- Refinancing your medical, dental, or veterinary school loans could save you money on interest, but it’s not always your best option.

- Loan forgiveness programs only apply to federal loans.

- If you intend on working for a qualifying institution full-time for 10 years and you have qualifying loans, you should pursue Public Service Loan Forgiveness.

- If you will not qualify for PSLF, refinancing becomes a prudent strategy after you start making significant income.

Is Refinancing Your Student Loans from Medical, Dental, or Veterinary School the Right Decision?

Refinancing student loans is a common strategy to pay off debt. Doing so could get you a lower interest rate and make your finances more manageable — something that’s appealing at all levels of your healthcare career, whether you’re in training as a resident or fellow, or even in practice as an attending.

But refinancing isn’t always your best option.

Refinancing is a big decision, one of the biggest financial choices a young doctor can make. But refinancing should only be done if it’s right for you! When you choose to refinance medical, dental, or veterinary school loans out of the federal system, you forfeit options that could lead to significant loan forgiveness opportunities. That’s why you must first explore all of the options available to you.

In 2025, 73% of graduating medical students had educational debt with a median debt burden of $264,519. And the average debt is even higher for dentists and veterinarians! Worse, physicians with high levels of debt experience higher rates of burnout and lower quality of life and satisfaction with their work-life balance.

So, before you consider refinancing your medical, dental, or veterinary school loans, make sure you understand what it means to refinance, the type of loans you have, your projected employment path, and more.

See Also: A Doctor’s No-Nonsense Guide to Student Loans

What is refinancing?

When you refinance, you create a new loan with a private lender. The private lender pays off your existing loans and gives you a new loan with new terms. Typically, the new terms include a lower interest rate than what you’re currently paying.

What type of loans do I have?

You either have federal student loans or private student loans — and many people have both. Federal loans are offered by the government, while private loans are offered by banks, credit unions, and other financial institutions.

You can find your federal student loans listed at studentaid.gov, and your credit report lists your private loans. There are many resources available at studentaid.gov, like a list of your loans, repayment calculators, and Public Service Loan Forgiveness assistance.

Here’s what you need to make an informed decision:

- Your total student loan balance

- Your current interest rate

- What federal income-driven repayment program you qualify for (more on that below)

- Your employment/career plan.

Once you have a full picture of all your student loans, you can explore if refinancing your medical, dental, or veterinary school loans is right for you.

Student loan forgiveness

Note: PSLF and IDR may be changing. Learn the latest updates »

One of the two major benefits of the federal system is student loan forgiveness — the other is deferment. Interest subsidies also exist in the federal system, which we will cover below. To be eligible for forgiveness, you must remain in the federal system — that means not refinancing medical, veterinary or dental school loans.

Public Service Loan Forgiveness (PSLF) is perhaps the most well-known forgiveness option available. It’s a federal program that can erase your medical, dental and veterinary school debt, tax-free, in 10 years, and you can enter the program once you graduate.

You can save a LOT of money by utilizing this strategy: Doctors have been forgiven hundreds of thousands of dollars through PSLF.

PSLF eligibility

To be eligible for PSLF, you must follow certain employment requirements:

- You must work for a 501(c)(3) nonprofit organization; more than 75% of hospitals qualify. (This means that most residencies qualify and that payments made during residency can be retroactively approved.)

- You must work full-time as an employee for the qualifying nonprofit.

- You must submit employment certification forms to confirm you’re working for an eligible organization.

Make sure to determine your eligibility and see if your employer qualifies.

In addition to the employment requirements, you must also sign up for an income-driven repayment (IDR) plan and make 120 cumulative payments.

Income-driven repayment (IDR)

There are currently three IDR plans you can choose from:

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

The Saving on A Valuable Education plan remains indefinitely paused. Learn the latest updates »

No matter which plan you choose, every monthly payment you make counts toward the mandatory 120 payments.

Pay As You Earn (PAYE)

PAYE requires you to pay 10% of your discretionary income toward student loans every month. The higher your income is the higher your monthly payment will be, and one unique benefit with PAYE is that you do not have to include your spouse’s income which makes it a good option if you’re graduating medical school with a spouse with a high income

With PAYE, you and your spouse should file taxes separately because your spouse’s income will not count toward calculating a higher monthly payment. Your spouse will pay more in taxes, but you’ll end up paying less over the lifetime of the loan due to the cap on monthly payment amount that comes with PAYE. The cap ensures you don’t pay more than the standard, monthly 10-year payment amount.

This plan has a partial hardship requirement: to be eligible your monthly 10-year payment amount must exceed what your calculated monthly payment would be for PAYE. This is not a difficult requirement to meet, otherwise you would be staying in the 10-year standard repayment plan.

Using PAYE, you also won’t lose as much money when you earn more as an attending physician due to the cap. You can switch to this plan at any time to save money.

Income-Contingent Repayment (ICR)

At this time, ICR requires you to pay 20% of your discretionary income. This plan is recommended if you have Parent Plus loans that have been converted to direct loans (because it’s the only plan that allows them).

ICR is similar to REPAYE and doesn’t have an income requirement to qualify.

Income-Based Repayment (IBR)

Before Biden’s proposed changes go into effect, IBR requires you to pay 15% of your discretionary income toward student loans every month. Like with PAYE, installment amounts are capped to the standard monthly 10-year payment amount, and have the same partial hardship requirement.

This plan was initially designed as an improvement to ICR, specifically for an older type of loan called Federal Family Education Loans. Now, all loans under that program can be consolidated within the federal system, making them eligible for PAYE or REPAYE. As such, this program has fallen out of favor.

Does my employment qualify for PSLF?

The first question to ask yourself is whether you’re willing to begin your career working in the nonprofit sector full-time. If the answer is no, then PSLF isn’t right for you — and you should consider refinancing your medical, dental, or veterinary school loans.

If you’re ready to refinance, seek private refinancing once you’re making enough money to receive competitive rates. In general, heavily indebted students are more likely to choose high-income specialties.

Keep in mind: Most private lenders offer the best rates to doctors who have been practicing for several years because their rates are based on your income, relative to the amount of debt you have. (Panacea Financial’s student-loan refinancing does not consider debt-to-income ratios because they understand the financial investment required to become a physician.)

As an alternative to PSLF, you can also pursue a 20- or 25-year forgiveness track, in which the government writes off the balance of your federal loans after paying your loans for 20-years through an IDR. You’ll still have to pay taxes on this, unlike PSLF, which is tax-free. (With the 20-year track, the forgiveness amount is taxed as income.)

Of note – few physicians are likely to qualify for the extended forgiveness because even at a lower tier physician salary, we simply make too much. Furthermore, this forgiveness is not tax free. This means that at a physician’s marginal tax rates, they are going to owe a huge tax bill when they finally receive forgiveness – between 30% and 50% potentially! While a physician may benefit from the extended forgiveness option, it should be regarded cautiously.

Keep in mind: This is a relatively new program. No one has completed the 20-year requirement to date, which means there’s no information on what this entire process is like.

PSLF popularity is growing, but the program is still relatively underutilized. Among medical school graduates choosing primary care specialties, 11.7% said they intended to utilize PSLF in 2010, compared to 25.3% in 2014.

So if you have federal loans and are committed to full-time work at a qualifying nonprofit organization, student loan forgiveness is likely a good choice for you.

Is there an income limit to PSLF?

Another reason student loan forgiveness may not be right for you is if you earn too much money. While there’s no income eligibility for PSLF, your repayment plans are based on your income. To determine this, you’ll need to calculate your discretionary income payments and your 10-year standard repayment plan.

If your discretionary income payments are more than your 10-year standard payments, then you should consider refinancing. If you (or you and your spouse, combined) are a high-earner, you would be paying the capped 10-year standard monthly amount. In this case, you would be making 120 payments (10 years) at your 10-year standard monthly amount, so you would have paid off the full amount of the loan and thus be forgiven $0. Over that time period, you would have paid significantly more in interest than if you had refinanced.

However, the math becomes more complicated if the discretionary payments are almost as much as your 10-year standard payments. In this case, you should determine the exact interest savings of refinancing. You also may need to consult a tax specialist about the implications of filing with your spouse.

Important things to know about PSLF

- If you temporarily lose eligibility, those months simply won’t count toward the 120 cumulative payments you have to make. In this case, the payments you already made still count toward the total balance, and you do not lose credit towards forgiveness.

- You are ineligible for PSLF the moment you refinance your medical school loans privately.

- Some worry about future changes to the amount of debt that’s eligible for forgiveness as both major parties have expressed interest in capping the benefit. Based on precedent, the general expectation is that people already working toward forgiveness won’t be affected.

- Payment amounts are based on discretionary income — a calculation that is based on your income, and the federal poverty level per family size. Getting married can significantly increase your income, which, combined with having kids (pushing IDR payments down) explains why the differences between IDR plans tend to hinge on family size and income

Student loan deferment and forbearance

The second major benefit of the federal system is deferment and forbearance. Both deferment and forbearance allow you to temporarily postpone or reduce your federal student loan payments.

The general rule is: If you’re in deferment, no interest will accrue to your loan balance. If you’re in forbearance, interest will continue to accrue on your loan balance. But oftentimes, the terms are used interchangeably.

Why should I be refinancing my medical, dental or veterinary school loans?

If you have federal student loans, you may be able to find a lower interest rate in the private market. And, ultimately, the lower rate is reflected in savings to you over the life of the loan.

Here are two scenarios to highlight why you may want to refinance your medical school loans:

1. Fastest payoff, minimum total interest paid

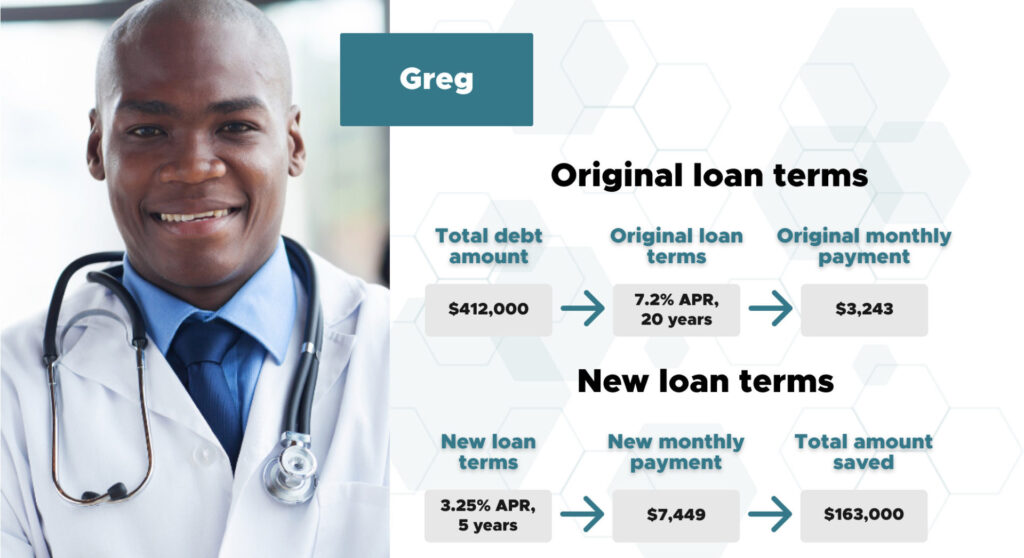

Greg recently became an attending physician. He wants to pay off his student loan debt as fast as possible, so he keeps his expenses down and continues to live like he did as a resident even after starting to get paid like an attending.

Greg has $412,000 in student loan debt at 7.2% over a 20 year term. He refinances this into a 5-year loan at 4.75% APR. Now, his monthly payment is $7,727 — more than double his previous monthly payment of $3,243.

The lifetime cost of the loan drops from $779,000 to $464,000. And instead of paying $367,000 in interest over the life of the loan, he’s only going to pay $52,000.

Thanks to refinancing, Greg can pay off his student loan debt 15 years faster and save $315,000.

2. Maintain lifestyle, lower interest rate

Michelle is also an attending physician. Like Greg, she has $412,000 in student loan debt at 7.2% interest over a 20 year term. She wants to maintain her current lifestyle, but she knows she can get a lower interest rate and save money in the process.

Michelle refinances her student debt to a 15-year loan at 5.99% APR. Now, her monthly payment is $3,474 — only a slight increase from her previous payment of $3,243.

The total cost of the loan drops from $779,000 to $625,000. And instead of paying $367,000 in interest over the life of the loan, she’s only going to pay $213,000.

In this case, refinancing allows Michelle to pay off her student loan debt 5 years faster and save $154,000.

Scenario 1 is about finding the fastest way to pay off your student loans:

- Get a lower interest rate

- Shorten the lifetime of the loan

- Increase your monthly payment amount

- Pay off your medical school loans faster

- Minimize the amount paid in interest

Scenario 2 is about managing your student loans to match your desired lifestyle:

- Get a lower interest rate

- Shorten the lifetime of the loan

- Maintain your monthly payment amount

- Pay off medical school loans faster

- Save money on interest charges

In both examples, you can see why refinancing is a good option. Whether or not refinancing is right for you comes down to your desired lifestyle and financial goals.

When is the best time to refinance?

The best time to consider refinancing your student loans is when you’re early in practice as an attending physician.

When you’re a med student, it’s still too early to refinance — but it’s never too early to educate yourself and learn about your options. And once you begin your residency, refinancing only makes sense if you can get into a deferred payment program — but you should start preparing for it by educating yourself.

If you’re interested in exploring deferred payments during your residency, Panacea offers programs with $100 monthly payments. However, the programs are not very flexible: There are restrictions on how long you can participate in the program. And once it ends, you revert to making full payments — something that’s very difficult to cover if you’re earning a resident’s salary.

How often should I consider refinancing?

If you have private education loans (PEL), you should always be on the lookout for a better deal — although you likely won’t get great terms until you’ve completed your training.

PELs — private loans taken to pay tuition costs like Sallie Mae — typically have higher interest rates even than public loans, which makes them enticing to refinance. The most important things to know when shopping for a better rate are your total balance and the interest rate on your current private education loans.

Should I try to pay off my student loans ASAP?

The real question is how comfortable you are with debt.

Many people will tell you to pay off your student loans as fast as possible, but debt isn’t the only thing you should consider. You should balance student loan debt with your desired lifestyle and other expenses in your life.

When dealing with significant debt, many sources suggest living like a resident as long as you can. But that doesn’t always lead to an ideal lifestyle.

Delaying important decisions in your life to prioritize debt — buying property, starting a practice, getting married or even having kids, for example — can result in missed opportunities. And the benefit of those opportunities often exceeds the burden of student loan debt.

Is refinancing student loans different than consolidating?

Consolidating is the process of organizing and combining multiple debts into a single debt.

If you have different student loans from undergrad, graduate school and medical school, you can consolidate them all into a single loan from a private lender. That way, you only have to make one payment toward student debt every month.

Consolidating your student loans is a way to simplify your finances, and you can often get a lower interest rate on a consolidation loan.

With refinancing, however, you’re moving your debt from one lender to another and setting new terms. Refinancing your student loans can also save you money on interest, and many people opt for refinancing to align their debts and monthly payment requirements with their current lifestyle.

Special refinancing options for doctors

If you decide loan forgiveness and other public programs aren’t right for you, Panacea Financial can help with a refinance product specifically designed for doctors. First, there are no cosigner requirements because we respect the path you took to become a physician. There are no maximums on these loans because we understand the cost of financing medical education. Almost every other financial institution has loan maximums that they won’t refinance above.

Additionally, we have fixed rates that are based on term length that you get to choose between. You won’t get offered a range, and there’s never a bait-and-switch with an imaginary interest rate because we do not utilize your debt-to-income levels like at traditional lenders.

Traditional banks won’t tell you your rate until you’ve given them all of your information. You have to apply to find your rate. Panacea’s rates are published publicly and they won’t change after you apply.

The bottom line on refinancing student loans from medical, dental, or veterinary school

- Whether or not you should consider refinancing your medical school loans depends on your situation.

- If you plan to pursue Public Service Loan Forgiveness, you should not refinance because it will disqualify you from these programs.

- If PSLF is central to your plans, make sure you utilize an income-driven repayment plan that best aligns with your financial needs to ensure you get the largest possible amount forgiven.

- If you are an attending who will make too much money to have your loan balance forgiven, you should seek a better rate via refinancing.

- How you refinance will be dictated by your lifestyle: Are you comfortable carrying a little more debt to have more access to experiences or investment opportunity? Or would you prefer to live modestly to pay off the debt as fast as possible? These are questions you’ll have to answer.

- The ideal time for refinancing your loans is as soon as you know you won’t be pursuing PSLF. Often this is early in your career as a practicing physician, dentist or veterinarian. For those that know this earlier, you can take advantage of in-training refinance programs.

- Panacea Financial allows you to refinance with no cosigner requirement, at transparent rates, and with no maximums. Click here to get started today.

This article was authored by Dr. Ned Palmer, Dr. Michael Jerkins, and Dr. Josh Daily. It draws heavily from the following journal articles:

- What Should I Do With My Student Loans? A Proposed Strategy for Educational Debt Management published in the Journal of Graduate Medical Education, Feb 2018

- Personal Finance for Pediatric Trainees published in Clinical Pediatrics, September 2016