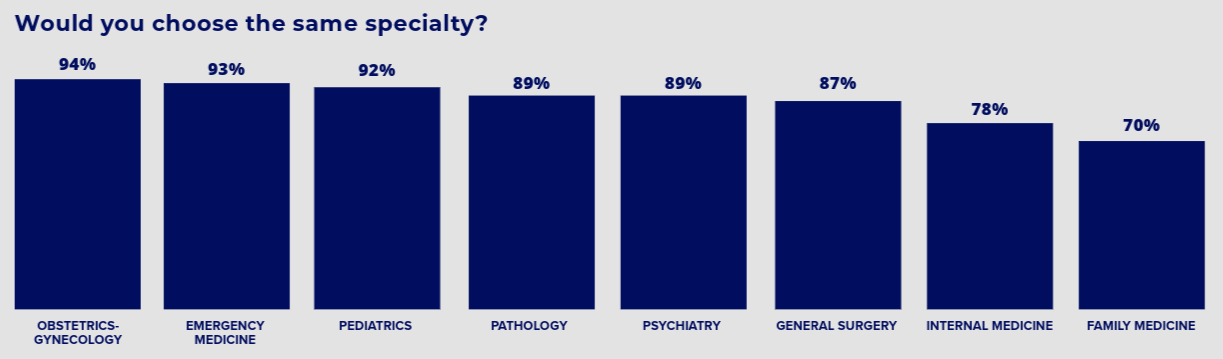

When asked if they would choose the same specialty again, 70% or more of respondents in all specialties said that they would. These included specialties with at least 10 respondents.

At the top of the list, obstetrics-gynecology (94%), emergency medicine (93%), and pediatrics (92%) were the most willing to choose their specialty again. Internal medicine (78%) and family medicine (70%) were at the bottom of the list.

Best Parts of Training

When asked what the best parts of their residency or fellowship program were, the aspects that were chosen most often included:

- 47% relationship with attendings/staff

- 47% diversity of patients and cases

- 43% quality of clinical training

- 39% program culture

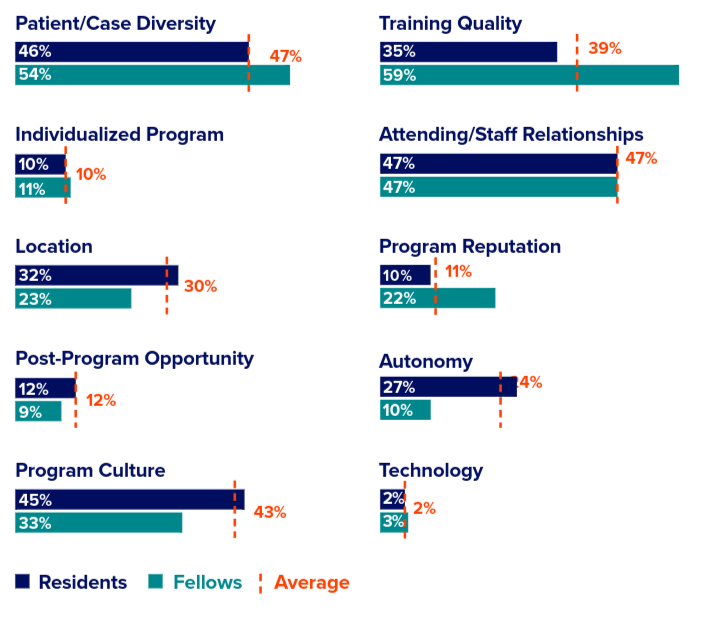

When broken down by trainee type, residents most appreciated staff, attending, and other resident relationships (47%), while fellows placed greatest value on quality of clinical training (59%). Both residents and fellows valued patient and case diversity, 46% and 54%, respectively.

Comments About Best Parts Of Training

“Best part is seeing patients.” – Second-year resident in California

“I am lucky that my program has been able to accommodate me throughout this process, but they have only partially done so for my ADHD. Any other place I might not have had such grace or second chances. I’m really grateful for the leadership and my colleagues.” – First-year resident in California

“I like best that we are in a union which protects the rights we do have.” – Third-year resident in Oregon

Challenges in Training

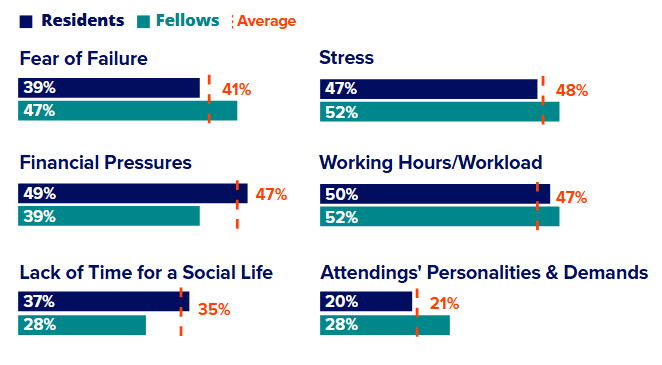

When asked about the most challenging parts of their training, respondents identified stress (48%) as the biggest challenge, followed by financial pressures (47%) and workload (47%).

Residents were more likely to choose workload (50%) and financial pressures (49%) than fellows (37% and 39%, respectively). Fellows were more likely to choose fear of failure (47%) than residents (39%).

Other Challenges

“Lack of autonomy”

“Low resident racial diversity”

“Impostor syndrome”

“Time away from family”

“Not having the best diversity of training with certain rotations. Lack of exposure to certain populations.”

Comments About Challenges

“A lot of the stress boils down to finances. Then the fear of failure sets in when thinking about how I need to succeed in order to eliminate the financial stress.” – Second-year resident from Georgia

“While it is an honor to work with some of the senior physicians, the work with them can be stressful since they still have a mindset that is not always reflective of the current times.” – Second-year fellow from Indiana

“Most challenging is feeling financially behind compared to people my age.” – Fifth-year resident from Virginia

“The necessity of needing to be perfect and the repercussions of doing wrong or mistake one time.” – First-year resident from Pennsylvania

“It feels like it doesn’t need to be this way.” – Second-year resident from Missouri

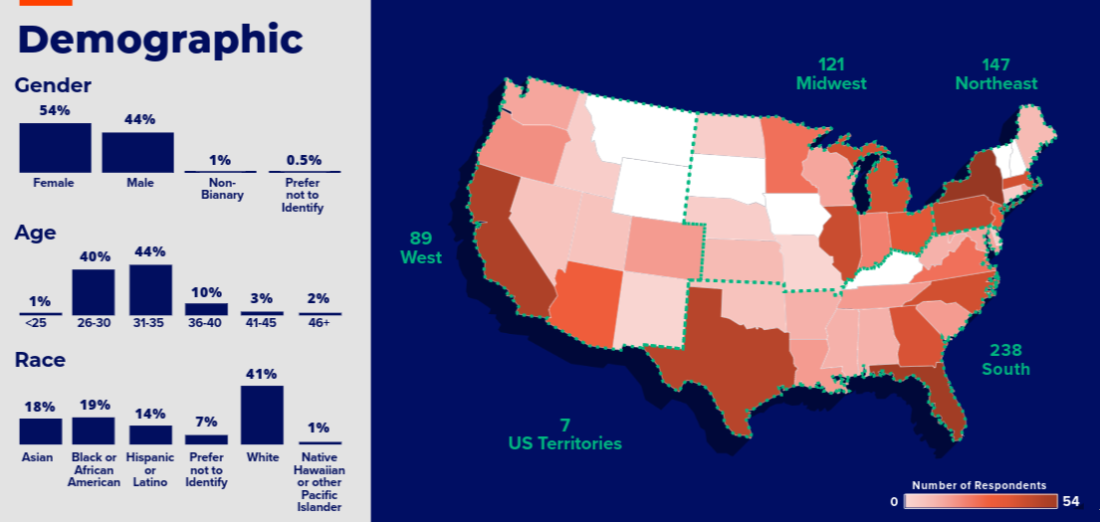

Demographics

Non-binary and “prefer not to identify” were not included in findings divided by gender because of an insufficient number of responses.

Thank You

Banks don’t recognize the hard work and dedication it takes for doctors to get through training, nor do they acknowledge your future as high-income earners.

The idea for Panacea Financial was born out of a desire to provide needs-based care for doctors and doctors-in-training. Panacea Financial grants you access to products and services designed specifically for medical professionals, built by a team that truly understands your needs.

Panacea Financial tailors products and services to medical students, residents and attendings when they need it most.

Our mission is to make doctors’ lives better. As new challenges arise, Panacea Financial will be there to grow with you.

Download the PDF